As extreme weather events upended domestic summer travel, the second quarter closed out without the SEC’s highly anticipated final climate disclosure rules. The International Sustainability Standards Board (ISSB) has recently finalized climate and sustainability standards. European Union (EU) standard setters have softened their proposals as they move toward the January 2024 effective date for their environmental, social, and governance (ESG) disclosure frameworks. Here are the latest updates.

A. U.S. Updates

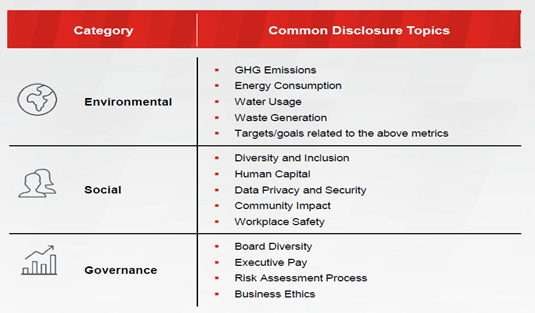

The term ESG spans a variety of issues as noted in the table below.

SEC

Regulatory Agenda

On June 14, 2023, the SEC issued its spring agenda, which continues to indicate an aggressive standard-setting plan. The agenda outlines the SEC’s rulemaking priorities for 2023—listing 18 proposed rules and 37 final rules—and includes the following ESG-related topics carried forward from the 2022 agenda:

Proposals

- Corporate board diversity

- Human capital management

- Payments by resource extraction issuers

Final Rules

- Climate change disclosures (registrants). Resource: SEC’s ESG Climate Proposal – What You Need to Know

- ESG investment practices (funds and advisers). Resource: Investment Advisers & Companies Face New ESG Disclosures

- Investment company names

- Cybersecurity (funds). Resource: SEC to Beef Up Cyber Rules & Disclosures

- Cybersecurity risk management (broker-dealers)

On July 27, 2023, the SEC finalized new cybersecurity disclosure requirements for registrants (see “Details on SEC’s New Cybersecurity Disclosures”).

In the absence of a final rule, registrants should continue to follow the SEC’s 2010 interpretive guidance (see Appendix ).

Climate & ESG Task Force

Announced with great fanfare in March 2021, the Climate and ESG Task Force was tasked with developing initiatives to proactively identify ESG-related misconduct. The initial focus was to identify any material gaps or misstatements in issuers’ disclosure of climate risks under existing rules. The task force also will analyze disclosure and compliance issues related to investment advisers’ and funds’ ESG strategies.

To date, the task force has only settled a limited number of enforcement actions, including:

- Vale S.A. – March 2023, $55.9 million penalty due to false and misleading disclosures about a 2019 dam collapse. Vale’s public sustainability reports assured investors that all of its dams were certified as stable. “Our action against Vale illustrates the interplay between the company’s sustainability reports and its obligations under the federal securities laws … public companies can and should be held accountable for material misrepresentations in their ESG-related disclosures, just as they would for any other material misrepresentations.”

- Goldman Sachs Asset Management – November 2022, $4 million settlement related to failing to follow internal policies and procedures for ESG funds.

- Health Insurance Innovations – July 2022, $12 million in penalties related to anti-fraud and reporting provisions related to health insurance products offered by the company.

- BNY Mellon Investment Adviser – May 2022, $1.5 million settlement related to ESG fund labels.

Committee of Sponsoring Organizations (COSO)

COSO has developed a framework used to establish internal controls to provide reasonable assurance that an organization is operating ethically, transparently, and in accordance with established industry standards. In April 2023, COSO issued guidance1 on effective internal controls over sustainability reporting and ESG disclosures.

B. European Developments

International Sustainability Standards Board (ISSB)

On June 26, 2023, the ISSB issued its first two ESG financial reporting standards (climate and sustainability). Certain provisions will be effective for annual reporting periods beginning on or after January 1, 2024. Early adoption is permitted if both standards are applied at the same time.

International Financial Reporting Standards (IFRS) S1 sets out the requirements for disclosing information about an entity’s sustainability-related risks and opportunities. Required disclosures include:

- The governance processes, controls, and procedures the entity uses to monitor, manage, and oversee sustainability-related risks and opportunities

- The entity’s strategy for managing sustainability-related risks and opportunities

- The processes the entity uses to identify, assess, prioritize, and monitor sustainability-related risks and opportunities

- The entity’s performance in relation to sustainability-related risks and opportunities, including progress toward any targets the entity has set or is required to meet by law or regulation if it would represent “undue cost or effort.”

IFRS S2 requires an entity to disclose information about climate-related risks and opportunities that could reasonably be expected to affect the entity’s cash flows, its access to finance, or cost of capital over the short, medium, or long term.

The ISSB standards are voluntary and will only become binding legal requirements in those jurisdictions that adopt them.

European Sustainability Reporting Standards (ESRS)

On June 9, 2023, the EU released 12 “near-final” drafts of the new sustainability reporting standards. These documents included significant updates based on feedback from the November 2022 proposals presented to the European Commission by the European Financial Reporting Advisory Group. The four-week comment period ended on July 7, 2023 and is the last formal step before EU Parliament approval for a January 1, 2024 effective date for large companies.

Comment letter feedback was mixed. A joint letter2 submitted by 100 industry groups, investors, and market participants felt the new materiality assessment was a “significant rollback of ambition” that would reduce comparability, undermining the project’s key goals. Large accounting firms pushed back on the inconsistencies between the ISSB and ESRS standards and the short implementation window for such a large undertaking. Financial statement preparers challenged the cost and benefits of the proposal, especially if the EU rules are not compliant with the recently issued ISSB standards noted above. Preparers focused on the differences in the materiality definition.

Conclusion

Whether you are publicly traded or privately held, FORVIS can provide an independent and objective view into your financial reporting. We leverage the latest technologies and process automation tools to provide companies assurance on their financial statements to help meet stakeholders’ needs. If you have questions or need assistance, please reach out to a professional at FORVIS or submit the Contact Us form below.

Appendix – Existing 2010 SEC Guidance

The 2010 document highlights the following existing requirements of Regulation S-K and S-X that may require disclosure related to climate change:

- Description of business. Regulation S-X Item 101 expressly requires disclosure regarding the costs of complying with environmental laws.

- Legal proceedings. Regulation S-K Item 103 notes the federal, state, or local provisions that have been enacted regulating the environmental discharge or protecting the environment will not be excluded from disclosure under the “ordinary routine litigation incidental to the business” safe harbor and must be described if:

- Such proceeding is material to the registrant’s business or financial condition

- Such proceeding involves primarily a claim for damages, or involves potential monetary sanctions, capital expenditures, deferred charges, or charges to income and the amount exceeds 10% of the registrant’s current assets on a consolidated basis

- A governmental authority is a party to such proceeding and such proceeding involves potential monetary sanctions, unless the registrant reasonably believes that such proceeding will result in no monetary sanctions, or in monetary sanctions, exclusive of interest and costs, of less than $100,000

- Risk factors. Regulation S-K Item 503(c) requires a discussion of the most significant factors that make an investment in the registrant speculative or risky. Item 503(c) specifies that risk factor disclosure should clearly state the risk and specify how the particular risk affects the particular registrant; registrants should not present risks that could apply to any issuer or any offering.

Registrants should consider specific risks they face as a result of climate change legislation or regulation and avoid generic risk factor disclosure that could apply to any company. For example, registrants that are particularly sensitive to greenhouse gas (GHG) regulation, e.g., the energy sector, may face significantly different risks from climate change regulation compared to registrants that currently are reliant on products that emit GHGs, e.g., the transportation sector.

- For registrants with operations concentrated on coastlines, property damage and disruptions to operations, including manufacturing operations or the transport of manufactured products

- Indirect financial and operational effects from disruptions to the operations of major customers or suppliers from severe weather, such as hurricanes or floods

- Increased insurance claims and liabilities for insurance and reinsurance companies

- Decreased agricultural production capacity in areas affected by drought or other weather-related changes

- Increased insurance premiums and deductibles, or a decrease in the availability of coverage, for registrants with plants or operations in areas subject to severe weather

- MD&A. Regulation S-K Item 303 requires that disclosure decisions concerning trends, demands, commitments, events, and uncertainties generally should involve the:

- Consideration of financial, operational, and other information known to the registrant

- Identification, based on this information, of known trends and uncertainties

- Assessment of whether these trends and uncertainties will have—or are reasonably likely to have—a material effect on the registrant’s liquidity, capital resources, or results of operations. Registrants also should consider—and disclose when material—the effect on their business of treaties or international accords relating to climate change.

- Registrants whose businesses are reasonably likely to be affected by such agreements should monitor the progress of potential agreements and consider materiality and the above principles

- 1"COSO Releases New Achieving Effective Internal Control Over Sustainability Reporting (ICSR) Supplemental Guidance," coso.org

- 2https://www.eurosif.org/wp-content/uploads/2023/07/Eurosif-PRI-IIGCC-EFAMA-UNEP-FI-Joint-statement-on-ESRS.pdf