Year-end processing, also known as “closing the books,” involves reviewing, reconciling, and verifying an organization’s financials from the past fiscal year. Accounting automation software—like Sage Intacct—can help you streamline your accounting workflows and complete year-end tasks like closing the subledgers and reconciling the subledgers to the general ledger. To help your team close faster, check out our Sage Intacct year-end processing tips below.

Close the Subledgers

A subledger provides the details that support general ledger balances. There are various types of subledgers, including:

- Accounts Payable (AP)

- Accounts Receivable (AR)

- Cash Management

- Inventory

- Fixed Assets

- Prepaid Expense Amortization

- Time & Expenses

Closing the subledgers helps to prevent additional transactions from being posted in a closed period. Certain subledgers can be closed individually in Sage Intacct, and others will close when the “close books” function is completed for the general ledger. This feature allows you to lock the main subledgers, AP, AR, and Cash Management, while still having the ability to record month-end journal entries, which often happens later in the year-end close process.

It’s important to note that closing a subledger also closes any co-dependent modules, e.g., closing AP closes Purchasing and closing AR closes Order Entry.

Be sure to check for any pending transactions, such as draft transactions, failed recurring transactions, and unapproved or declined transactions in approval workflows, before closing the subledgers. As an example, if an AP bill with a posting date of 12/31/2022 does not make it through the approval process before the period is closed, then an error will generate when an approver completes the approval process at a date after the AP subledger was closed for December 2022.

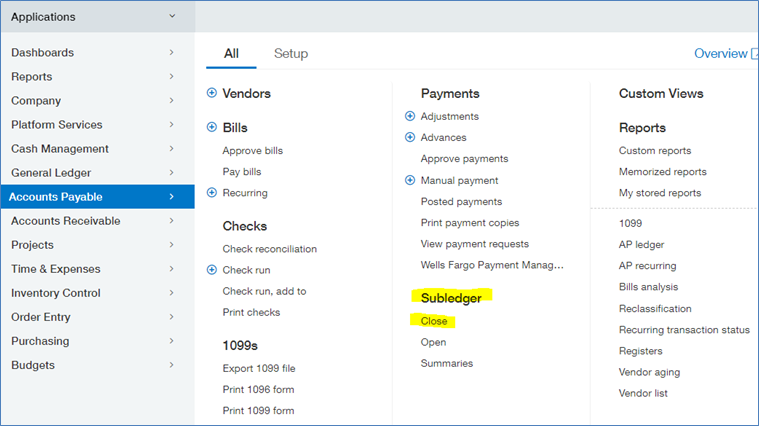

Close the main subledgers from the All menu under Applications > Accounts Payable (or Accounts Receivable or Cash Management) > All > Subledger > Close (shown below using AP as an example):

Reconcile the Subledgers to the General Ledger

After the subledgers have been closed, the next step is to reconcile the subledgers to the general ledger. Reconciliation compares subledger totals to the general ledger account balances.

To reconcile a subledger in Sage Intacct, follow the steps below (shown using AP as an example):

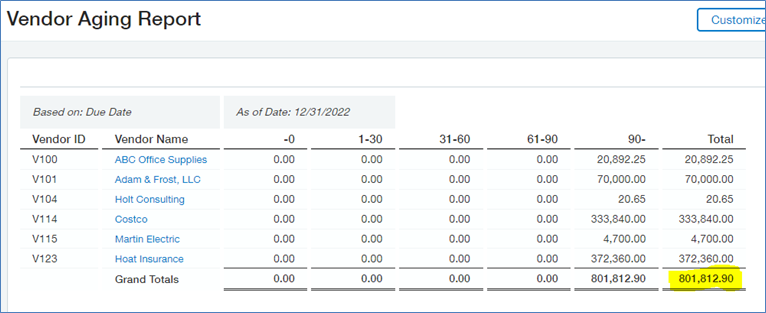

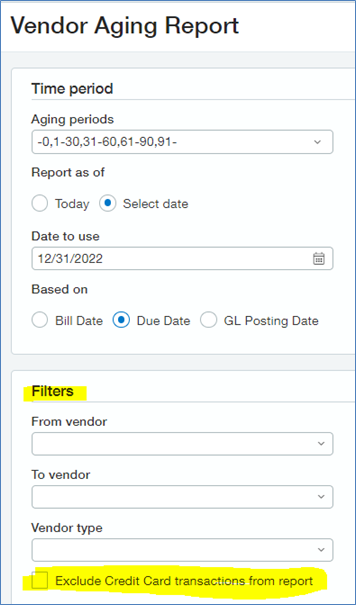

- Run the Vendor Aging report as of 12/31/2022 and make note of the total. Note: there is a filter option to include/exclude credit card balances. Depending on your setup of credit cards and corresponding liability accounts, this “toggle switch” may need to be disabled to obtain Aging results that tie to the AP general ledger account only.

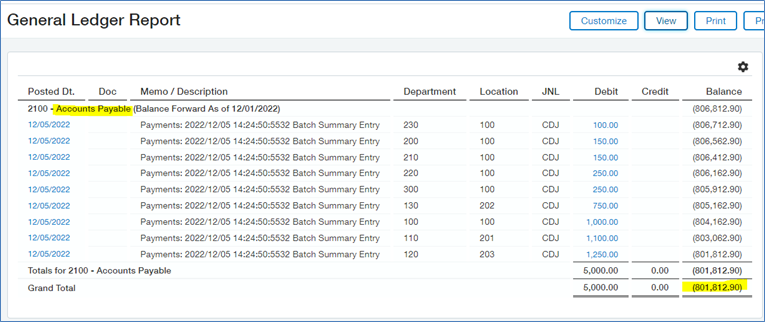

- Run the General Ledger report as of 12/31/2022 for your AP account. Alternatively, run a Trial Balance report at 12/31/2022 and locate the AP account balance.

- Compare the Vendor Aging report total to the General Ledger AP balance to verify they match.

Make Journal Entries

If there are variances between the subledger and general ledger balances, this is when further research and making journal entries to correct any discrepancies can occur. Your month-end and year-end processes also may include other types of journal entries such as:

- Payroll Entries

- Accrual Entries (that may or may not reverse in a later period)

- Depreciation Entries (if subscribed to Fixed Assets, users will post depreciation in that application)

- Prepaid Expense Entries (if subscribed to Prepaid Expense Amortization, users will post prepaid expense entries in that application)

- Revenue Recognition Entries

- Percentage Completion Entries

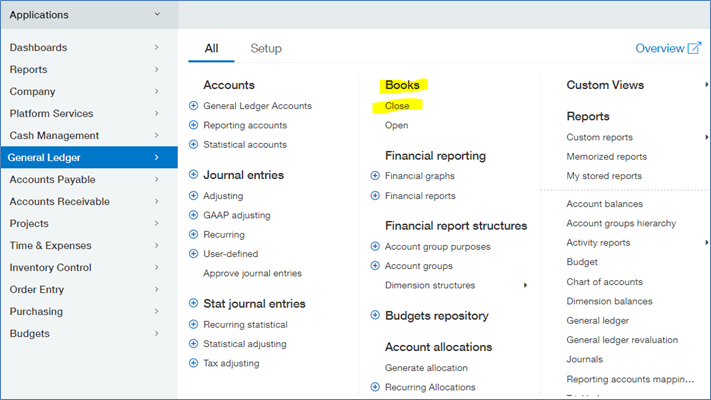

To make journal entries to accounts, go to Applications > General Ledger > All > Journal Entries. Select View Transactions next to the desired Journal name. Click Add to enter and post an entry or submit in an approval workflow if applicable. (You can Bookmark the entry page for quicker access rather than making multiple clicks through the menu.)

Best practice recommendation: Manual journal entries should only be recorded in the General Journal, Payroll Journal, or other custom Journals an administrator may have added for other defined purposes. Other system journals, such as Cash Disbursements Journal (CDJ), Cash Receipts Journal (CRJ), Inventory Journal (IJ), and Sales Journal (SJ), that Sage Intacct created during initial setup and configuration are designed to be used with various subledger transaction processing.

Adjusting Entries, sometimes referred to as Post-Closing Entries, also are available in Sage Intacct for transactions the organization needs to record to closed periods. One example is audit-related entries made after year-end and financial audit processing. These types of entries are usually isolated for tracking or research purposes. The debit and credit amounts of Adjusting Entries are reported in two separate columns in the Trial Balance report. Adjusting Entries can be set up to reverse, but the reversals also must be posted to closed periods.

After you’ve posted month-end and year-end journal entries, you should reconcile your bank and credit card accounts.

Reconcile Bank Accounts & Credit Cards

In 2019, Sage Intacct released the ability to feed bank transactions directly from your bank into Sage Intacct’s bank reconciliation. In 2020, Sage Intacct announced the addition of credit card transaction feeds.

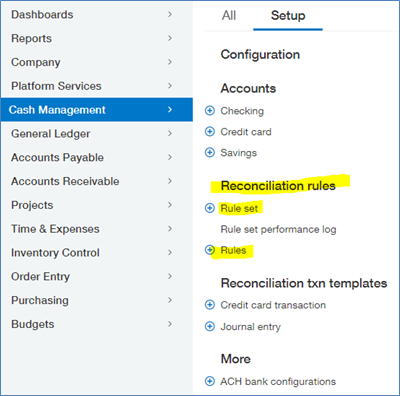

If your bank does not participate in the Sage Intacct banking cloud program for bank feeds, an alternate approach for bank reconciliations is to upload a file of transactions posted to your bank. The imported transactions or bank feed transactions can be automatically matched to Sage Intacct transactions with the use of the Matching Rules setup in Applications > Cash Management > Setup > Reconciliation rules. Users can create rules to match transactions based on data fields such as Amount, Posting Date, and Document (Check) Number. The individual rules can be added to a Rule Set and sorted in any order to efficiently auto match Intacct and bank transactions. Once Rule Sets are assigned to bank or credit card accounts, the time it takes to complete the reconciliation process can be greatly reduced.

If you need assistance setting up bank and credit card feeds for reconciliation or adding Matching Rules and Rule Sets, please reach out to your Sage Intacct Partner.

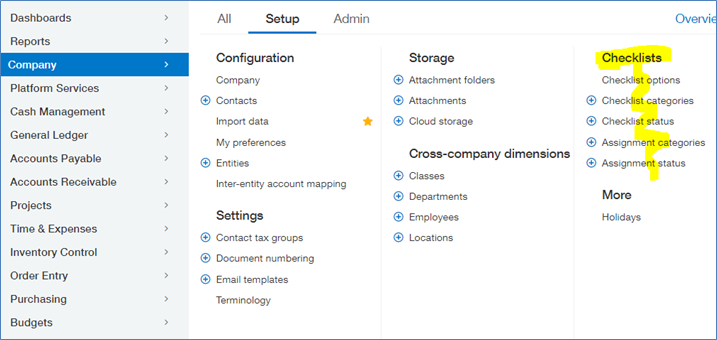

Checklists & Assignment

In the Company application, users will find functionality for creating and managing Checklists in the system. Checklists can be added for various processes, including month-end and year-end close. Assignments are created, attached to users in the system, and then added to a Checklist. Using Checklists for your processes can be an efficient way to digitally track and review responsibility and status of a year-end close process to check that all steps are performed in the proper order and fully completed.

Verify Results

Run standard application reports, like a Trial Balance and General Ledger Detail Report as well as financial reports such as Balance Sheet, Profit & Loss, and Cash Flow Statement (or for nonprofits, Statement of Financial Position and Statement of Activities) to verify results for the period. In addition, these standard reports and financial statements can inform your organization’s financial planning processes.

Close the General Ledger

Closing the general ledger prevents any additional transactions from being posted in that period. As mentioned above, this step also will automatically close any open subledgers.

Closing during the month of December can close the entity for all periods from January 1, 2022 to December 31, 2022. If you close your books monthly, your “Close company books from” date most likely will be December 1, 2022.

A user with appropriate permissions may close the general ledger and any open subledgers from Applications > General Ledger > All > Books > Close (shown below):

A dashboard component can be added to any existing dashboard to display a summary of all “closed thru” dates by subledger. The Closed Thru Summary component is found under “General” and can be set to a summary view or entity view to see all closed thru dates by subledger by entity.

We hope our Sage Intacct year-end processing tips help improve your close process. However, if closing the books is a challenge and you’d like to see Sage Intacct in action, please contact us.

The Business Technology Solutions Team at FORVIS is a Sage Partner. We provide implementation, training, and support services for Sage applications. Use the Contact Us form below to get in touch.