In "Marital/Family Trust Planning (Part 1)," we discussed some of the basics of the federal estate tax, provided an illustration of the benefits of this type of planning, and mentioned other benefits of using trusts. In Part 2, we explain how this type of planning is implemented and answer some frequently asked questions.

What is a Marital/Family Trust plan?

Marital/Family Trust planning is when married couples utilize separate trusts at the death of the first spouse to reduce or eliminate the payment of estate taxes, while taking full advantage of the estate tax exemption. Clients can incorporate this planning into their wills, or into their revocable trust.

How does the Marital/Family Trust work?

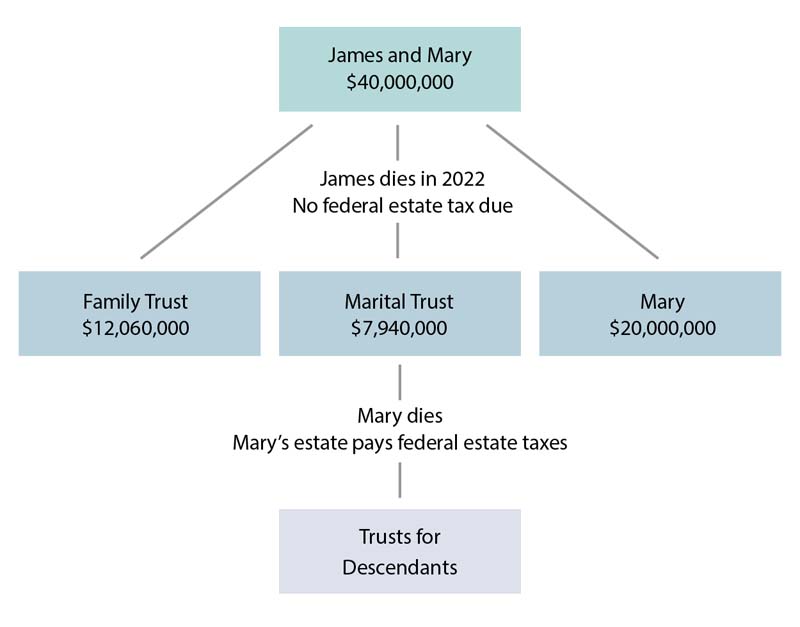

This plan begins at the death of the first spouse (the “predeceased spouse”). At their death, the predeceased spouse’s assets will flow into two trusts. A Family Trust will be established to hold assets equal in value to the predeceased spouse’s estate tax exemption amount. If there are any remaining assets in the predeceased spouse’s estate, they will be used to fund the Marital Trust. Let’s look at an example:

Example: James and Mary are married and have three adult children. They have an estate worth $40,000,000, and they each own 50% of the assets. They execute wills that incorporate a Marital Trust and a Family Trust at the death of the first spouse. By doing this, they will not pay estate taxes at the death of the predeceased spouse.

Commonly Asked Questions About Marital/Family Trusts

Are these trusts obsolete since the federal estate exemption is so high?

The increase in the federal estate tax exemption over the years has led some to argue that this type of planning is not necessary. In 2022 the federal estate tax exemption was $12,060,000 per person, or $24,120,000 for a married couple. The exemption increased to $12,920,000 in 2023, or $25,840,000 for a married couple. It should be noted, however, that under the current law the exemption amount will revert back (or “sunset”) to $5,000,000 per person, adjusted for inflation, at the end of 2025. This is expected to significantly increase the number of estates that will be subject to the federal estate tax. This type of planning can also be useful in the 17 states that have their own version of an inheritance tax for the same reasons discussed above. As you can see, there are still some benefits to incorporating this type of planning into your overall estate plan.

Are the Marital and Family Trusts irrevocable?

First, you need to keep in mind that these trusts are not actually created until the first spouse dies. Up to that point, the documents can be amended as often as necessary, provided they still follow the tax rules. Once the first spouse dies, however, the trusts are created and they are irrevocable. This is done for both tax and creditor protection reasons. This includes protecting the children’s inheritance if the surviving spouse remarries.

Can the surviving spouse get money out of the Marital or Family Trust?

The short answer is YES. In order to qualify for the unlimited marital deduction, the Marital Trust is required to pay the surviving spouse all of the income from the trust at least annually. In addition, the Marital Trust can be drafted to allow the surviving spouse to have access to funds through mandatory distributions or through distributions at the trustee’s discretion for such things as health, education, maintenance, and support.

The Family Trust is not subject to the same income distribution requirements as the Marital Trust. However, it too can be drafted to allow for mandatory distributions to the surviving spouse or distributions at the trustee’s discretion. Generally speaking, it is more beneficial to have distributions to the surviving spouse come from the Marital Trust before distributing funds from the Family Trust. This is because at the death of the surviving spouse the balance of the Marital Trust will be included in their taxable estate, while the Family Trust will not.

Can my children or other people be beneficiaries of the Marital or Family Trust? What if the surviving spouse remarries?

In order to qualify for the unlimited marital deduction, the surviving spouse can be the only beneficiary of the Marital Trust while the surviving spouse is living. The Family Trust is a lot more flexible as there are no restrictions on who can be a beneficiary. A common planning technique is to grant the trustee the power to make distributions, at the trustee’s discretion, to the surviving spouse and any of their descendants for things such as their health, education, maintenance, or support. Additional language can be added to require the trustee to consider the surviving spouse’s needs before making any distributions to other beneficiaries.

The trusts can be drafted with as much or as little flexibility as you desire. The only exception being that the surviving spouse can be the only beneficiary of the Marital Trust while they are alive. In many cases the trusts are drafted so that if the surviving spouse remarries they are not able to add or remove any beneficiaries from the trusts. This is an area that you should discuss in detail with your professional advisors.

Can’t you transfer the exemption at the first spousal death to the second spouse through “portability” and not use a trust?

The tax code does allow you to transfer any remaining estate tax exemption from the deceased first spouse’s estate to the surviving spouse. While this can be a great benefit, especially in instances where no tax planning has been done, it does have its drawbacks. Here are just a few:

- The executor of the estate of the first spouse to die has to file an estate tax return to report the election, even if there is no other reason to file the return. Under current rules you have up to five years after the death of the first spouse to file this return (note, this late portability election relief only applies if an estate tax return is not otherwise required to be filed).

- Assets left to the surviving spouse outright can continue to appreciate in value during their lifetime, which will increase the amount of estate tax that is due on their death. If those same assets were in a Family Trust, that appreciation would not be subject to estate tax.

- The generation-skipping transfer tax exemption, which can reduce the tax that applies to transfers to grandchildren and lower generations, is not portable.

- Assets left to a surviving spouse outright cannot take advantage of the creditor protection benefits of trust planning.

Are there situations where my executor would not want to use the Family Trust in my will or revocable trust?

There are several variables in every client’s estate plan that make it difficult to anticipate what their estate will look like at their death. Your estate can grow significantly, or it can decrease through spending or gifting. In addition, an estate involves the intersection of a number of tax laws, including federal and state estate taxes, federal generation-skipping transfer taxes, and even federal and state income taxes. These laws change over time, which means that clients should, to the extent possible, keep some level of flexibility in their planning documents.

Reach out to a professional with FORVIS Private Client™ or fill out the Contact Us form below to discover smart planning strategies and the financial benefits of establishing Marital and Family Trusts.