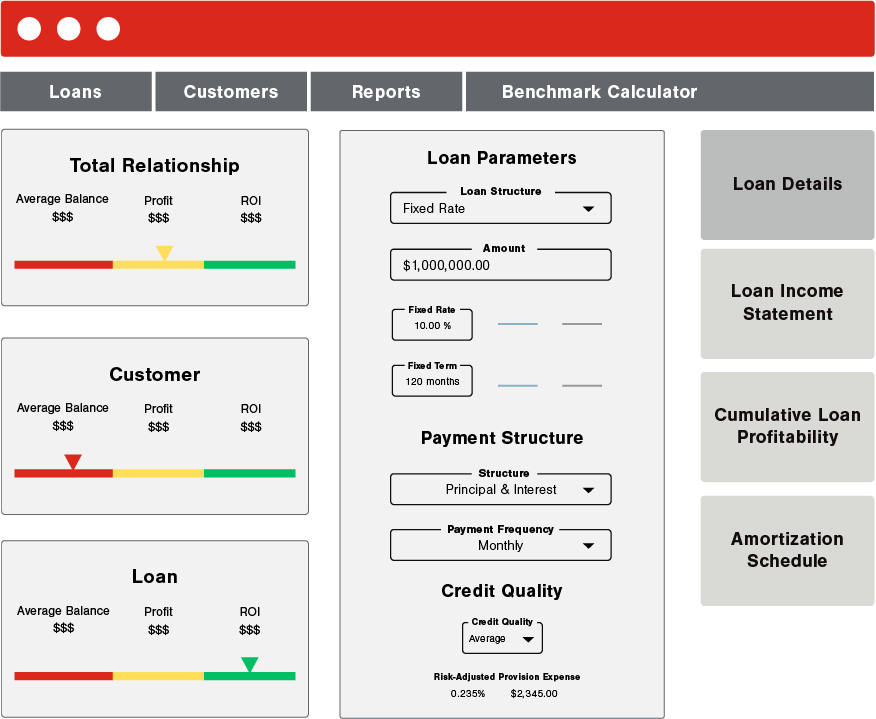

Is your financial institution relying on intuition to price loans? Are you seeking ways to help grow your loan portfolio in a competitive market? Do you need more visibility into your institution's lending portfolio performance at the lender, branch, product, and customer levels?

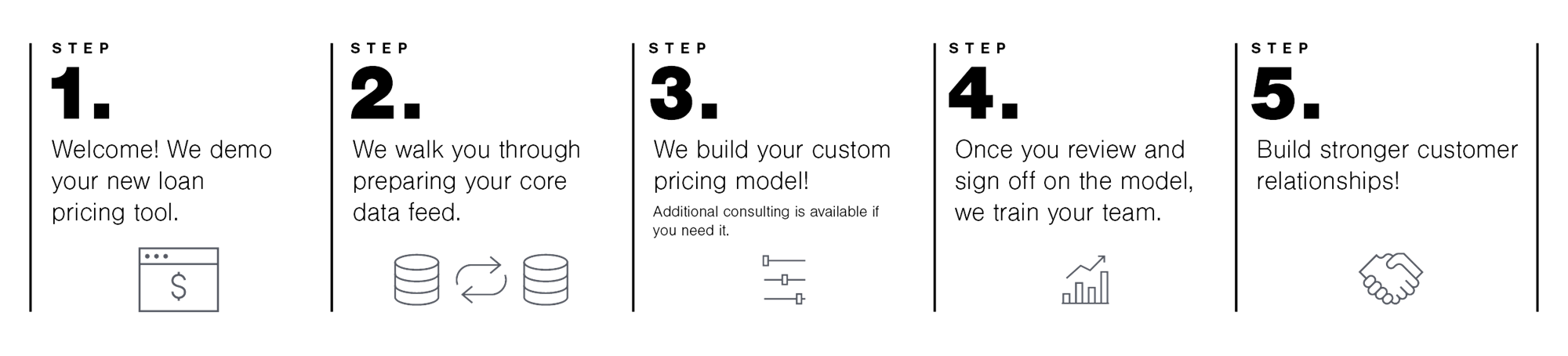

LoanPricingPRO can help your financial institution manage and grow your portfolio by factoring in the value of your existing customer relationships and optimizing your proposed loan terms with real-time profitability analysis. LoanPricingPRO's multidimensional reporting allows you to drill down into your lender, product, and customer profitability.