With the introduction of the Basel III Endgame proposal, navigating regulatory capital requirements will become more challenging for banks with total assets equaling or exceeding $100 billion. While a lot of articles have been written on the impacts that this proposal could have on a bank’s overall capital requirements, much fewer have considered the significant changes that will need to occur with respect to a bank’s data management and regulatory reporting processes. Planning for these new reporting requirements and managing expectations for compliance will take considerable attention, and should not be postponed until 2025.

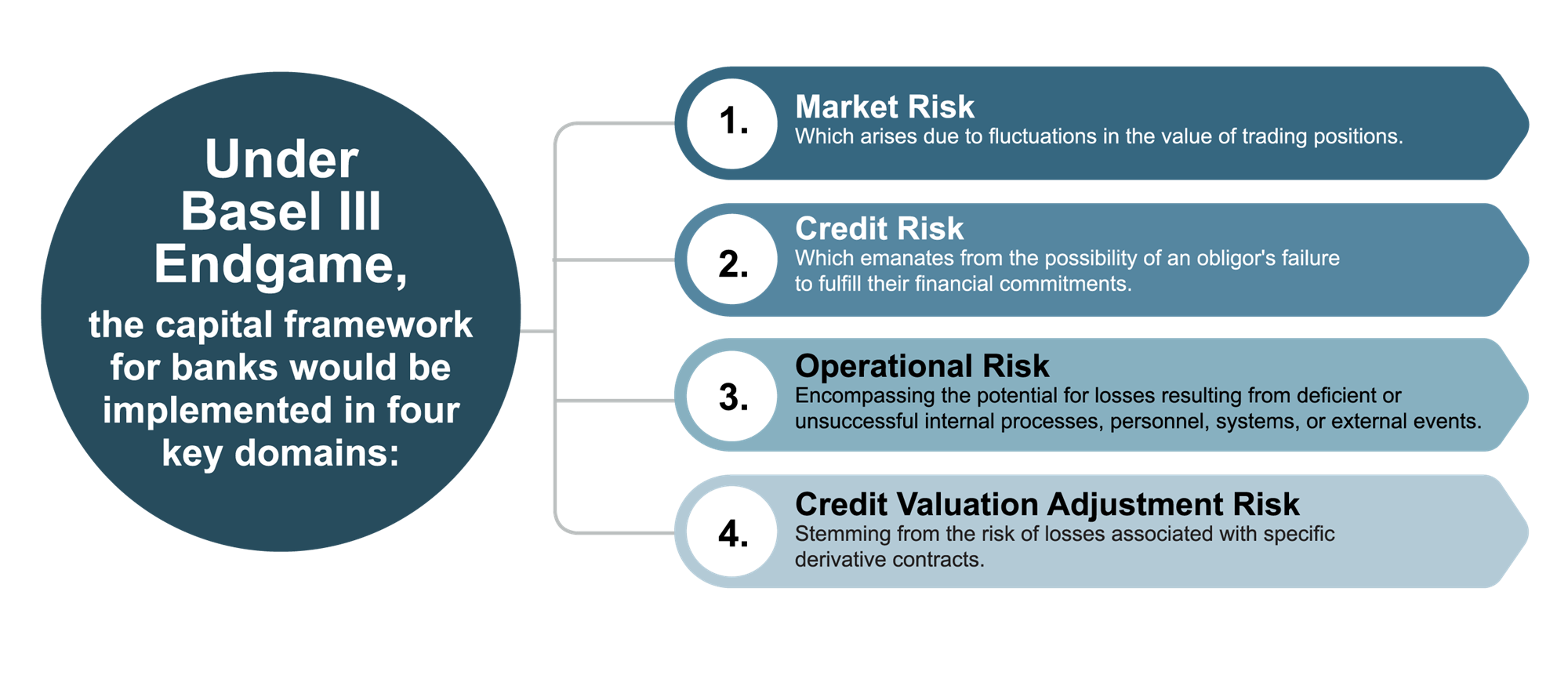

Under Basel III Endgame, the capital framework for banks would be implemented in four key domains:

- Market Risk: Which arises due to fluctuations in the value of trading positions

- Credit Risk: Which emanates from the possibility of an obligor's failure to fulfill their financial commitments

- Operational Risk: Encompassing the potential for losses resulting from deficient or unsuccessful internal processes, personnel, systems, or external events

- Credit Valuation Adjustment Risk: Stemming from the risk of losses associated with specific derivative contracts

Especially in the wake of the March 2023 banking upheaval, the proposal aims to fortify the banking system by implementing a uniform set of capital requirements that would apply to both regional and GSIB banks—this new category is referred to by the regulators as “larger banks.” Specifically, the proposal would mandate banks with total assets equal to or exceeding $100 billion must, among other requirements:

- Include unrealized gains and losses from certain securities in their capital ratios;

- Apply a “dual-requirement framework” and calculate risk-weighted asset amounts under both the current standardized approach and the expanded risk-based approach;

- Comply with the supplementary leverage ratio requirement; and

- Comply with the countercyclical capital buffer, if activated.

No Longer Business as Usual: The New Reporting Requirements

To accommodate this new framework, banks will be required to disclose a significant amount of additional information that is expected to result in wholesale changes to banks’ regulatory reports, including the key capital-related reports:

- FR Y-9C

- FR Y-14

- FFIEC 031/041/051 – Consolidated Reports of Condition and Income

- FR Y-15 – Systemic Risk Report

While there are more than 50 unique reports filed by banks and bank holding companies, not all reports will be affected by the new capital network. However, new data requirements under the proposal could have indirect effects across multiple reports. Nevertheless, it is important to understand how these key capital-related reports will be directly impacted by the new proposed regulatory requirements, detailed here.

The FR Y-9C and FFIEC 031/041/051

The changes to the FR Y-9C reflect the proposed Basel III Endgame capital rules’ impact to the report. The two schedules impacted are the Regulatory Capital Schedule (HC-R) and Trading Assets and Liabilities Schedule (HC-D). Within HC-R, specifically in Part I (Regulatory Capital Components and Ratios), the instructions were updated to apply identical capital standards for Category III and IV institutions as those for Category I and Category II institutions, replacing references to advanced approach firms with an “expanded risk-based approach." Within HC-D, Memorandum Item 11 is added to report customer and proprietary broker-dealer reserve bank balances.

Furthermore, there are suggested guidelines for replacing obsolete transition provisions related to the Community Bank Leverage Ratio (CBLR) framework and specific CECL instructions for advanced approach firms. In HC-R, Part II (Risk-Weighted Assets), the guidance has been updated to substitute mentions of “advanced approach firms” with the “expanded risk-based approach.” Additionally, changes were made to Market-Risk Weighted Assets (Item 27) to align with the proposed market risk rule.

To account for the transition impact related to Categories III and IV and the removal of the AOCI opt-out, several other changes have been made. These changes include the revision of Item 3.a (pertaining to the AOCI opt-out election) and Items 9.a through 9.f. Additionally, to accommodate the application of the stress capital buffer requirement to risk-based capital ratios derived from both the expanded risk-based approach and the standardized approach, modifications have been made to the instructions for the Capital Conservation Buffer requirement (Items 60.a through 60.c).

The FR Y-14 Series

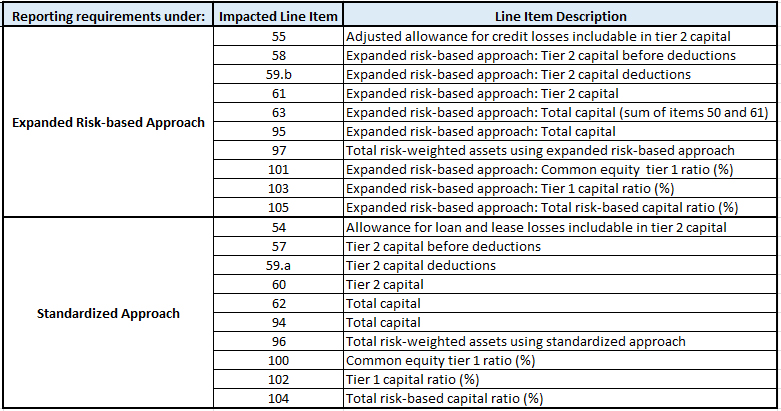

The proposed capital rule would mandate that Category I, II, III, or IV standards firms compute their risk-based capital ratios using both the newly expanded risk-based approach and the standardized approach. The more conservative of the two ratios for each approach would serve as the required standard. All capital buffer requirements would be applicable, irrespective of whether the expanded risk-based approach is employed.

To provide institutions with flexibility to choose their reporting method, the NPR introduces changes to the FR Y-14A Schedule A.1.d (Capital). Under the proposed revisions, Category I, II, and III firms would report items based on the common equity method ratio that is required as of the reporting date. Institutions falling under Category I, II, or III and subject to the expanded risk-based approach would be required to report the listed line items in the table below under ‘expanded risk-based approach.’ For institutions where the common equity Tier 1 ratio, as calculated under the standardized approach, is constraining as of the reporting date, these entities would be required to disclose the line items in the table below under ‘standardized approach.

| Reporting Requirements Under: | Impacted Line Item | Line Item Description |

|---|---|---|

| Expanded Risk-based Approach | 55 | Adjusted allowance for credit losses includable in tier 2 capital |

| 58 | Expanded risk-based approach: Tier 2 capital before deductions | |

| 59.b | Expanded risk-based approach: Tier 2 capital deductions | |

| 61 | Expanded risk-based approach: Tier 2 capital | |

| 63 | Expanded risk-based approach: Total capital (sum of items 50 and 61) | |

| 95 | Expanded risk-based approach: Total capital | |

| 97 | Total risk-weighted assets using expanded risk-based approach | |

| 101 | Expanded risk-based approach: Common equity tier 1 ratio (%) | |

| 103 | Expanded risk-based approach: Tier 1 capital ratio (%) | |

| 105 | Expanded risk-based approach: Total risk-based capital ratio (%) | |

| Standardized Approach | 54 | Allowance for loan and lease losses includable in tier 2 capital |

| 57 | Tier 2 capital before deductions | |

| 59.a | Tier 2 capital deductions | |

| 60 | Tier 2 capital | |

| 62 | Total capital | |

| 94 | Total capital | |

| 96 | Total risk-weighted assets using standardized approach | |

| 100 | Common equity tier 1 ratio (%) | |

| 102 | Tier 1 capital ratio (%) | |

| 104 | Total risk-based capital ratio (%) |

The NPR expands the reporting requirements to encompass both the risk-based approach and the standardized approach for the following items:

- Line Item 134 – Maximum Payout Ratio

- Line Item 135 – Minimum Payout Amount

- Line Item 146(a) – TLAC risk-weighted asset buffer

In addition, the proposed modifications to the capital framework lay out a revision to the definition of eligible credit reserves within Tier 2 capital. These changes would be substituted along with the adjusted allowance for credit losses that can be included in Tier 2 capital for entities, subject to the expanded risk-based approach. Consequently, an updated Item 55 (Adjusted Allowance for Credit Losses Includable in Tier 2 Capital) would be introduced to encompass this adjusted allowance for credit losses that can be included in Tier 2 capital.

The capital ratio proposal removes the option to opt out of All Other Comprehensive Income (AOCI), introducing a transition period. Specifically, in the case of Category III and IV firms, the opt-out option for AOCI has been eliminated, as reflected in the revised FR Y-14A, A.1.d, line item 18. It is important to note that the draft instructions have not been updated to incorporate this change as of now.

In addition, revisions were made to the guidance for the FR Y-14 Schedule A.1.d and FR Y-14Q Schedule D (Regulatory Capital) to clearly define which items (deductions) are relevant for firms employing the expanded approach and which items apply to firms utilizing the standardized approach.

Operational Risk (Schedule E, FR Y-14Q)

The NPR outlined numerous modifications to operational risk, including suggesting a standardized approach and addressing various industry-perceived deficiencies within the existing framework. Due to the complexity of these changes, implementing them from a reporting standpoint could be one of the more demanding tasks.

The definition of operational loss was modified to specify the categories of loss events that are encompassed within it. On Schedule E, institutions will disclose loss incidents at the impact level when a loss event encompasses multiple charges occurring over a period. In other words, “a single operational loss occurrence may result in several impacts, such as multiple different accounting or recovery dates, and may also be associated with multiple lines of business. When an institution submits a single loss event with multiple impacts and assignments to multiple business lines, they should report these impacts as separate entries. It is critical to use the same loss reference number to connect these individual records to the original event.”1

The instructions were updated to encompass timing losses, which pertain to operational risk incidents causing temporary irregularities in a banking organization's financial statements during a given financial reporting period. These irregularities can be amended by adding a timing loss indicator when discovered later. Furthermore, the instructions were clarified to emphasize that the accounting date for loss events should be distinct for each impact, aligning with the date the financial loss linked to that impact was officially recorded on the banking organization’s financial statements.

The suggestion put forth in the NPR is to establish a reporting threshold not exceeding $20,000 based on both nominal and net loss criteria for Schedules E.1 and E.4, instead of permitting institutions to determine their own thresholds. Additionally, a new entry named “Insurance Recovery Amount ($USD)” has been put forward for inclusion in Schedule E.1. To prevent duplication in accounting for insurance recoveries, the “Recovery Amount ($USD)” entry is proposed to be renamed “Non-Insurance Recovery Amount ($USD)” and clarified to encompass only recoveries unrelated to insurance.

The FR Y-15

The FR Y-15 report provides data on risk exposures for banks engaged in certain market activities. Basel III Endgame affects the risk assessment process, as it requires banks to adjust their risk models to incorporate the new regulatory capital requirements and changes in market conditions. The information reported in the FR Y-15 will need to reflect these adjustments. Numerous alterations have been suggested for the FR Y-15 to harmonize with the proposed changes in capital outlined on Schedule A: specifically, the proposed revisions to other off-balance sheet exposures on Schedule A.

Time Frame

The NPR new capital framework is scheduled to take effect in July 2025. The modifications to the FR Y-14Q, FR Y-14M, and FR Y-9C reports will become effective with the September 2025 reporting cycle. Changes to the FR Y-14A reports are set to be implemented starting with the December 2025 report filings. As for the FR Y-15 reports, their effectiveness will be determined two quarters following the approval of the GSIB surcharge rule.

Actions to Take Now to Meet Organizational Preparedness for 2025

These anticipated changes in the reporting framework will require bank organizations to examine current approaches to the preparation of these reports, and any changes required to the data infrastructure, IT, and regulatory reporting systems.

While the regulatory reporting changes may not become effective until at least 2025, organizations should initiate the needed protocols to ensure compliance.

Banks should act now to:

- Interpret the new capital framework and assess the changes in reporting requirements

- Complete an impact assessment on the bank’s capital and related ratios

- Evaluate changes to reporting systems used for the preparation of regulatory reports including critical data elements, reporting logic, and the calibration of RWA calculation engines

- Assess data management infrastructures identifying any data gaps

- Contact any third-party vendors used for regulatory reporting to review their implementation plans

- Begin discussions related to business engagement and ownership in the implementation process which will be essential for effective capital planning and the development of mitigation strategies

- Assess impact on other regulations’ single-counterparty credit limit and leverage ratio

- Establish disciplined programs to drive successful implementation of the framework

All bank functions will be affected by the proposed new capital framework, including finance, risk, treasury, data office, IT, and internal audit. Assessments should be conducted across every function to holistically capture the impact to the bank. Instead of waiting until 2025, preparing for these changes today will put banking organizations ahead of the curve in ensuring compliance with the new reporting requirements.

If you have questions or need assistance, please reach out to a professional at FORVIS.

- 1Federal Register / Vol. 88, No. 179 / Monday, September 18, 2023 / Proposed Rules.