Over the past several months, financial institutions (FIs) of all sizes have found themselves in the crosshairs of regulators who are keen to prevent any further bank failures such as those witnessed in 2023. This heightened awareness of operational vulnerability against uninsured deposits and the ease at which technology has enabled contagion has caused a rethinking of what is necessary to enable banks to successfully navigate stress environments and, in extreme cases, resolution scenarios.

How We Got Here: A Look Back at the Regional Banking Crisis

The regional banking crisis of 2023 demonstrated that even the failure of smaller banks can pose significant risks to the financial system. Specifically, insured depository institutions (IDIs) as small as $100 billion can create challenges to resolvability if the deposit profile, operational structure, and complexities of the organization are not well understood and documented. The crisis also highlighted potential risks of an overreliance on funding from uninsured deposits and the reality that deposits in general may no longer be as stable as once thought due to the impacts of social media and other technological advances.

This has led to an evolution of the resolution planning guidance with much of the new proposals—coupled with the changes to the risk capital framework in the “Basel III Endgame”—aimed at addressing the challenges faced during this stress period and significantly increasing the resolution planning expectations of these institutions.

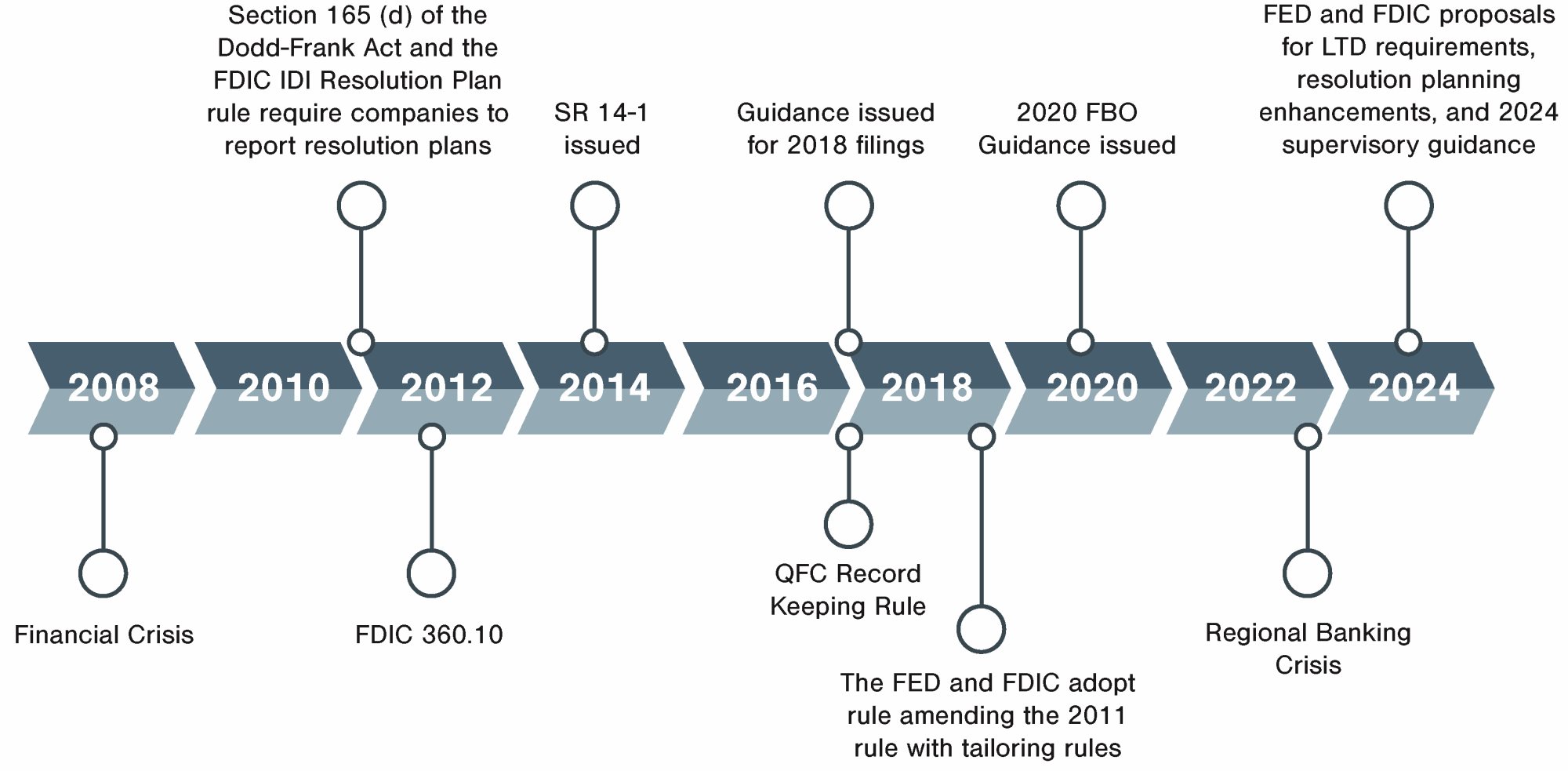

- 2008

- Financial Crisis

- 2010

- Section 165 (d) of the Dodd-Frank Act and the FDIC IDI Resolution Plan rule require companies to report resolution plans

- 2012

- FDIC 360.10

- 2014

- SR 14-1 issued

- 2016

- 2018

- Guidance issued for 2018

- QFC Record Keeping Rule

- The Fed and FDIC adopt rule amending the 2011 rule with tailoring rules

- 2020

- 2020 FBO Guidance issued

- 2022

- Regional Banking Crisis

- 2024

- FED and FDIC proposals for LTD requirements, resolution planning enhancements, and 2024 supervisory guidance

Raising the Bar on Category II–IV Banks

In August 2023, the FDIC released a Notice of Proposed Rulemaking (NPR) for Resolution Planning Standards for all IDIs with $50 billion in assets or more. While prior regimes allowed for tailoring based on the size and complexity of an organization, the impacts of recent bank failures caused the FDIC to walk back certain allowances and create a more uniform standard.

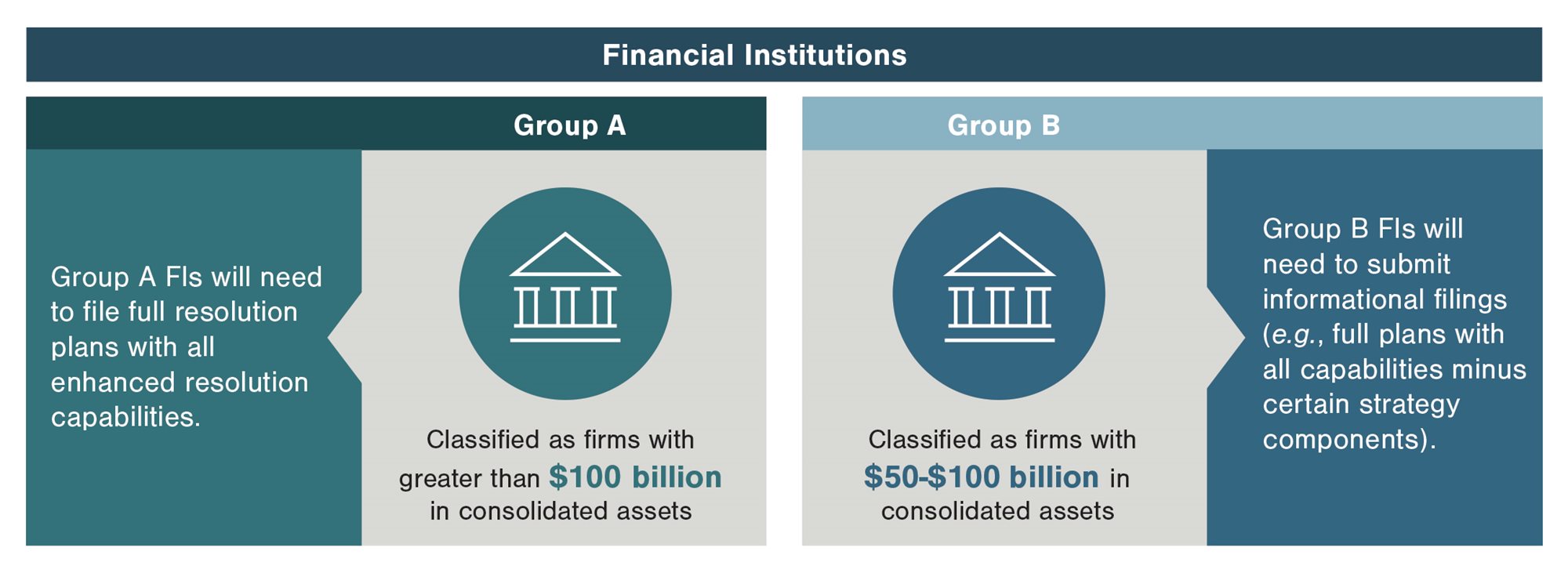

Group A Banks, which are those with assets greater than $100 billion, will need to both design and demonstrate capabilities to execute a multiple-acquirer resolution strategy under a wide range of scenarios. Group B IDIs are required to file an “informational filing,” which can be misleading since it is a required filing and necessitates institutions to build and evidence all the capabilities as those required for Group A, minus certain strategy components (see details in “IDI NPR Requirements Summary” below). In other words, even the informational filing is a rather heavy lift when considering all that would be required for compliance with the proposed rule.

- Financial Institutions

- Group A

- Classified as firms with greater than $100 billion in consolidated assets

- Group A FIs will need to file full resolution plans with all enhanced resolution capabilities.

- Group B

- Classified as firms with $50-$100 billion in consolidated assets

- Group B FIs will need to submit informational filings (e.g., full plans with all capabilities minus certain strategy components).

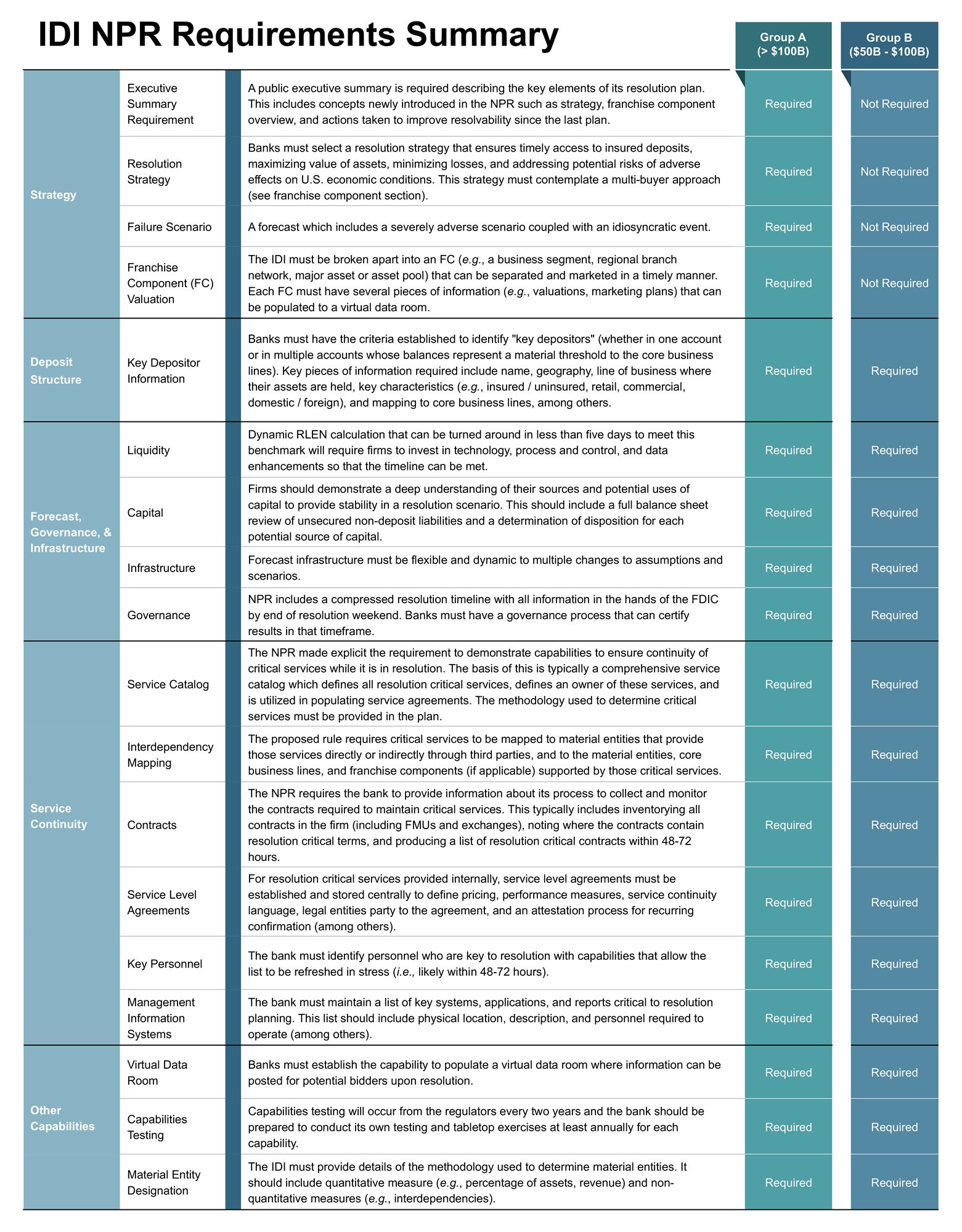

A Closer Look: IDI NPR Requirements

While there are differences between what is required for Group A and Group B, what remains consistent for both groups is the FDIC’s move from “tell me how” to “show me how” with significant emphasis on being able to react effectively to a range of different scenarios and assumptions, which is consistent with having to navigate deteriorating market conditions. Below is a summary of the IDI NPR requirements. As mentioned previously, while Group B IDIs aren’t on the hook for all the strategy capabilities like Group A IDIs, they are still responsible for most of the operational requirements outlined by the NPR and are actually subject to more regulatory engagement, which is expected to be annually for Group B IDIs rather than biannually for Group A IDIs.

| IDI NPR Requirements Summary | Group A (>$100B) | Group B ($50B - $100B) | ||

| Strategy | Executive Summary Requirement | A public executive summary is required describing the key elements of its resolution plan. This includes concepts newly introduced in the NPR such as strategy, franchise component overview, and actions taken to improve resolvability since the last plan. | Required | Not Required |

| Resolution Strategy | Required | Not Required | ||

| Failure Scenario | Required | Not Required | ||

| Franchise Component (FC) Valuation | Required | Not Required | ||

| Deposit Structure | Key Depositor Information | Required | Required | |

| Forecast, Governance, & Infrastructure | Liquidity | Required | Required | |

| Capital | Required | Required | ||

| Infrastructure | Required | Required | ||

| Governance | Required | Required | ||

| Service Continuity | Service Catalog | Required | Required | |

| Interdependency Mapping | Required | Required | ||

| Contracts | Required | Required | ||

| Service Level Agreements | Required | Required | ||

| Key Personnel | Required | Required | ||

| Management Information Systems | Required | Required | ||

| Other Capabilities | Virtual Data Room | Required | Required | |

| Capabilities Testing | Required | Required | ||

| Material Entity Designation | Required | Required | ||

The Path Forward: A Single IDI Resolution Plan Standard

While the NPR isn’t finalized, there are specific actions Group A and Group B IDIs should consider taking now to best prepare for future requirements.

Regulatory Engagement

- Organizations should adequately plan to meet the regulatory requests within 48 to 72 hours, demonstrating preparedness. This includes careful reconsideration of current staffing levels and the resources needed for the exams, which have become more resource intensive and overlapping.

Forecasting & Valuation

- Multiple industry participants have highlighted a five-day Resolution Liquidity Execution Need (RLEN) turnaround expectation during the most recent supervisory exams. In response, organizations should look to invest in resolution planning infrastructure to develop more flexible and dynamic models that allow for changes in assumptions to more accurately analyze deteriorating market conditions.

- Financial data will need to be produced, aggregated, and modeled in ways not previously needed, e.g., franchise carve-up for Group A IDIs.

Operations

- Operations departments should conduct resolution critical language assessments of all relevant contracts. This is particularly important as the requirements related to ensuring continuity of critical services are now explicit.

- Organizations should leverage the technology to digitize and package certain operational agreements, e.g., service-level agreements (SLAs), financial markets utilities (FMUs), etc., to ensure they are readily available upon FDIC request.

- Understanding the testing of capabilities should be done annually at a minimum, processes should be in place for the documentation of necessary playbooks and business as usual capabilities.

Technology

- Identification of the necessary virtual data room enhancements.

- Assessment of technology platforms, e.g., deposit platforms, to ensure they support the flexibility needed to execute a multibuyer resolution strategy.

- Organizations should allow for lead time for a technology build, while maintaining focus on both short- and long-term goals. This is especially critical for financial and operational data, which may require significant data remediation and technology enhancements to meet the new standard.

Demonstrated Preparedness for Tomorrow

Whether your organization is a Group A or Group B IDI, meeting the proposed IDI rule will require significant investment in resources and technology to meet both the expected increase in operational capabilities and the more aggressive regulatory engagement timeline. While Group A IDIs have a slightly more arduous requirement, they likely have higher capabilities than Group B IDIs, making their lift a bit more incremental in nature when compared to Group B IDIs that are coming off a multiyear submission moratorium. One thing is clear—both groups need to be prepared to demonstrate they can execute on what is documented in their plans, and do so expeditiously.

If you have any questions or need assistance, please reach out to one of our professionals.