Charitable trusts are becoming increasingly popular for taxpayers looking to make a charitable impact while still working toward their wealth transfer goals. Use of these types of trusts provides taxpayers an opportunity to support the charities that mean the most to them and transfer wealth to future generations. The major benefit of using charitable trusts is that they can provide the donor with an income tax deduction based on the type of trust used and the value of the gift. Similarly, for certain types of trusts, there is an estate tax benefit since the value of the assets gifted into the charitable trust is removed from the donor’s estate.

There are two primary types of charitable trusts—lead trusts and remainder trusts.

Charitable Lead Trusts

A charitable lead trust (CLT) is an irrevocable trust that pays, at least annually, a specified amount to one or more charities for a term of years or for the life of a designated individual. This is referred to as the “lead interest.” CLTs have two options for the type of payments that can be made to the charitable beneficiaries: annuity payments or unitrust payments. Annuity payments are made to charitable beneficiaries for the same amount each year. Unitrust payments are determined as a percentage of trust assets on a certain date each year.

A CLT can either be treated as a grantor CLT or non-grantor CLT. A grantor CLT is preferred in situations where an individual does not need an income stream and wishes to take advantage of receiving an immediate income tax deduction. Funding of a grantor CLT permits the donor to take a charitable deduction in the year of funding for the value assigned to the lead interest being paid to charity. During the term of the trust, the grantor pays tax on the income earned by the trust. For a non-grantor CLT, tax is owed by the trust on the annual income earned by the trust less the amount of the lead interest paid out to charity.

At the end of the stated term or individual’s life, any assets remaining in the trust are then distributed to non-charitable remainder beneficiaries. For a CLT with assets reverting to the grantor, no gift or estate tax exemption is used because the remaining assets are includable in the grantor’s estate. For a CLT with remainder beneficiaries other than the grantor, the reportable amount of the gift is discounted to reflect the value of the lead interest given to charity. The ultimate transfer to non-charitable beneficiaries can be accomplished with little to no usage of gift or estate tax exemption, making this a very valuable tool for ultimate wealth transfer to future generations.

Charitable Remainder Trusts

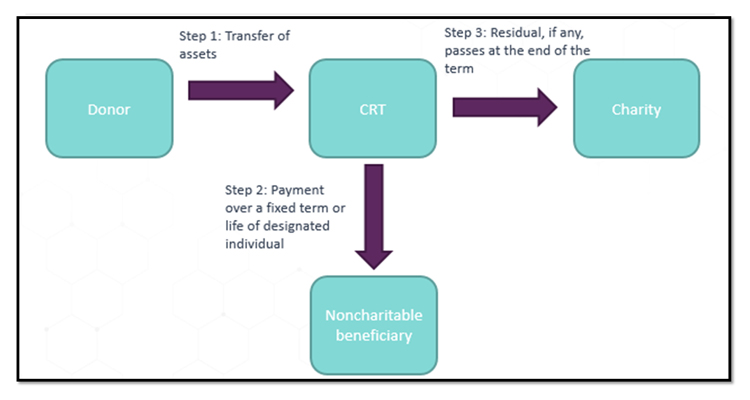

A charitable remainder trust (CRT) is essentially the opposite of a CLT. CRTs first benefit non-charitable beneficiaries (lead interest) while the remaining trust assets at the end of the term, which can’t exceed 20 years, pass to a charitable organization. The donor is subject to gift tax on the value assigned to the lead interest being paid to non-charitable beneficiaries but also is entitled to a charitable deduction for the value assigned to the remainder interest passing to charity in the year the trust is funded. A CRT is preferred in situations where an individual desires an income stream for themselves or other non-charitable beneficiaries while living, with the remainder going to charity upon their death.

Similar to CLTs, CRTs have two options for the type of payments that can be made to non-charitable beneficiaries: annuity payments or unitrust payments. Only the income distributed to a non-charitable beneficiary is taxed to that beneficiary. If any income is earned by the trust in excess of the annuity or unitrust payment for the year (and is therefore retained by the trust), no tax is owed on that amount, which will ultimately be distributed to a charity at the end of the trust term.

Charitable trusts can be an effective tool in supporting your charitable and wealth transfer goals. There are many other factors to consider when it comes to charitable giving and planning with trusts, so please reach out to a professional at FORVIS or submit the Contact Us form below to learn more.

Interested in learning more about the different types of trusts? Register now for our webinar, “Do I Need a Trust?” on November 9 at 11 a.m. Central time.