“DeFi,” short for “decentralized finance,” is a term used to describe financial applications that have been built on top of blockchains. These applications allow users to swap assets, earn interest, participate in governance, and even take out loans by offering their digital assets as collateral. All of this is done without the use of a central intermediary, such as a bank or brokerage. Without the presence of a central intermediary, individuals can receive a greater portion of the revenue being earned with their funds (DeFi applications charge interest and transaction fees for their services). While these systems may promise a greater return on investment, this also comes with a greater responsibility on behalf of the DeFi participant to keep track of their transactions and the tax owed because of their activity.

One of the most common DeFi applications is an automated market maker (AMM). These applications create decentralized exchanges that allow users to trade various forms of digital assets almost instantaneously. To do so, the DeFi application will typically charge a fee for conducting the trade and will in turn offer these fees to anyone who wants to contribute their assets as liquidity to the application. For our purposes, we will walk through the steps that a taxpayer who contributes to a liquidity pool will face when participating in the protocol and attempt to describe the tax implications along the way.

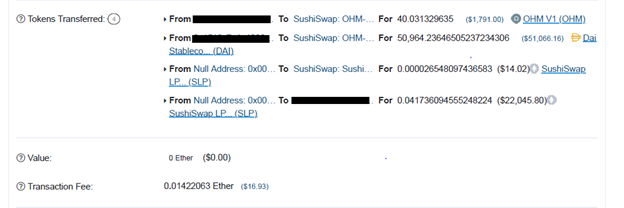

The first transaction that a liquidity provider would face would be the initial contribution of their assets into the liquidity pool. An example of this transaction is shown below:

In this transaction, the user is trading 40 OHM tokens and 50,964 DAI tokens for .0417 SLP tokens. When providing liquidity to a pool, users must provide liquidity for both sides of the pair swap, i.e., both OHM and DAI. In this example, every time someone swaps DAI for OHM and vice versa, the user will be rewarded with their proportion of transaction fee income. The SLP tokens that the user received are used to represent their share of the pool of assets that they contributed to. The tax consequences of this transaction are listed below:

- Capital gain or loss on the sale of the OHM and DAI tokens. The sales proceeds in this instance would be equal to the market value of the SLP tokens received. The cost basis for these tokens would need to be provided by the user. The gain or loss would be either long or short term, depending on how long the user had held the assets.

- The SLP tokens would receive cost basis equal to the market value of the token at that time plus the amount of the fee incurred.

Decentralized exchanges would charge a fee on these trades in the same way that centralized exchanges would. However, unlike in centralized exchanges, these fees would be distributed to the decentralized group of pool contributors. In this example, the protocol distributes the fees by adding them back to the pool that was used to facilitate the trade. The SLP tokens held by the liquidity providers would then increase in value as fees are deposited into the pool.

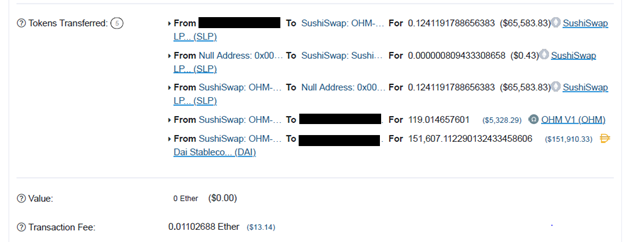

When the user is ready to withdraw their assets from the liquidity pool and effectively realize their portion of the trading fees, they can do so by trading back their SLP tokens. An example of this transaction is shown below:

Here we can see the user is trading their SLP tokens back to the application in exchange for the same form of digital assets that they originally deposited. This transaction would result in the following tax consequences:

- Capital gain or loss on the sale of the SLP tokens. The sales proceeds in this instance would be equal to the market value of the OHM and DAI tokens received. The cost basis for the SLP token should have been accurately documented from step 2 above. The gain or loss would be either long or short term, depending on how long the user had held the SLP tokens.

- The DAI and OHM tokens would receive cost basis equal to the market value of the token at that time plus the amount of the fee incurred.

This exercise, while limited in scope, does highlight two of the most important elements to properly reporting crypto transactions. First, it is incredibly difficult to know what amount of taxable income is owed without understanding the cost basis for the assets involved. This point is exacerbated by the fact that DeFi users can incur thousands of transactions per year. Second, DeFi participants need to understand how the applications they are working with are operating on the blockchain. The tax consequences that a DeFi user faces depend solely on the facts and circumstances of the transactions as they incur on the blockchain, and DeFi users will want to know how to find and interpret this data. Two DeFi applications could have significantly different methods to accomplish the same objective, and it’s important to know how these systems work before triggering unwanted taxable events.

As shown above, a heavy burden is placed on participants of DeFi systems. There are tools available, however, that attempt to relieve this burden. Services such as TaxBit and Ledgible will import a user’s transactions and generate a tax summary based on the data it sees from a taxpayer’s wallet. However, these services tend to have a hard time keeping track of DeFi activities, since there is a lack of uniformity to how they operate and the tokens that are used. A DeFi user would need to fill in the gaps missed by the tax software, which is a long and tedious process. Hiring a tax professional who understands how DeFi protocols operate and also is familiar with the tax software is a great step to alleviating this burden. In addition, tax professionals also can offer tax planning prior to the end of the calendar year to help reduce the tax burden and make sure the taxpayer is operating in a tax-efficient manner.

If you have any questions or need assistance, please reach out to a professional at FORVIS or submit the Contact Us form below.