In the fall of 2021, we completed our second annual “State of the Nonprofit Industry” report. One of the primary goals was to explore how organizations were being affected by the global pandemic.

Though the U.S. has experienced a downturn in cases throughout the first quarter of 2022, the nation continues to struggle with the pandemic’s broad ripple effect.

Like all industries, the nonprofit sector is trying to put the pandemic in the rearview mirror.

Record-high inflation and economic uncertainty seem to be escalating. Higher interest rates, supply chain problems, rising energy costs, and the war in Ukraine have created an unstable and unpredictable environment.

When asked about their organization’s financial position last fall, less than half (48.71%) reported being somewhat or very concerned about their financial condition. Many organizations were financially sound due to programs like the Paycheck Protection Program (PPP), Higher Education Emergency Relief Fund (HEERF), Employee Retention Credit (ERC), and Shuttered Venue Operators Grant (SVOG).

In a recent follow-up survey*, we found overall satisfaction in the past three months has increased considerably (by 64%), while those who are somewhat or very concerned has remained nearly the same (48.71% to 46.7%).

| Fall 2021 | Satisfaction with Current Financial Position | Spring 2022 |

|---|---|---|

| 09.67% | Very pleased | 0.00% |

| 18.71% | Somewhat pleased | 46.7% |

| 38.94% | Somewhat concerned | 26.7% |

| 09.77% | Very concerned | 20.0% |

| 22.82% | Unsure | 6.70% |

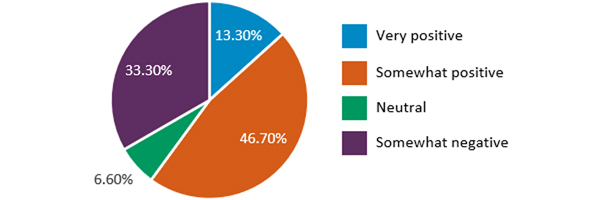

A feeling of optimism has emerged as health restrictions have lifted and organizations are once again able to deliver in-person services and events. As the chart below shows, leaders are mostly positive about the nonprofit financial forecast for the next 12 to 18 months.

*The follow-up survey had smaller sampling and did not include all the organizations that participated in the 2022 State of the Nonprofit Industry Report.

That optimism is tempered with concern over financial markets and other factors that affect operations. As one leader said, “We've had a strong recovery, but does that momentum continue into the next fiscal year? Is a recession looming? Is inflation going to recede?”

Questions about additional federal and state assistance persist, as well as concerns about foundation and individual support. “We are seeing a slight downturn in giving as government pandemic relief has dried up and inflation is having a strong effect on individual givers and our own operational costs,” a respondent commented. Others worried about donor fatigue amidst economic turbulence.

Organizations’ three greatest concerns at this time are:

- Administrative/operational costs

- Costs of delivering services/programs

- Transportation/energy costs

The cost of doing business is rapidly increasing. Not just from a salary perspective, but from benefits, fuel, and other direct costs.

According to the U.S. Department of Labor, the annual inflation rate for the U.S. is 8.3% for the 12 months ended April 2022.1 Inflation is a loss of purchasing power over time. Simply put, a dollar does not go as far today as it did yesterday. The rate is typically expressed as the annual change in prices for goods and services.

Increasing fees for services and programs is not an option for those that serve low-income populations. In most cases, this means the organization must absorb the loss or reduce programs and services.

Many nonprofits receive a large portion of their annual revenue through government contracts and reimbursements. But those have not kept pace with inflation, creating a burden for the organizations providing the services. As one survey respondent said, “Our fees for services are not regularly adjusted and are largely based on state contracts, which we cannot control.”

Operational Challenges

The pandemic created major disruptions to the international supply chain. The highly complex network has buckled under increasing demands and constricted capacity. The three key challenges are supply availability, labor shortages, and global bottlenecks. Nearly all industries, including the nonprofit sector, are suffering from each of these.

Two-thirds of the respondents in our most recent survey said supply shortages are having a negative impact on their organization’s ability to deliver programs and services.

One high-profile example is the infant formula shortage. Nonprofits that assist families in need are unable to keep shelves stocked and meet the demand. Experts say the shortages have been largely caused by supply chain issues and a recall of several contaminated baby formula products. According to a recent report in the Wall Street Journal, 43% of baby formula in the nation is out of stock.2

A second example is the escalating cost of construction materials. There was an increase of nearly 18% year-over-year from 2020 to 2021, which is the largest year-over-year increase in material costs since 1970.3 For organizations like Habitat for Humanity, that means that the typical home is costing them $30,000 more to build now versus the cost pre-pandemic.

Workplace Challenges

During the COVID-19 recession, the nonprofit sector suffered a rapid employment decline. Recent studies show that around 75% of the jobs lost have now been recovered.

As organizations scramble to fill positions, they are facing intense competition to recruit and retain quality employees.

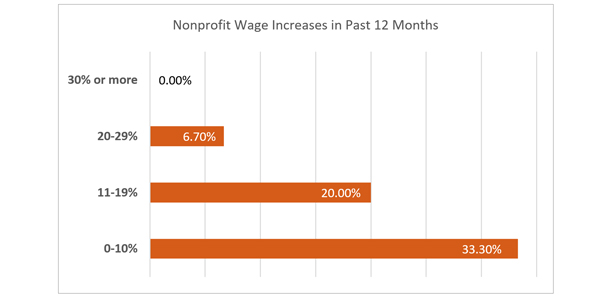

The 2022 State of the Nonprofit Industry Report revealed how most organizations (77.4%) were planning to increase pay and benefits and place a high priority on improving workplace diversity, equity, and inclusion.

For too many years, nonprofits have asked their employees to sacrifice fair compensation in exchange for the privilege of doing charitable work. Those days appear to be over. As one nonprofit leader explained, “While pay hasn't been the driving factor for employees, that is shifting dramatically. Dismissing low pay for the intrinsic values of working for a nonprofit is no longer helpful.”

As of mid-May 2022, most organizations have recently increased wages and benefits or are planning to do so this year. Only 13.3% have no immediate plans to increase pay and benefits.

Organizations are eager to provide employees with fair wages and benefits. However, the added costs have created financial stress and caused leaders to make structural adjustments. Several respondents described how they’ve had to reduce hours or eliminate positions to adjust for the increased compensation.

As one survey respondent said, “Rising costs of talent is one of our biggest issues.”

Moving Forward

Going into the third year since COVID-19, organizations and their leaders are left with the reality that the former strategies and tactics may never return.

To maintain stability, nonprofits must embrace innovation and accountability.

Innovative approaches may require increased use of technology or never-before-tried approaches to solving problems. It could mean joining forces with another entity, combining resources to create a stronger, more effective program.

Accountability first and foremost means listening and responding—listening to those you serve, your employees, other nonprofits, and boundary partners. Listen, learn, and adapt quickly.

Accountability requires the establishment of clear and measurable key performance indicators for every aspect of the organization, from finances and fundraising to program outcomes.

To keep on track, leaders and the board must diligently monitor the indicators and make adjustments to work toward stability and success.

Contact a professional at FORVIS or submit the Contact Us form below if you have questions.

- 1https://www.bls.gov/news.release/pdf/cpi.pdf

- 2https://www.wsj.com/articles/baby-formula-shortage-stuns-states-including-tennessee-kansas-and-delaware-11652526002

- 3https://www.abcactionnews.com/news/region-pinellas/construction-materials-see-highest-year-over-year-price-spike-in-50-years#:~:text=in%2050%20years.- ,Construction%20materials%20costs%20are%20up%2017.5%20percent%20year%2Dover%2Dyear,hundreds%20of%20materials%20in%20between