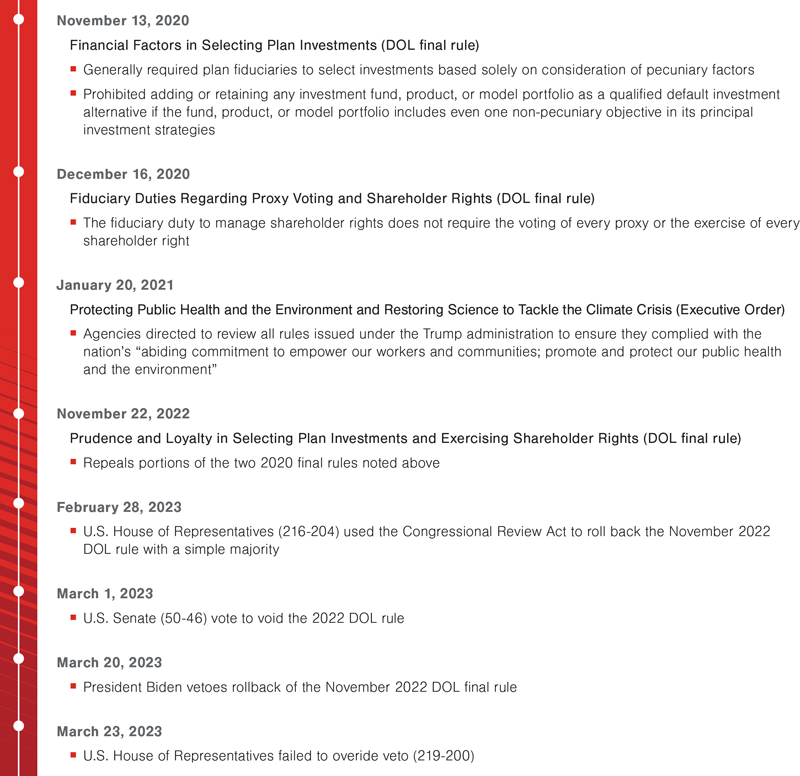

Employee benefit plan (EBP) managers continue to have a difficult time navigating a flip-flopping regulatory landscape on environmental, social, and governance (ESG) investment offerings and duties related to proxy voting. The timeline below summarizes recent events for Department of Labor (DOL) regulation. For provisions of the most up-to-date guidance, the November 2022 Prudence and Loyalty in Selecting Plan Investments and Exercising Shareholder Rights, see “New DOL ESG Rules for ERISA Plans.” State governments also are proposing legislation on ESG matters for their pension funds.

DOL Rules

State Regulation

State legislatures continue to propose and pass legislation limiting efforts that can be related to ESG. In August 2022, Florida Gov. Ron DeSantis’ administration approved a resolution to bar the state’s $186 billion pension fund from considering noneconomic factors when making investment decisions. On February 23, 2023, the Indiana House adopted House Bill 1008, which would require the $45 billion Indiana State Public Retirement System to make investment decisions “solely in the financial interest of the participants and beneficiaries of the public pension system.” The bill defines “furthering a social, political, or ideological interest” as pursuing a reduction in greenhouse gas emissions beyond legal requirements and for nonfinancial purposes, assessing corporate boards based on characteristics of a protected class (such as race, sex, or age), and divesting from companies in a list of protected industries (firearms, oil, gas, lumber, mining, agriculture, and meat production). The bill also requires the pension fund to track and report all of its proxy votes, roughly 200,000 annually.1

Conclusion

FORVIS will continue to follow this evolving situation.

With the significant investment you make in your EBP, you understand the importance of closely monitoring your plan’s areas of risk, internal controls and financial statement amounts, and disclosures, all while maintaining compliance with regulations. That’s why many plan sponsors are turning to FORVIS to assist them with timely insight, innovative services, and depth of plan resources. Reach out to a professional at FORVIS or submit the Contact Us form below for more information.

- 1“Anti-ESG Pension Bill Could Drop State Pension Returns $6.7 Billion in Next Decade,” indianacapitalchronicle.com, February 6, 2023