On November 2, 2022, in a partisan three-to-two vote, the SEC approved a final rule enhancing the information mutual funds, exchange-traded funds, and other registered management investment companies (funds) report annually on proxy votes. The rule also completes a Dodd-Frank Act requirement for institutional investment managers to report annually on proxy voting related to executive compensation say-on-pay1 matters. Other highlights:

- Funds and managers would categorize voting by type using the issuer’s proxy language.

- Funds and managers must disclose the number of shares that were voted and the number of shares held by the funds that were loaned out on the record date and not recalled for voting.

These changes will be effective for votes occurring on or after July 1, 2023. The first filing date for amended Form N-PX will be on August 31, 2024.

Background

Funds own approximately 32% of U.S. corporate equities and, therefore, can influence shareholder votes on governance, corporate actions, and shareholder proposals. Proxy voting decisions play an important role in maximizing investment value but may contradict stated environmental, social, and governance policies or investor intent. Investment advisers are fiduciaries that owe duties of care and loyalty to each client. To satisfy its fiduciary duty in making any voting determination on behalf of a fund, an investment adviser must determine the best interest of its client and cannot place its own interests ahead of the client’s interests. An investment adviser that assumes proxy voting authority must adopt and implement policies and procedures reasonably designed to ensure it votes client securities in the client’s best interest.

Since 2003, a registered management investment company2 is required to file its proxy voting record annually on Form N-PX.

Changes to Form N-PX

A fund currently discloses on Form N-PX whether it cast its votes on each proposal, how it voted, e.g., for, against, or abstained, and whether any votes cast were for or against management. The instructions do not specify the disclosure format or how the information is presented or organized. Funds’ reports are currently filed in plain-text or HTML format. The final rule requires that funds file their reports using an XML structured data language. The final rule also requires a fund that offers multiple series of shares to provide the complete voting record of each series separately. Funds also must disclose that proxy voting records are available to investors either upon request or on their websites; most funds currently disclose that at this information is available upon request.

Identification of Proxy Voting Matters & Categories

Currently, funds use different language to describe a proxy proposal and do not categorize their votes by type. This lack of standardization makes it difficult to compare how funds voted on a particular proposal. The final rule requires funds and managers to use the same language as the issuer’s proxy to identify proxy voting matters and list items in the same order as the issuer. Managers must group their votes into the following categories so that investors can focus on the topics they find important:

- Director elections

- Section 14A

- Audit-related

- Investment company matters

- Shareholder right and defenses

- Capital structure

- Corporate governance

- Environment or climate

- Human capital

- Diversity, equity, and inclusion

- Other social issues

- Other

Quantitative Disclosure & Securities Lending

Funds commonly engage in securities lending to generate additional income. When a fund lends its portfolio securities, it transfers ownership of the loaned securities, including proxy voting rights, for the loan duration. While the securities are on loan, the fund is not able to vote the proxies. If a fund determines that it wants to vote loaned securities, it must recall the securities and receive them prior to the vote’s record date. Recalling loaned securities may decrease a fund’s income. The decision of whether to recall a security on loan to vote is not currently disclosed on Form N-PX.

Under the final rule, disclosure will now be required of the number of shares voted (or instructed to be cast), as well as the number of shares loaned but not recalled. Disclosure would be required only where the manager has loaned the securities, including where the manager loans the securities directly or indirectly through a lending agent. A manager would not exercise voting power over loaned securities when its client hires a securities lending agent to loan securities in the client’s account and the manager has no involvement in the securities lending arrangement or in decisions to recall loaned securities.

In some cases, this disclosure may require coordination between the fund and custodians and proxy voting service providers.

Say-on-Pay Vote Disclosure for Institutional Investment Managers

The final rule extends Form N-PX reporting obligations for say-on-pay votes to institutional investment managers subject to §13(f) reporting requirements.3 Rule 14Ad-1 would require managers to report annually on Form N-PX each say-on-pay vote over which the manager exercised voting power or when it uses voting power to influence a security’s voting decision. There is a two-part test for determining whether a manager exercised voting power over a security and must report a say-on-pay vote on Form N-PX. Reporting is required only if the manager:

- Has the power to vote—or direct the voting of—a security. This includes the ability to determine whether to vote the security at all or to recall a loaned security before a vote. Voting power could exist or be exercised either directly or indirectly by way of a contract, arrangement, understanding, or relationship.

- Exercises this power to influence a voting decision for the security. The exercise of voting power means the actual use of voting power to influence a voting decision.

A manager will have no reporting obligation for a voting decision that is entirely determined by its client or another party.

Instruction in Form N-PX will allow managers to request confidential treatment of proxy voting material. Confidential treatment could be justified in narrowly tailored circumstances and would not be warranted solely to prevent proxy voting information from being made public.

Effective Date

The rule is effective on July 1, 2024. Funds will continue to be required to report their proxy votes, and managers will be required to report their say-on-pay votes, annually on Form N-PX not later than August 31 of each year, for the most recent 12-month period ended June 30. Managers and funds will be required to file their first reports on amended Form N-PX by August 31, 2024, covering the period of July 1, 2023 to June 30, 2024.

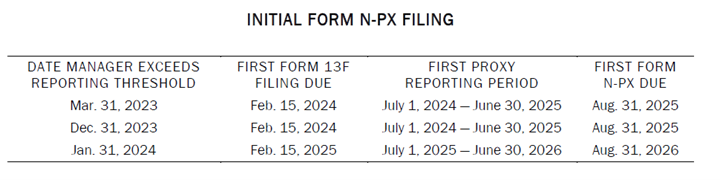

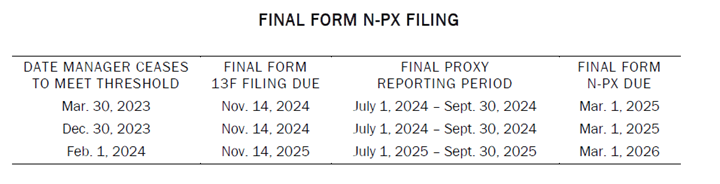

Form 13F requirements cover managers with assets of more than $100 million. Special transition provisions for say-on-pay disclosures are provided for managers that enter or exit from the obligation to file Form 13F reports.

Conclusion

The asset management team at FORVIS has more than 50 years of experience providing accounting, tax, and consulting services to various types of investment holdings, including conventional debt and equity investments, loans, businesses, alternative investments, and other unique assets. As of August 2022, Convergence Optimal Performance ranked FORVIS as a top 25 accounting and audit firm to registered investment advisors. FORVIS also was ranked in the top 20 by assets under management. We have experience providing services to fund complexes with net assets ranging from a couple million to several billion dollars. Our experience allows us to provide tailored services to help meet your unique needs. For more information, visit FORVIS.

- 1Section 951 of the 2010 Dodd-Frank Act generally requires public companies to hold nonbinding shareholder advisory votes to: Approve the compensation of their named executive officers, determine the frequency of such votes, with the option of every one, two, or three years, and approve golden parachute compensation in connection with a merger or acquisition

- 2Other than a small business investment company registered on Form N-5

- 3A manager that exercises investment discretion with respect to accounts holding at least $100 million of securities.