The current economic landscape is faced with many uncertainties, and commercial real estate (CRE) is at the forefront of the distrust. CRE is facing risks in occupancy, interest rates, and values. Many industries may be impacted by any fallout, but community and regional banks would likely feel the brunt of the impact.

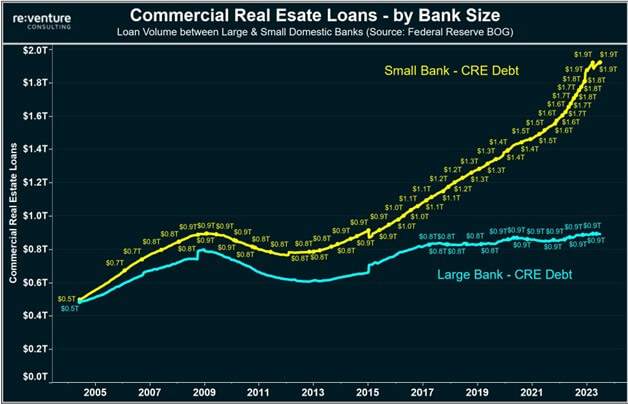

According to Federal Reserve data, in 2023, small banks (defined as banks outside the top 25 in asset size) hold $1.9 trillion of CRE loans.1 This is an increase of $1 trillion over the last seven years, while large bank CRE commitments held constant. Small banks now hold 67% of the $2.8 trillion CRE loan market.

Source: Reventure Consulting1

Specific sectors of CRE could get hit the hardest. Investor-owned office and retail real estate face significant pressure. According to Cushman & Wakefield, the first quarter of 2023 showed the average office vacancy in the U.S. was 18.6%, which is 5.9% higher than the last quarter of 2019, and prices are seeing a similar deterioration.2 The chart below shows how different sectors have fared in values over the past year.

Source: Green Street3

What could cause even more headache for small banks in the near future is nearly $1.5 trillion in commercial mortgages that are coming due over the next three years, according to data provider Trepp.3 With deterioration in real estate income, value, and the Fed fund rate more than doubling since September 2022, there is limited room to refinance these upcoming commercial mortgage maturities.

One way for “small” banks to stay on top of their commercial mortgage portfolio, especially if there is heavier concentration in office real estate, is for continued monitoring and stress testing on an individual borrower basis. Below are some of the practices we suggest to help maintain a robust commercial loan portfolio.

- In-depth underwriting of a property’s repayment is crucial, including stress testing multiple inputs of the cash flow analysis. This allows the bank to assess the property’s resilience and potential vulnerabilities. By shocking different factors, and stressing different inputs at the same time, a bank can see if a property is able to show a sufficient debt service coverage ratio during times of duress.

Some of the common inputs we have seen stressed are:- Interest Rates: Consider various interest rate scenarios on a loan to assess how changes in rates might affect loan repayment, property values, and cash flow.

- Vacancy Rates: Stress testing can involve scenarios with increased vacancy rates to evaluate the impact on rental income and the ability of borrowers to repay their loans.

- Rental Rates: Changes in rental rates due to economic downturns, market shifts, or shifts in tenant demand can impact the cash flow of properties. Stress testing can simulate reductions in rental rates to gauge the impact on loan repayment capacity.

- Property Values: Property values can be subject to volatility due to market fluctuations, changes in demand, or economic crises. Stress testing can involve scenarios with declining property values to assess the potential impact on loan-to-value ratios and borrowers’ equity positions.

- Cap Rates: Cap rates are impacted by the current borrowing costs, which are driven by the federal fund rate. Property values are derived from what the current cap rate is, and an increase to cap rates would negatively impact the property value. The recent guidance on CRE outlines how examiners will rely on the local market to validate cap rates from appraisals. This could impact older appraisal values and cap rates. Stress testing cap rates shows the potential impact on property values and the loan-to-value ratios.

- Operating Expenses: Increases in operating expenses, such as property maintenance costs, property management fees, and utilities, can impact property cash flows. Stress tests can assess how these cost increases might affect the ability to repay loans.

- Tenant Concentration Risk: A concentration of tenants from a single industry or tenant type can increase risk. Stress tests can explore scenarios where major tenants default or exit the property, impacting rental income.

- During the annual review process, we suggest banks not only look retroactively, but proactively as well. Many banks create a pro forma cash flow based on a recent roll, to project what the upcoming year may look like. You also can stress test the pro forma inputs (operating expenses, interest rate, etc.) to see how potential macroeconomic changes would impact the property.

- Also, during the annual review process, a best practice is comparing the actual results of the property to the original projections or the appraisal results. These findings can be telling and show a bank how a property has differed from its original projection. This allows the bank to have quality dialogue with the client and to assist the client in finding the best solution.

- We recommend running portfolio stress testing on loans maturing or repricing within a short period of time, typically 18 months. Banks will reperform the debt service calculation on these borrowers with the new interest rate in place. By knowing this information, banks can have client outreach well in advance of that maturity or repricing. If the stress test shows a borrower will struggle to service their debt at the new debt level, it’s best to combat that problem before it’s too late and running a risk of loss for the bank.

The Office of the Comptroller of the Currency, Federal Reserve, FDIC, and the National Credit Union Administration recently published guidance on CRE titled “Policy Statement on Prudent Commercial Real Estate Loan Accommodations and Workouts.” They provide light on how financial institutions should be treating and monitoring CRE loans in times of duress. The guidance states that examiners will analyze many of the above factors during their credit review. They also stressed the importance of financial institutions performing their own internal analysis and to work proactively and prudently with borrowers who may be unable to meet their contractual payment obligations.

FORVIS’ dedicated loan review team serves approximately 400 financial institutions across the country each year. Our professionals take a proactive monitoring approach, focused on credit administration practices that can help drive long-term success. We look for opportunities to help our clients enhance their credit administration practices so they can detect risk earlier, including some of the monitoring mentioned above.

Our loan review team provides a variety of services. Lean on our deep skill sets and forward vision to assist you with the knowledge you need to help manage your institution’s risk. For more, reach out to a professional at FORVIS.

- 1 a b “$1.5 Trillion Debt Crisis About to Hit Real Estate Market,” blog.reventure.app, July 7, 2023.

- 2“3 Banks With Big Commercial Real Estate Portfolios Could Face Trouble,” forbes.com, April 18, 2023.

- 3 a b “Interest-Only Loans Helped Commercial Property Boom. Now they’re Coming Due,” wsj.com, June 6, 2023.