Introduction

Relationship profitability is an important metric within most pricing models. While it is important to understand the profitability impact of individual new loans, it is crucial to understand how the pricing decision on a new credit will impact the profitability of the entire customer relationship. These relationships often include deposit accounts.

Analysis of time deposits is straightforward because they have a stated maturity term. The credit for funding (CFF) rate—or funds transfer pricing (FTP) rate—is based on the term of the certificate of deposit and the origination or last renewal date. The CFF on these types of accounts is assigned in the exact same way the cost of funding is assigned to loans.

Assigning CFF Rates to Non-Maturity Deposits

Non-maturity accounts pose a separate issue. Because they do not have a stated maturity term, the assignment of a CFF rate isn’t as straightforward. The results of a deposit decay study normally provide the key average life assumption needed to properly assign the CFF. Once the average life is known, it can be weighted with the repricing term of the account (0.0 years) to define the CFF, or FTP term.

Below is an example of the FTP terms assigned to non-maturity accounts based on a 50/50 weighting of average life and repricing term.

| Contractual Term | Average Life | Duration | CFF Rate | |

|---|---|---|---|---|

| NIB DDA | 0 years | 6 years | 3 years | 1.96% |

| IB DDA | 0 years | 4 years | 2 years | 2.77% |

| MMDA | 0 years | 2 years | 1 year | 4.31% |

| SAVINGS | 0 years | 8 years | 4 years | 2.10% |

At this point, the FTP term is compared to the appropriate funding curve on a blended average basis. For example, instead of matching the savings account to the current four-year rate on the funding curve, it would be assigned a CFF rate based on the average four-year funding rate over the last four years. These blended rates may be further adjusted by comparing the rate of the longest-lived product to the CFF rate on capital.

Given the increase in market rates over the last year, now is the time to update the CFF rates on non-maturity accounts within your pricing models.

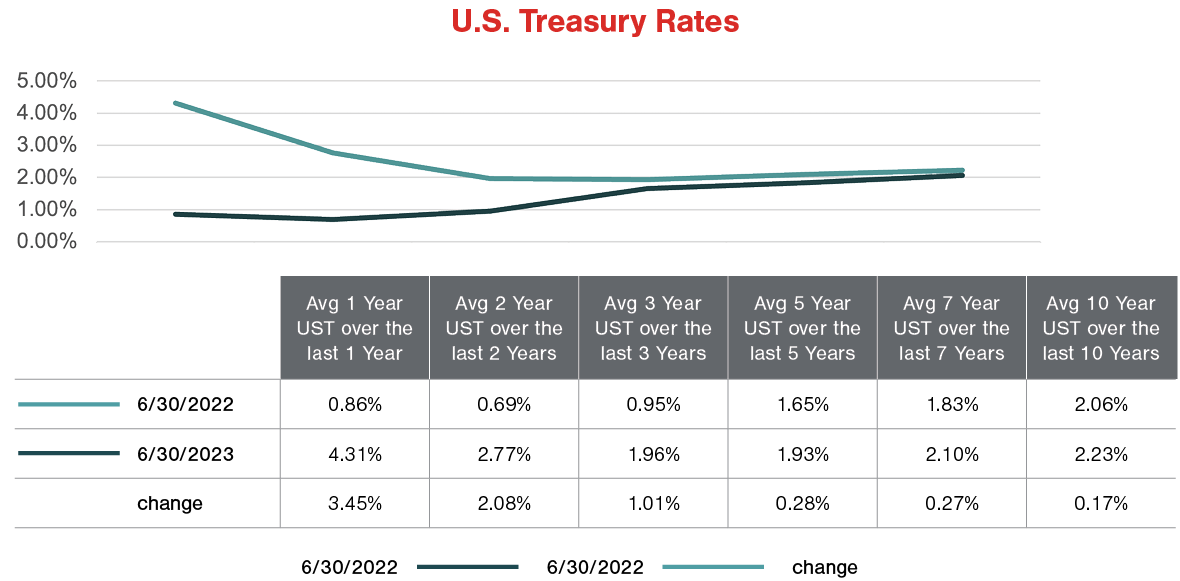

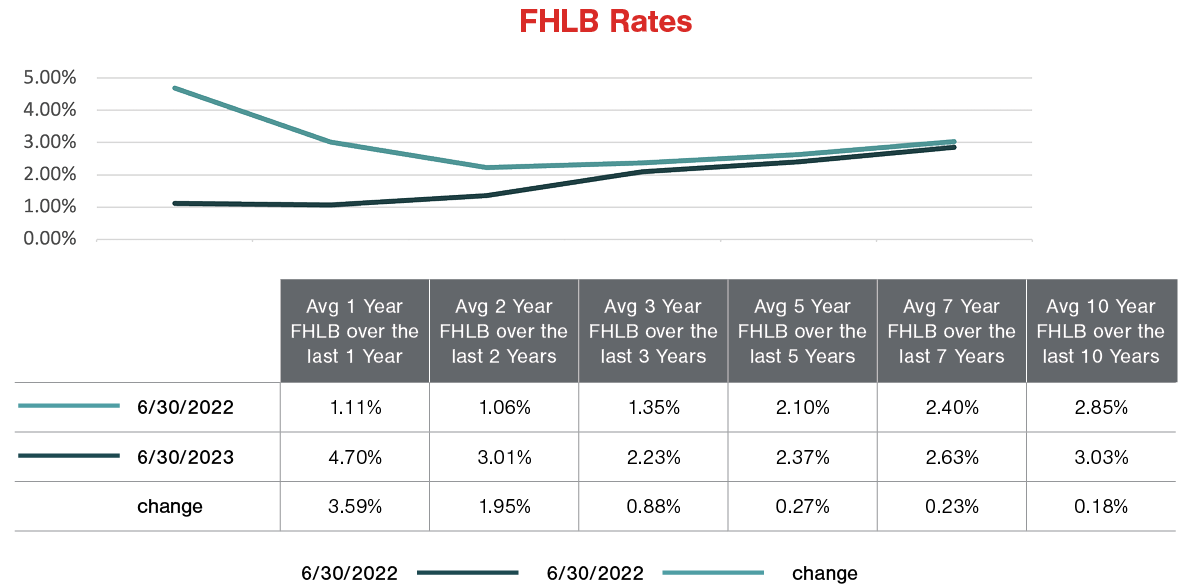

According to the data in the charts below, the CFF rate should be increased between 200 bps (basis points) and 350 bps on the shortest hottest money and 25 bps to 100 bps on longer term accounts depending on the product type, funding curve, and average life assumption.

Changes in the United States Treasury curve. FederalReserve.gov

Changes in the United States Treasury curve. FederalReserve.gov

Changes in the Federal Home Loan Bank borrowing rates. FHLBC.com

Changes in the Federal Home Loan Bank borrowing rates. FHLBC.com

Conclusion

Keep the CFF rate up to date and in sync with current market conditions so that customer profitability is accurately assessed on new loan requests.

Visit the LoanPricingPRO® page to learn more about FORVIS’ strategic loan pricing platform.

If you have questions or need assistance, please reach out to a professional at FORVIS.