The Cambridge Dictionary defines sustainability as “the quality of being able to continue over a period of time.”1

Being able to continue or even survive took on an entirely new meaning in 2019 when the pandemic struck. The global crisis, along with other ongoing changes, redefined the concepts of survival and sustainability for individuals and organizations.

In the post-pandemic world, nonprofit organizations continue to face challenges and uncertainties in their operations such as fluctuations in funding sources, unexpected expenses, economic volatility, and increased demand for services. To cope with these risks and help achieve financial stability and sustainability, nonprofit organizations need an operating reserve.

What Is an Operating Reserve?

There is a long-standing myth that “nonprofit” organizations should not make a profit or have a surplus. Unlike for-profit businesses, nonprofits don’t share profit with shareholders. Surplus—money left over after expenses—can provide stability and help organizations continue to provide important services.

An operating reserve is an unrestricted fund balance set aside to help stabilize a nonprofit’s finances by providing a cushion against uncertain times, losses of income, and large unbudgeted expenses. Operating reserve is not the same as cash flow, which is the amount of money available at any given time to pay for current expenses. Operating reserve is a long-term savings account that can be used to cover short-term cash flow gaps or emergencies.

Benefits of Operating Reserves

Operating reserves can help organizations:

- Enhance their ability to fulfill their mission and serve their constituents even in times of crisis or uncertainty.

- Increase their credibility and trustworthiness among donors, funders, partners, and stakeholders who value financial prudence and resilience.2

- Reduce their dependence on external borrowing or fundraising, which can be costly, time-consuming, and unpredictable.

- Invest in strategic opportunities, such as expanding programs, hiring staff, upgrading equipment, or launching new initiatives.

Calculating Operating Reserves

When it comes to knowing how much of an operating reserve an organization should have, there is no one-size-fits-all. Different nonprofits have different needs, goals, and circumstances. However, some factors that can influence the ideal level of operating reserve include:

- The size and complexity of the budget and operations.

- The diversity and reliability of current revenue sources.

- The nature and frequency of expenses and obligations.

- The volatility and unpredictability of the organization’s external environment.

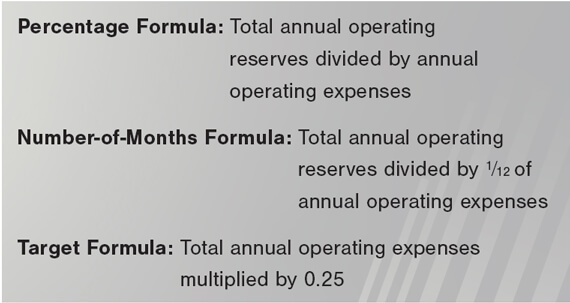

Although the sector hasn’t established a universal benchmark, the Nonprofit Operating Reserves Initiative suggests the minimum operating reserve ratio should be 25%, or about three months’ expenses.3 Operating reserve ratios can be calculated using one of these formulas:

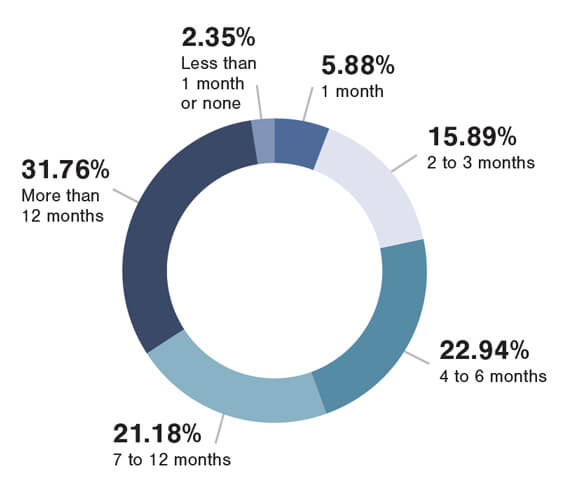

The past year’s economic conditions tested organizations’ abilities to boost reserves. FORVIS’ 2023 State of the Nonprofit Sector Report showed that slightly more than half (52.9%) of organizations had at least six months’ reserves, while 47% had less than six months’ reserves. More than one-fifth (24.1%) were near the critical zone of three months or less.

Building & Managing an Operating Reserve

Building and managing an operating reserve requires planning, commitment, and discipline from an organization’s board and staff.

Steps to help achieve this goal include:

- Adopting a written policy that defines the purpose, amount, use, replenishment, and oversight of the operating reserve.

- Creating a realistic budget that includes a line item for operating reserve contributions and expenditures.

- Allocating a portion of surplus funds or unrestricted donations to the operating reserve on a regular basis.

- Monitoring and reporting on the status and performance of the operating reserve periodically.

- Reviewing and updating the operating reserve policy and level at least annually.

Conclusion

Operating reserves are a vital component of an organization’s financial health and sustainability. By having an adequate amount of operating reserve, a nonprofit can better weather financial challenges, maintain its mission delivery, enhance its reputation, reduce its dependence on external sources, and invest in strategic opportunities.

If you have any questions or need assistance, please reach out to a professional at FORVIS or submit the Contact Us form below.