Accounting Standards Update (ASU) 2021-08, Accounting for Contract Assets and Contract Liabilities from Contracts with Customers, is now effective for public business entities and will be effective for private companies next year. This ASU requires that entities recognize and measure contract assets and liabilities acquired in a business combination in accordance with Accounting Standards Codification (ASC) 606, Revenue from Contracts with Customers.

Background

Business combinations can be one of the most complicated areas of accounting guidance. Under the rules in ASC 805, Business Combinations, an acquirer generally recognizes identifiable assets acquired and liabilities assumed in a business combination and measures them at fair value, with limited exceptions. ASC 606 created a single comprehensive model for recognition and disclosure but did not change business combination accounting. For acquisitions after ASC 606’s adoption, financial statement preparers requested guidance on the accounting treatment of contract liabilities resulting from unfulfilled performance obligations, a new concept created by ASC 606. Before the adoption date of Topic 606, a liability for deferred revenue was generally recognized in an acquirer’s financial statements if it represented a legal obligation.

Scope

The ASU applies to all entities that enter a business combination within the scope of ASC 805-10 after the adoption of ASC 606. The ASU’s scope also includes all contracts that contain contract assets and contract liabilities, such as contract liabilities from the sale of nonfinancial assets within the scope of ASC 610-20, Other Income—Gains and Losses from the Derecognition of Nonfinancial Assets, which are recognized and measured using the guidance in ASC 606.

ASU 2021-08 does not affect the accounting for other assets or liabilities that may arise from revenue contracts from customers in a business combination, such as customer-related and contract-based intangible assets.

Recognition of an Acquired Contract Liability in a Business Combination

An entity would first evaluate whether it has a contract liability from a revenue contract assumed in a business combination if the acquiree has been paid (or consideration is due) for promised goods or services for which control has not been transferred to the customer, i.e., an unfulfilled performance obligation.

The acquirer would not need to perform this evaluation if the acquiree has not received payment or there is no consideration due.

Acquired contract assets and liabilities recognized in a business combination would be measured in accordance with ASC 606 at the acquisition date. The acquirer would no longer measure the acquired revenue contract’s remaining obligations at fair value, but instead use the contract transaction price for the remaining performance obligations in accordance with ASC 606 principles. For example, if a revenue contract was fully prepaid before the acquisition, the acquiree would have recognized a contract liability for the remaining, unsatisfied performance obligations in accordance with ASC 606. At the acquisition date, an acquirer would assess the acquiree’s accounting under ASC 606 to determine what to record for the acquired contract.

FASB acknowledges there may be circumstances in which the recognition conclusion could be different, such as for licenses of symbolic intellectual property or goods or services provided as a customary business practice because an entity is not legally obligated to perform in those situations.

In general, the acquirer will record a contract liability that is the same as—or similar to—the contract liability that would have been recorded by the acquiree before the acquisition, assuming the acquiree had prepared GAAP financial statements.

Practical Expedients

The new guidance should simplify the accounting for most acquired contracts with customers in a business combination; however, if there are long-term, complex contracts that have been previously modified or the acquirer is unable to assess or rely on the acquiree’s accounting under ASC 606, the valuation could be more complicated. The ASU provides two practical expedients:

- For contracts that were modified before the acquisition date, an acquirer may reflect the aggregate effect of all modifications that occur before the acquisition date when:

- Identifying the satisfied and unsatisfied performance obligations

- Determining the transaction price

- Allocating the transaction price to the satisfied and unsatisfied performance obligations

- For all contracts, for purposes of allocating the transaction price, an acquirer may determine the standalone selling price at the acquisition date (instead of the contract inception date) of each performance obligation in the contract

Variable Consideration

Future expected variable consideration that is constrained under the general constraint on estimates of variable consideration or the constraint for sales-based and usage-based royalties would be precluded from being recognized in the acquired contract asset balance until the variable consideration becomes unconstrained.

However, the fair value of that expected variable consideration could still be captured as part of the valuation of customer-related intangible assets. FASB concluded that this is similar to how revenue contracts with variable consideration are generally valued and accounted for in current practice.

Disclosures

Entities must disclose if any of the practical expedients have been elected and, to the extent reasonably possible, a qualitative assessment of the estimated effect of applying each expedient. The ASU does not add any other new disclosures; however, entities would still need to adhere to the existing disclosure requirements in ASC 805 and 606.

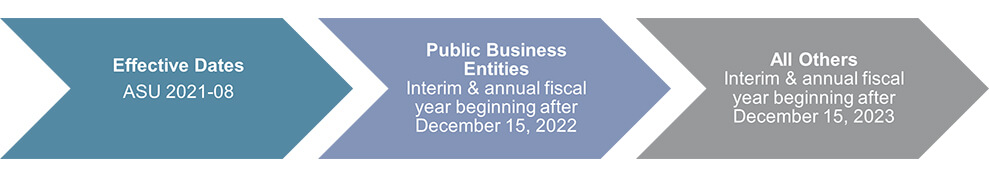

Transition & Effective Date

The ASU is effective for public business entities for fiscal years beginning after December 15, 2022, including interim periods. For all other entities, the ASU is effective for fiscal years beginning after December 15, 2023, including interim periods. The amendments should be applied prospectively to business combinations occurring on or after the ASU’s effective date.

Early adoption is permitted, including adoption in an interim period. If an entity early adopts in an interim period, it should apply the amendments retrospectively to all business combinations on or after the beginning of the fiscal year that includes the interim period of early application and prospectively to all business combinations that occur on or after the date of initial application.

Conclusion

The assurance team at FORVIS delivers extensive experience and skilled professionals to assist with your objectives. Our proactive approach includes candid and open communication to help address your financial reporting needs. Whether you are publicly traded or privately held, FORVIS can help provide an independent and objective view into your financial reporting. We leverage the latest technologies and process automation tools to provide companies assurance on their financial statements to help meet stakeholders' needs. If you have questions or need assistance, please reach out to a professional at FORVIS or submit the Contact Us form below.