Available over the last 17 years, Section 45L was originally implemented under the Federal Energy Policy Act of 2005. Homebuilders and multifamily developers, along with their tax advisors, have been navigating the rules of a tax credit that, although was never made permanent, was extended multiple times. The Inflation Reduction Act of 2022 finally provided an extension long enough to plan, which will be necessary due to the new certification requirements. Moving forward, taxpayers need to be proactive long before the first cubic yard of concrete is poured if they wish to pursue this newly expanded tax credit.

Although many changes occurred within the Inflation Reduction Act of 2022 regarding §45L, there still could be an opportunity to claim this credit for prior tax periods that are still open under the IRS statute of limitation and subject to the original rules of the credit.

General Information & Rules – Units Initially Leased or Sold Before December 31, 2022

Since 2006, the §45L credit has been available for dwelling units built by an eligible contractor and then acquired or leased from such an eligible contractor. Under the existing rules, to receive a credit, the eligible contractor must show a 50% reduction in energy use as compared to a set building standard, where one-fifth of the reduction comes from items such as exterior walls, floors, windows/doors, and roofing. If all the qualifications are met, each dwelling unit is eligible for a $2,000 federal tax credit. Or, in the case of manufactured homes, a $1,000 per dwelling unit tax credit is available if it meets a 30% reduction in energy use.

Under current rules, an “eligible contractor” is a person who has basis in the building during construction. This could include the person constructing the new energy-efficient dwelling unit (or manufactured home producer), or an owner who hired a third-party contractor to construct a dwelling unit to be leased or sold.

A dwelling unit qualifies under the existing rules if it meets the following criteria:

- Is located in the United States;

- Substantially built after December 31, 2005;

- Is initially sold or leased before the end of 2022;

- Is three stories above grade or less; and

- The dwelling unit has an energy consumption reduction that is 50% or more than a comparable dwelling unit that meets certain energy requirements in accordance with 2006 International Energy Conservation Code Residential Energy Efficiency standards.

General Information & Rules – Units Initially Leased or Sold Between January 1, 2023 & December 31, 2032

Beginning on January 1, 2023, the credit amounts adjusted to $500, $1,000, $2,500, or $5,000, depending on the criteria met. The definition for “eligible contractor” remains the same, but the dwelling unit definition now could include buildings over three stories in height above grade. There also have been multiple changes to the energy reduction qualifications and standards.

For both single-family and manufactured homes, the credit has been increased to $2,500 if the dwelling unit is certified under the ENERGY STAR® Single-Family New Homes program. The credit increases to $5,000 if the dwelling unit is certified a DOE Zero Energy Ready Home. Both standards require planning during the development process. There are additional requirements including, but not limited to, design checklists and pre-drywall inspections as well as a few specific items that if not implemented in the design will automatically exclude the dwelling unit from certification. Timing and planning are now critical.

For multifamily homes, the credit per dwelling unit is decreasing to $500 if they are certified under ENERGY STAR® multifamily. The credit will increase to $1,000 if the building is certified a DOE Zero Energy Ready Home. In addition, these amounts could potentially increase further per unit if the prevailing wage requirements are met.

To meet the prevailing wage requirements, a taxpayer will need to ensure that all laborers, contractors, and subcontractors are paid during the construction at a rate not less than the local prevailing rates for construction, alteration, or repair and set by the U.S. Department of Labor. Records must be maintained documenting the compliance in a manner sufficient to establish qualifications for the higher deduction amounts. These records at minimum should include identifying information of the laborer or mechanic, location of the facility, labor classification, hourly rate paid, total number of labor hours, total wages paid for each pay period, and timing for any correction payments.

If the prevailing wage requirements are met, an ENERGY STAR® certified multifamily home would qualify for a $2,500 credit per dwelling unit, increasing to a $5,000 credit if certified as a DOE Zero Energy Ready Home.

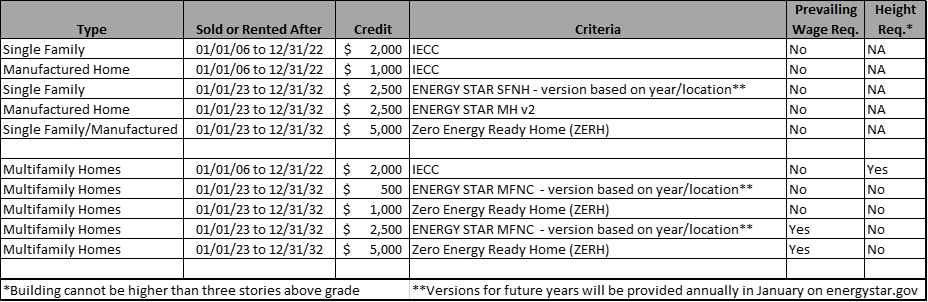

The following chart provides a summary of the various qualifications and credit levels available for single-family, multifamily, and manufactured homes. Specific details regarding the version required to follow are located on the energystar.gov website.

If you have any questions, please reach out to a professional at FORVIS.