On July 18, 2023, the U.S. Small Business Administration (SBA) released a new rule, Small Business Investment Company Investment Diversification and Growth, that will modernize the Small Business Investment Company (SBIC) program to better serve both the businesses that receive government-backed funding and the investors who wish to invest in growing businesses. The rule became effective on August 17, 2023.

“This final rule will unlock unrealized potential and strengthen, diversify, and expand our network of SBIC licensed private funds to address capital deficiencies in underserved small businesses, startups, and critical U.S. industries impacting our nation’s security,” said Isabella Casillas Guzman, SBA administrator.1

Background

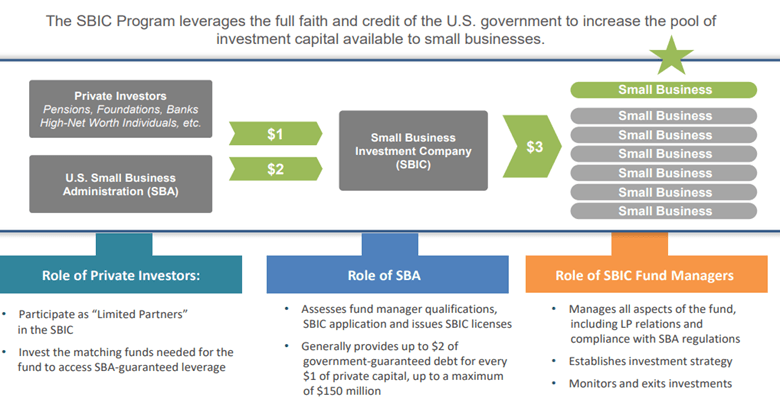

For many who follow the venture capital market, the SBA, or investment companies in general, the SBIC program is not something new. The SBA created the SBIC program in 1958 and has generated an estimated $67 billion in funding to small businesses since its inception. The program focuses on issuing debt to venture capitalists, private equity funds, and other vehicles that invest in America’s small, but scaling, businesses. With more than 300 active licenses issued through the SBIC program, small businesses are continuing to find long-term capital with the assistance of government-backed funds to satisfy their growing needs.

The SBIC program has certain advantages for both private funds and banks. SBIC assets are excluded from the $150 million threshold for determining if an investment adviser meets the private fund adviser exemption. Banks and their holding companies can own or invest in SBICs to own indirectly more than 5% of the voting stock of a small business and can receive Community Reinvestment Act credit for SBIC investments.

Source: sba.gov

Since its inception, the SBA has continued to shape the SBIC program to change with the needs of small businesses and capital market fluctuations. The most recent changes—in July 2023—are a continued effort toward that goal. The SBA highlighted some of the findings that these recent rulings were issued, in part, to remedy:

- Limited types of debentures that did not consistently match with the capital needs and cash flow structures of companies qualifying for SBIC funding.

- Restrictions and limited exceptions for investing into relenders and reinvestors.

- The SBIC fund structures are overwhelmingly focused on debt components, with 75% of current SBIC funds mainly funded with debt, whereas only 25% were primarily focused on equity.

Rule Highlights

- Accrual SBICs. The SBIC program established a new financial instrument called the Accrual Debenture Instrument. This new funding option will only be available to the newly established Accrual SBIC and the Reinvestor SBIC. The Accrual Debenture has a 10-year term, is issued at face value with the accrued interest due at the end of the term, and the SBA fully guarantees both the principal and accrued interest. The 10-year accrual term (compared to the current three years) is intended to better align with the capital and cash flow structure of scaling small businesses. To utilize the Accrual Debentures, funds must originally elect to license as an Accrual SBIC or as a Reinvestor SBIC, which focuses on investing in small businesses through the fund of funds model.

- Reinvestor SBICs. The SBA updated certain restrictions on prohibited investments and added new exemptions for Reinvestor SBICs. These more lenient guidelines will allow a Reinvestor SBIC to make equity capital Investments in underserved non-SBA leveraged limited partnerships, SBIC or non-SBIC licensed, that finance businesses that:

- Meet the basic size requirements for a small business as defined by the SBA.

- Have ownership by U.S. citizens or the entities are headquartered in the United States.

- Have 50% of employees based in the U.S. at the time of investment.

These exemptions around Reinvestor SBICs will allow the fund of fund’s concept to pool investor money for small businesses with less restrictions and will be eligible for 2x tiers of leverage (up to a maximum of $175 million in guaranteed principal and interest).

- Licensing. The SBA revisited its minimum capital requirements for licensees, specifically when it comes to the “good cause” exception. The SBA requires that each applicant have $5 million in regulatory capital to receive a license. The program allows certain exceptions, down to $3 million, if a licensee has good cause, fulfills other standards outside of the capital requirement, has a viable plan to be profitable, and creates a detailed timeline on a plan to acquire the $5 million capital requirement.

The new rule broadens the good cause option. If the applicant is headquartered in a state that is under licensed, the new ruling would consider this satisfactory of the good cause requirement. An under licensed state is one that has less SBIC funding dollars than the median state. This change is expected to broaden the pool of applicants that do not meet the higher capital requirements and to encourage states, who have not historically participated, to increase their usage of the SBIC program.

The rule also creates a short form Management Assessment Questionnaire to expedite the licensing process for a subsequent SBIC applicant if certain criteria are met.

- Program Accessibility. The rule modifies licensing fees to reduce the financial burden for new program applicants and broadens a fund manager track-record and eligibility requirements to enable a more diversified group of investment teams and a wider range of investment strategies to participate in the SBIC program.

- Streamlined Process. Updates include:

- To accelerate the fundraising process, the SBA will indicate the total intended financial commitment at the time of conditional fund approval.

- The SBA will accept FASB GAAP compliant valuations for non-leveraged licensees.

- SBA pre-approval of a capital call line is eliminated.

- New safe harbor for eligible follow-on funding of a portfolio company through a non-SBIC vehicle managed by the principals of the SBIC without prior SBA approval.

Conclusion

The asset management team at FORVIS has more than 50 years of experience providing accounting, tax, and consulting services to various types of investment holdings, including conventional debt and equity investments, loans, businesses, alternative investments, and other unique assets. We have experience providing services to fund complexes with net assets ranging from a couple million to several billion dollars. Our experience allows us to provide tailored services to help meet your unique needs. For more information, please reach out to a professional at FORVIS.

- 1“Biden-Harris Administration to Establish Reforms to Transform Public-Private Investment Program,” sba.gov, July 17, 2023.