When asked to describe the economic outlook for 2023 in a word, you might answer, “uncertain.” What is certain, however, is the costs of capital have been steadily increasing. Since the start of 2022, the Federal Reserve Bank has raised its key rate from near zero to a target rate of 3.75%-4%. Notably, in the last four Federal Reserve Bank meetings, that rate has been increased by 75 basis points each time. These rate hikes have monetary implications throughout the economy that impact everyday business decisions. To combat the unknown, decision makers often focus on what they can control to shield themselves from future uncertainties.

Developing options at every decision point becomes critical to continued organizational success. As the economy rises and falls, no matter how enduring those undulations may be, controlling costs often shapes strategic thinking. And, more to the point, access to affordable capital directly impacts sustained success for the economy overall. This raises the question: in a capital environment facing rising costs, are there more favorable borrowing options to help finance businesses?

One option is to explore the New Markets Tax Credit (NMTC) Program, which is administered by the Treasury Department via the Community Development Financial Institutions (CDFI) Fund. The NMTC Program is a community development tool that aims to inject low-cost capital into underserved areas—those communities with higher unemployment rates and lower-than-average median income levels. To participate in the program, a project or business must be in a designated NMTC zone and also must be selected by a Community Development Entity (CDE) for NMTC Program investment.

The NMTC Program operates by providing individual and corporate investors a tax credit against federal income tax liability in exchange for making equity investments into specialized financial intermediaries (a CDE). The investor receives a credit over a seven-year period for a total credit of 39% of the original investment in the CDE (5% in years 1–3 and 6% in years 4–7).

Investors participate in the NMTC Program primarily for tax credits. However, corporate investors also participate to fulfill regulatory obligations, notably Community Reinvestment Act (CRA) requirements. Financial institutions are required to invest in the communities they serve and participation in the NMTC Program helps satisfy these obligations.

CDEs use the equity provided by investors and make direct loans into qualified businesses located in underserved communities (under the NMTC Program, qualified businesses that receive private capital from CDEs are known as Qualified Active Low-Income Community Businesses, or QALICBs). CDEs are the gatekeepers of the NMTC Program and make project financing decisions that result in direct impacts to residents of the underserved communities.

The impact of financing received through the NMTC Program from a CDE is powerful for several reasons.

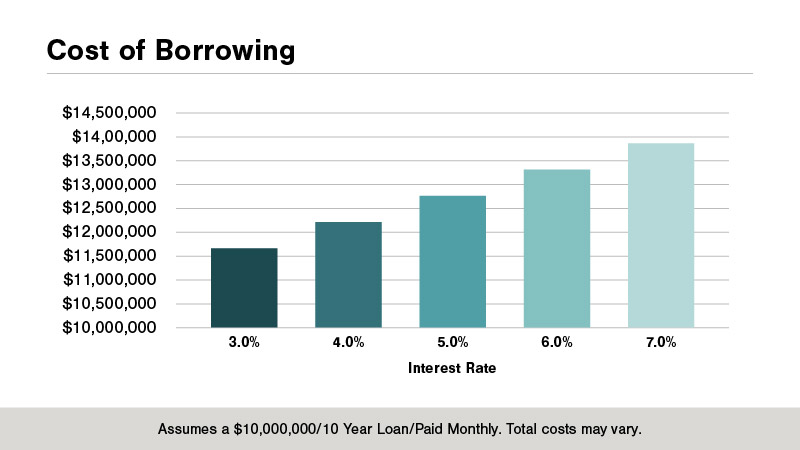

- Financing terms associated with NMTC loans are generally at or below market rates as compared to similar loan products.

- Financing must be interest-only for seven years, as required by the NMTC Program. Moreover, principal payments are prohibited during this time.

- After the seven-year recapture period, a portion of the financing may be returned to the project business as equity.

The goal of the financing is to support businesses as they grow and expand so the community and its residents can overcome challenges arising from a historical lack of capital investments.

In conclusion, the NMTC Program provides access to financing for businesses that is low-cost and high-impact while also supporting historically overlooked communities. The flexible nature and hyperlocal impact of the NMTC Program help ensure ongoing stability to businesses and communities alike—stability that is of critical importance when future economic outlooks are uncertain.

FORVIS can offer practical insight to help you navigate the complex nature of the NMTC Program. If you have questions or need assistance, reach out one of our professionals or use the Contact Us form below.

Read more articles from FORVIS' 2022 tax guide here.