According to Inside Mortgage Finance, seven of the 10 largest refinance lenders in 2021 were nonbanks.1 Nonbank mortgage sellers and servicers, as well as bank mortgage companies, of all sizes, need to be aware and prepare for huge storms and waves on the horizon. These storms and waves are made up of several “weather” conditions. Certainly, not all of these factors need to occur to wreak havoc on a company. Even if just a few of these conditions are met, it could spell trouble for nonbank mortgage sellers and servicers. It’s possible that a perfect storm of these weather conditions may be on the horizon. This article offers ways to help safeguard your institution during this troubling time.

Weather Conditions

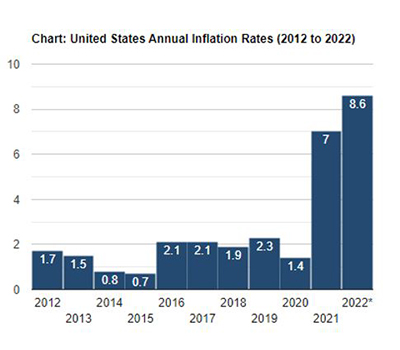

The storms and waves of interest rates are rising at unprecedented speeds. As depicted below, the U.S Bureau of Labor Statistics notes that the all-items index increased 8.6% over the last year, hitting a 40-year high.2

*The latest inflation data (12-month based) is always displayed in the chart’s final column.3

While the goal is to control inflation, this rise in rates will likely lead to declining mortgage loan origination volumes. This reduction in new loans will decrease profitability, leading to cost-cutting measures and liquidity challenges. Along with these financial factors, there has been an increased focus on regulations, post-Dodd-Frank, raining down on nonbank mortgage sellers and servicers. Regulatory and compliance focus is narrowing in on consumer complaints. Examples of severe weather conditions for nonbank mortgage sellers and servicers may include but are not limited to environmental, social, and governance (ESG) compliance and climate change regulations.

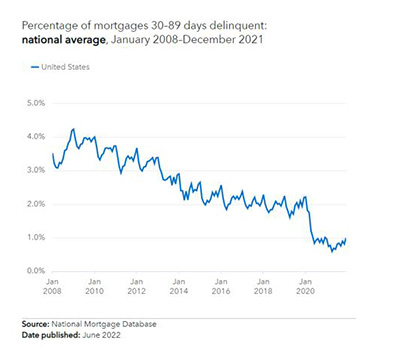

In addition, the Fair Lending/Community Reinvestment Act (CRA) and SEC cybersecurity disclosure guidance are regulations that nonbank sellers and servicers must navigate through. The Federal Housing Finance Agency (FHFA) has recently announced they will be making on-site reviews of nonbank sellers and servicers. The Office of the Comptroller of the Currency (OCC) recently issued consent orders to a variety of institutions due to inadequate and failed risk management programs. If these weather conditions weren’t enough, there may be an increase in credit risk challenges as consumers may begin to become past due on credit cards, auto loans, personal loans, utility payments, rent, and mortgages as COVID protections are lifted. While overall delinquencies on mortgages have dropped from a high of 4.2% in January 2009 to a low of 0.6% in April 2021, trends are showing upward movement to 1.0% in December 2021, as noted in the chart below.4

It is also noted that there are still many job openings with fewer people looking for them.5 This scenario may impact mortgage applications and approvals.

Safeguarding Your Institution

There is a way to weather the inevitable storms and waves. It starts by enhancing your enterprise risk management program. This can be done by performing a health check to identify weaknesses and gaps in your program and taking mitigating actions to address the above-noted challenges.

- Conduct a Current & Emerging Risk Assessment: Assess the seller/servicer’s risk management program in identifying and mitigating current and emerging risks.

- Benchmark: Benchmark the seller/servicer’s risk management against peer firms and industry expectations.

- Test: Test the elements of the risk management program of the seller/servicer to evaluate its effectiveness in managing current and emerging risks.

- Analyze Results: Review the results of the assessment, benchmarking, and procedures performed to evaluate the status of current risk management practices in identifying and mitigating current and emerging risks.

- Report/Action Plan: Report on and prioritize findings and recommendations to management and create an action plan for improvement.

FORVIS has years of experience helping companies weather the storms and waves of an ever-changing market. Our professionals aim to provide your company with Unmatched Client Experiences™ to help your business improve its resiliency. Reach out to a risk advisory professional at FORVIS or submit the Contact Us form below if you have questions.

- 1https://www.wsj.com/articles/rising-rates-are-battering-mortgage-lenders-11653471002

- 2https://tradingeconomics.com/united-states/inflation-cpi

- 3https://tradingeconomics.com/united-states/inflation-cpi

- 4https://www.consumerfinance.gov/data-research/mortgage-performance-trends/mortgages-30-89-days-delinquent/

- 5https://www.bls.gov/news.release/pdf/jolts.pdf