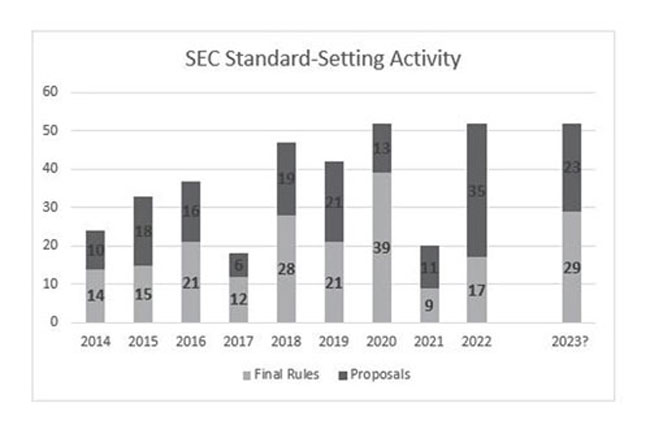

On January 4, 2023, the SEC’s semiannual regulatory agenda was released. The agenda outlines the SEC’s rulemaking priorities for 2023 and includes 23 proposed rules and 29 final rules, continuing the scorching standard-setting pace set in 2022. This level of output is only comparable to the regulation following the 2001 Enron scandal and the 2007 mortgage crisis.

Proposed Highlights

| Registrants | Investment Funds & Advisors | Broker-Dealer & Clearing Agencies | Capital Formation |

|---|---|---|---|

| Corporate board diversity | Amendments to the custody rule for investment advisers | Securitization conflicts of interests | Regulation D |

| Human capital management | Fund fee disclosure & reform | Single stock ETFs | Rule 144A holding period |

| Cybersecurity | Digital engagement practices – funds | Digital engagement practices – brokers | Securities held of record definition |

| Payments by resource extraction issuers | Clearing agency recovery & wind-down |

Final Rule Highlights

| Registrants | Investment Funds & Advisors | Broker-Dealer & Clearing Agencies |

|---|---|---|

| Climate change disclosures | ESG investment practices | T +1 settlement |

| Cybersecurity risk governance | Cybersecurity risk governance | Clearing agency governance |

| Share repurchase | Investment company names | Dealer definition |

| Shareholder proposals (Rule 14a-8) | Money market reforms | Exchange definition |

| Payments by resource extraction issuers | Form PF: Large PE & liquidity fund advisers Large hedge fund advisers | Security based swaps: Record-keeping Execution Undue influence |

| SPACs | Stock borrow/loan | Consolidated audit trail data security |

Each quarter FORVIS prepares an overview of proposals and final rules issued and updates on key outstanding projects. See the latest edition, “Quarterly Perspectives: SEC 4Q 2022.”

Conclusion

The Assurance Team at FORVIS delivers extensive experience and skilled professionals to align with your objectives. Our proactive approach includes candid and open communication to help address your financial reporting needs. At the end of the day, we know how important it is for you to be able to trust the numbers; our commitment to independence and objectivity helps provide the security and confidence you desire. FORVIS works with hundreds of publicly traded companies in the delivery of assurance, tax, or advisory services, within the U.S. and globally. For more information, visit forvis.com.

If you have questions or need assistance, please reach out to a professional at FORVIS or submit the Contact Us form below.