Lately on the Hill

Congress is back in session, so here is what you need to know as we gear up for a busy few weeks on the Hill:

- Debt limit update. We’re expecting debt limit talks to dominate headlines with Congress back in session since Treasury estimated that we may reach the statutory debt limit as early as June (the “X” date). House Republicans are expected to release their opening offer soon, with hopes of taking debt limit legislation to the House floor for a vote by the end of April. The opening offer is likely going to follow the framework in House Speaker Kevin McCarthy’s March letter to President Joe Biden and his speech on the debt limit yesterday at the New York Stock Exchange,1 but there also are other lists floating around the Hill with the most popular ideas that Republicans are discussing to bring to the negotiation table. As of now, here are some of the possibilities:

- A temporary fix that would lift the debt limit until May 2024 or increase the debt limit cap by $2 trillion

- Cap non-defense discretion spending or an overall cap on discretionary spending after reducing it to fiscal year (FY) 2022 levels (note that this could have an impact on tax policy because a spending cap like this will impact appropriations negotiations later this year for FY 2024 government funding)

- Limit budget growth to 1% annually for the next 10 years (also could impact tax policy options)

- Rescind unspent COVID-19 funds

- Prohibit student loan forgiveness

- Repeal certain clean energy tax credits (no insight yet on which tax credits)

- Establish work requirements for social programs like Medicaid, SNAP, and TANF

- Implement the Republicans’ energy package, the Lower Energy Costs Act

- Implement the Regulations from the Executive In Need of Scrutiny (REINS) Act of 2023

The Main Street Caucus, one of the five main groups at the negotiation table in the House, is the first to share its input on the spending cut options listed above. Note that any proposed debt limit bill that House Republicans introduce is unlikely to make it through the Senate intact, so take these proposed policies with a grain of salt and look for Democrats to counter with their own offers in the coming weeks (or maintain their position that they’ll only agree to a “clean” debt limit bill with no spending cuts attached).

- New bills introduced. It’s a short list this week.

- A new R&D bill is expected to be released this week to allow businesses to permanently deduct R&D costs the same year they are incurred and reverse a provision in the Tax Cuts and Jobs Act that requires businesses to amortize research costs over a period of five years starting in 2022. This bill has bipartisan support, but it is still to be determined which legislative vehicle it could fit into during this session since Democrats still want to tie any corporate tax policy with an expanded child tax credit.

- Rep. Andrew Garbarino (R-NY) reintroduced the Securing Access to Lower Taxes by ensuring (SALT) Deductibility Act, which would repeal the $10,000 state and local tax (SALT) cap deduction.

- Reps. Earl Blumenauer (D-OR) and Dean Phillips (D-MN) introduced the Restaurant Revitalization Tax Credit Act, which would create a tax credit to offset restaurants’ payroll tax liabilities at up to $25,000 per quarter in 2023. The credit would be available only to businesses that have applied for, but did not receive, Restaurant Revitalization Fund grants under the American Rescue Plan and were open before March 14, 2020.

- Rep. Chris Pappas (D-NH) introduced the No Taxation on PFAS Remediation Act, which would remove federal taxes on per- and polyfluoroalkyl substances (PFAS) contamination reimbursements.

IN CASE YOU MISSED IT

- Sen. Elizabeth Warren (D-MA) and Rep. Alexandria Ocasio-Cortez (D-NY) sent letters to 14 of the largest depositors with Silicon Valley Bank (SVB), asking for information on the company’s decision to bank with SVB and insight “describing SVB’s ‘coddling’ and ‘white glove’ treatment” of large venture capitalist and startup depositors.

- Rep. Bill Pascrell (D-NJ) is asking the IRS to better address and understand the nation’s tax gap, based on a report issued by the Treasury Inspector General for Tax Administration that found shortcomings in the methodology and data sources used to calculate components of the tax gap.

- The Senate Finance Committee will hold a hearing tomorrow, April 19, at 10 a.m. ET, on President Biden’s IRS budget for FY 2024 and the 2023 tax filing season. The hearing will include testimony from Daniel Werfel, the new IRS commissioner.

- The IRS is recommending that taxpayers who filed their federal income taxes early in this year’s filing season and reported certain 2022 state tax refunds as taxable income should consider filing an amended return. Specifically, the IRS has provided guidance that taxpayers in the following states don’t need to report state payments on their 2022 tax return: Alaska (but only for special supplemental energy relief payments), California, Colorado, Connecticut, Delaware, Florida, Hawaii, Idaho, Illinois, Indiana, Maine, New Jersey, New Mexico, New York, Oregon, Pennsylvania, and Rhode Island.

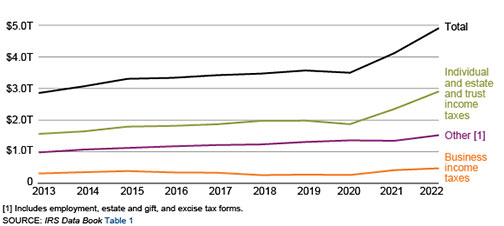

- The IRS issued its annual Data Book with details of the agency’s activities during FY 2022, including revenue collected and tax returns processed. Gross collections came in at $4.9 trillion—here is a breakdown of the sources of the collections over the last decade.2

Gross Collections by Type of Tax, Fiscal Years 2013–20222

- The IRS issued Revenue Ruling (Rev. Rul.) 2023-08, making Rev. Rul. 58-74 obsolete. Rev. Rul. 58-74 allowed taxpayers to file a claim for refund or amended return to deduct research or experimental (R&E) expenditures that the taxpayer had failed to deduct in prior taxable years under Section 174. The IRS recently issued new guidance on accounting method changes related to R&E expensing, and as such, Rev. Rul. 58-74 is no longer relevant.

- In Rev. Proc. 2023-15, the IRS provided a safe harbor accounting method for taxpayers to use when determining whether expenses to repair, maintain, replace, or improve natural gas transmission and distribution property must be capitalized.

- The IRS issued two new fact sheets for individual taxpayers: FS-2023-09 with a list highlighting tax credits for individuals and FS-2023-10 summarizing tax deductions for individuals (including the difference between standard and itemized deductions).

- The Biden administration continues to focus on getting more electric vehicles on the road. Last week, the U.S. Environmental Protection Agency released two proposed rules with more stringent standards to reduce greenhouse gas emissions from heavy-duty vehicles beginning in model year 2027, and new standards to further reduce air pollutant emissions from light-duty and medium-duty vehicles starting with model year 2027. If finalized, these standards would require more than two-thirds of all vehicles manufactured in the U.S. to be fully electric by 2032.

- The IRS and Departments of Labor and Health and Human Services have jointly issued FAQs to clarify how the COVID-19 coverage and payment requirements under the Families First Coronavirus Response Act (FFCRA) and the Coronavirus Aid, Relief, and Economic Security Act (CARES Act) will change when the Public Health Emergency (PHE) ends.

This newsletter features developing content that is subject to change at any time. It does not constitute legal or tax advice. Consult your professional advisors prior to acting on the information set forth herein.