On October 28, 2022, the Community Development Financial Institutions (CDFI) Fund announced the 107 community development entities (CDEs) that were awarded a total of $5 billion in New Markets Tax Credit (NMTC) allocation authority. The announcement was a momentous day for all 107 CDEs but also for all who participate in—and around—the NMTC program. However, for most the NMTC program is either unknown, too complex, or misunderstood altogether, and confusion often follows. We will attempt to alleviate some of that confusion and briefly outline some of the most common misconceptions surrounding the NMTC program.

A. “It’s not for me. As a tax-exempt organization, I don’t need and can’t use tax credits.”

Yes, the program uses “tax credits” in the name, but the program’s function goes well beyond a tax credit. Regardless of tax position, many can benefit. In most cases, multiple parties participate in the NMTC program, and for each NMTC transaction, there are generally three participants:

- An NMTC Investor – Traditionally, a financial institution with community investment goals and tax liability. The investor is the organization that directly benefits from the tax credit.

- A CDE – Traditionally, a mission-driven organization with community development goals. The CDE facilitates the NMTC program and makes loans to qualified projects located in distressed communities.

- A Project or Business – The underlying business or investment in need of financing. The project or business receives low-cost financing at below-market rates and with more favorable repayment terms than traditional bank financing.

The program benefits numerous parties both directly—as outlined above—and in almost all cases through indirect benefits to the community at large. To this extent, the NMTC program’s value goes well beyond a tax credit. Yes, tax credits are an important function of the NMTC program, but as with most things, there is more to the story.

B. “My project is in a distressed community, so I automatically qualify for NMTC funding. All I need to do is apply for funding.”

The NMTC program aims to overcome community challenges such as poverty, unemployment, and access to services often found in low-income areas. In this regard, NMTC funding is designed for—and ultimately directed toward—distressed communities, i.e., communities with poverty rates exceeding 20% or average median income (AMI) levels falling below 80%.1 Thus, the location, specifically the census tract, is the first step for NMTC project evaluation. If a project sits in a census tract with either characteristic, it is eligible for the NMTC program. However, not all distressed communities are created equal.

CDEs make investment decisions based on distress levels—among other factors, including job creation and workforce development and training—and access to critical services missing in the community. In addition, the CDFI Fund awards NMTC allocation authority to the CDEs based on where the CDEs plan to make investments. Since the NMTC program is designed to address long-standing community needs, it makes sense that the most distressed communities would be first in line for funding. However, this results in many worthy and deserving projects with strong community benefits being on the outside looking in when asking for NMTC funding.

C. “My project costs $15 million and I received an allocation for $15 million, so I don’t need any additional funding. The NMTC program covers all my costs.”

The NMTC program is a low-cost funding mechanism that often is a “last in” portion of the capital stack. It can help address a gap in financing that ultimately helps move a project forward. Unfortunately, the amount of financing received by a project and the amount of allocation committed to a project are not a one-for-one match.

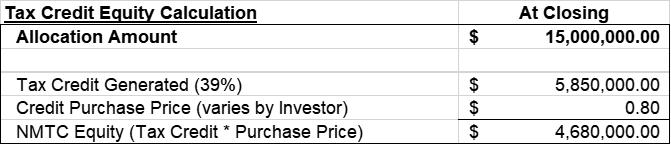

CDEs are not awarded investment dollars; rather, they receive tax credit allocation authority. For every $1 of tax credit allocation authority, 39 cents of tax credits are generated. However, the tax credit generated is claimed over a period of seven years. As a result, an NMTC investor is unwilling to pay full value today for the tax credit since it is unable to use the full value today. The NMTC investor purchases those tax credits at a discounted rate. An example calculation of this concept is shown in Figure 1 below:

Figure 1

These funds are then syphoned through an NMTC transaction where additional fees and costs also are subtracted. The key point is that the allocation amount of $15 million, in this example, leads to $4.68 million in available NMTC equity. That’s far less than the $15 million potentially contemplated. The remaining funds are then loaned to a project to help finance project-related costs. Therefore, NMTC funding is referred to as a gap filler or a “last in” funding mechanism. Although less than one might expect, the NMTC funding resulting from the allocation committed to a project has real value and may be truly significant in the completion of a worthy project in a needy community.

If you have questions or need assistance, please reach out to an NMTC professional at FORVIS or submit the Contact Us form below.