Trends in Medtech & Biotech Funding

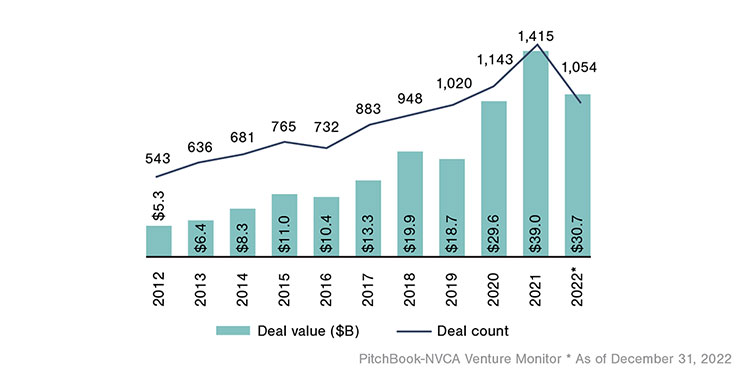

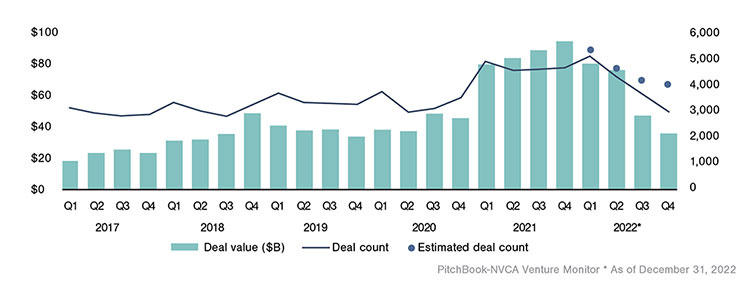

Funding resources can be challenging, especially when a company and its product are in the very early stages. These breakthrough technology and product discoveries will require financial backing through government grants, private sources and partnerships, or venture capital (VC) investments. After record highs during 2021, market headwinds in 2022 resulting from supply chain challenges, inflation, and interest rate hikes drove declines in VC deal activity within the Biotech and Pharma sector as well as the broader VC market.

U.S. Biotech & Pharma Venture Capital Deal Activity1

U.S. Venture Capital Deal Activity by Quarter1

Funding Considerations for Early-Stage Life Sciences Companies

Many life sciences companies that raised capital during 2021 will require additional investment during the coming year. Innovative and novel discoveries hold the promise of long-term profits and much-needed remedies, but there can be significant challenges along the way. When evaluating funding source options, medical technology and biotechnology startups will often consider government grants, early seed funding, and venture capital funding.

- Government grants – Government grants are an attractive funding source for startup life science companies because they are often non-repayable. However, grants often come with restrictions and founders should be careful not to let the terms of a specific grant drive their project. Additionally, although an attractive initial funding source, grants are often not recurring sources of follow-on investment.

- Early seed funding – Startup life sciences companies often seek other sources of early seed funding such as an angel investor. When seeking early seed funding, founders must effectively portray the future demand for their product. It is also essential to understand competing products and why yours can provide a transformative response to an otherwise unmet need. Once seed funding is secured, it is critical to carefully monitor spending so that milestones are met before seeking the next financing round.

- VC funding – Life sciences startups that require more significant investments often seek VC funding. VCs have specific strategies and are often highly specialized. Partnerships with medtech or biotech-oriented VCs should be well vetted and based on suitable connections, not just available funding. Companies seeking VC funding must articulate their value proposition by portraying their strategy for market entry. At this stage, it is important to have a capable management team behind an innovative product. Often founders will surround themselves with other credible and business-savvy individuals who have extensive experience and success navigating the startup landscape.

Accelerate the Path to Regulatory Approval for Medical Device Startups

As investors evaluate opportunities, they often choose partners that are later stage, more established companies. To improve access to capital, innovative early stage medical device companies have an opportunity to improve their prospects by participating in the FDA’s Total Product Life Cycle Advisory Program (TAP).2

The TAP program was launched in January 2023 to help spur rapid development and widespread patient access to safe and effective, high-quality medical devices of public health importance. By creating a pathway for breakthrough early discoveries in alignment with FDA guidelines, investors may be more inclined to provide seed financing to early-stage startups. FDA approval may lend credibility to a product and boost investor confidence to invest in new breakthrough discoveries that will yield long-term profits and essential health benefits for patients.

While the purpose of the TAP program is to create a faster pathway for breakthrough medtech products to reach markets and alleviate patient suffering, it also has the potential to create a more vibrant and sustainable medtech ecosystem.

How FORVIS Can Help Medtech & Biotech Startups

FORVIS can assist medical technology and biotechnology startups seeking funding with the preparation of GAAP-compliant financial statements, financial statement audits, business valuations, grants management, supply chain engineering, and tax planning and compliance. Reach out to us today by submitting the Contact Us form below.

- 1 a b "Pitchbook-NVCA Venture Monitor: Q4 2022," https://pitchbook.com/news/reports/q4-2022-pitchbook-nvca-venture-monitor, January 11, 2023.

- 2Southeast Life Sciences Taps New FDA Breakthrough Program