In 2022, Congress passed the Inflation Reduction Act (IRA), which includes $80 billion in additional new funding for the Internal Revenue Service (IRS or Service) over the next 10 years.

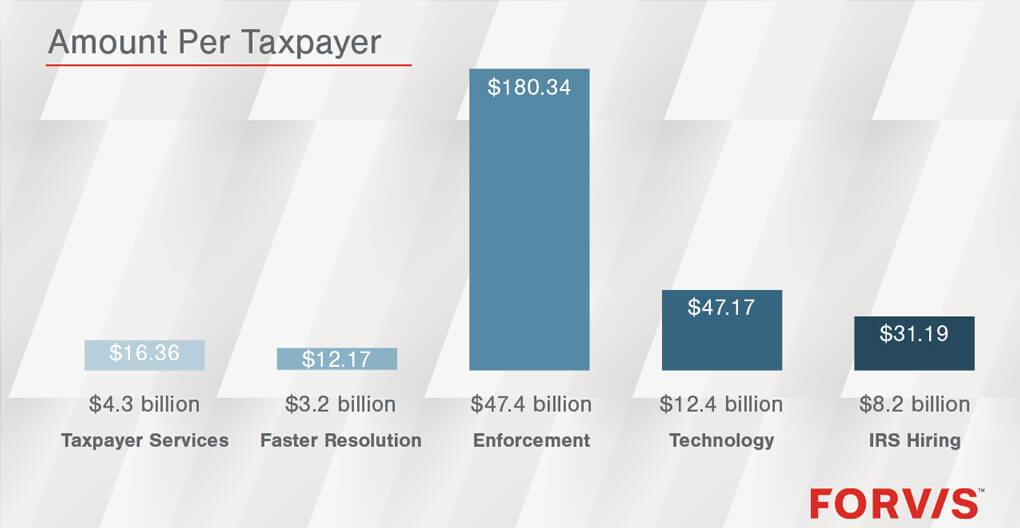

On April 6, 2023, the U.S. Department of the Treasury and the IRS unveiled the long-awaited IRA Strategic Operating Plan (SOP). The 150-page document lists how, over the next decade, the IRS will use the IRA funding to support enhanced tax enforcement to increase compliance on behalf of both the Service and the taxpayer. See the chart below for a breakdown of the spending plan’s allocation per taxpayer. In this article, we’ll provide a summary of the SOP’s five primary objectives and examine what these objectives may mean for you.

Source: 2022 IRS Data Book1

The IRS believes that an upgraded taxpayer experience will result in improved taxpayer compliance across the board, thereby bridging the current tax gap and increasing tax revenues. In addition, the IRS intends to update existing technology and create an agencywide transformation to new, interconnected, data-driven decision making. The Service’s expectation is that this necessary modernization will attract specialized talent and create a more diverse and motivated workforce.

The IRA also includes a variety of clean energy tax credits and bonus credits. The IRS believes that through better education and accessible assistance, a greater amount of taxpayers will claim energy security and clean energy credits, so some of the IRA funding will be directed at increasing taxpayer access to IRA clean energy tax credits.

Before we look at how the IRS plans to achieve each SOP objective and what it means for taxpayers, here’s a list of commonly referenced SOP terms:

- Wealthy/High-Income – Individual taxpayers with more than $1 million in annual income

- Large Corporations & Complex Partnerships – Corporate taxpayers with more than $250 million in assets. Partnerships exceeding $1 million or more in assets and 100 or more direct and indirect partners

- Historical Levels – Increased audit rates compared to current levels, but below historical levels (discussion below on what the IRS will use as its benchmark for “historical levels”)

- Complex Filings – “Lower-audited areas,” such as estate, gift, and employment taxation

- High-Risk & Emerging Issues – Digital assets, potentially abusive tax landscapes, and international tax issues

SOP Objectives

- Improve Taxpayer Services: Dramatically improve services to help taxpayers meet their obligations and receive tax incentives for which they are eligible.

- How will the IRS accomplish this? Taxpayers and tax professionals are expected to be able to interact with the IRS through a variety of new platforms: electronic filing, on-demand and in-person scheduled customer service, digital tools, and self-service options are all included as potential new initiatives. In addition, the IRS intends to increase taxpayer education and awareness so more taxpayers, individuals, and small businesses can take advantage of claiming available incentives.

- What does this mean for taxpayers? The IRS expects taxpayers will experience improved service levels, heightened satisfaction, and decreased filing burdens. Taxpayers also may enjoy faster and easier payment processing and personalized status-tracking for returns, refunds, and claims. From an IRA perspective, the IRS is expected to launch mapping tools to help taxpayers identify eligibility for IRA energy tax credits, and starting in 2024, taxpayers claiming the clean vehicle tax credit will be able to transfer their tax credit to car dealerships for an equivalent price discount.

- Pick Up the Pace … for Everyone: Quickly resolve taxpayer issues when they arise.

- How will the IRS accomplish this? The IRS intends to improve tax certainty programs by expanding and refining programs for taxpayers with complex and simple filing needs alike. The expected result is that taxpayers may make fewer mistakes when completing their returns. Newly developed digital communication capabilities also will equip the IRS with the ability to contact all taxpayers with past-due balances earlier and facilitate more initiative-taking collection efforts.

- What does this mean for taxpayers? Objective two calls for increased voluntary compliance on the part of the taxpayer, but the IRS does not plan to sit out of the process. Taxpayers can expect to receive more immediate and direct contact from the Service through digital alerts, notices, and inquiries over mistakes and/or misreporting. One key project focuses on increasing systemic checks on missing forms of income reported by third parties, such as Venmo. Beginning in 2024, taxpayers should expect to report transactions made and received through cash apps during 2023. In addition, taxpayers also may see removal of certain user fees from programs where appropriate, to be determined.

- Spotlight on Wealthy & High-Income Taxpayers: Improve compliance for taxpayers with complex tax filings and high-dollar noncompliance to address the tax gap. However, the SOP provides that small businesses and households earning $400,000 or less should not see audit rates increase relative to historical levels.

- How will the IRS accomplish this? More staff, and heightened emphasis on enhanced detection of noncompliance, enforcement, and risk identification through improved technology and expertise.

- What does this mean for taxpayers? For most taxpayers, whether this objective affects them depends on the meaning of “historical levels” of income. The IRS intends to focus enforcement efforts on taxpayers with complex issues in areas such as large partnerships, large corporations, and high-income and high-wealth individuals. In a Senate Finance Committee hearing on April 19, IRS Commissioner Daniel Werfel committed to using the tax year 2018 audit rate as the historical level metric for how the agency increases enforcement, especially concerning taxpayers making less than $400,000 per year. According to the 2022 IRS Data Book, the overall individual audit rate in tax year 2018 was 0.3%. Specifically, 1 in 300 individual taxpayers making less than $500,000 were audited in 2018. For individual taxpayers making $10 million or more, the 2018 audit rate was 9.2%.

- System Modernization & Digitalization: Deliver innovative technology, data, and analytics to operate more effectively.

- How will the IRS accomplish this? Currently, the IRS and taxpayers use more than 600 applications to file taxes, some of which are more than 20 years old. IRA funding is expected to enable the IRS to retire legacy applications and improve technological infrastructures. Specifically, data privacy and security are top priorities. In addition, improved technology could result in faster IRS response times to taxpayers, and legislative and internal changes.

- What does this mean for taxpayers? Taxpayers are expected to have faster access to their personal data and new digital filing capabilities, assuming the IRS can truly provide a secure platform. The IRS maintains that it is “committed to working with taxpayers to ensure that all tax accounts remain secure.”

- Enhance IRS Culture & Operations: Attract, retain, and empower a highly skilled, diverse workforce, and develop an IRS culture better equipped to deliver results for taxpayers.

- How will the IRS accomplish this? The IRS intends on hiring, developing, and retaining a diverse group of employees who are both data savvy and innovative. The emphasis is on creating a renewed hiring process with increased geographic flexibility and additional outsourcing and automation. By the end of fiscal year 2024, the IRS estimates it will hire approximately 20,000 employees using IRA funding. For context, since the IRA was enacted and the IRS started using IRA funding, the IRS hired 4,000 new customer service representatives ahead of the 2023 tax filing season.

- What does this mean for taxpayers? There is expected to be an increase in IRS employment opportunities and outreach activities. While taxpayer satisfaction is currently high, according to the 2022 IRS Data Book, most taxpayers still believe IRS should focus on improving in-person and phone assistance. Taxpayers can hope to see improvement in the types of interaction between them and the Service through better IRS workforce training and more agent availability.

The overall goal is to use IRA funding to make the use of energy incentives both seamless and safe. The proposed transformation of the Service is highly ambitious and may drastically change how taxpayers interact with the IRS. Managing the transformation is expected to be an ongoing investment, and there is much still left to the imagination. In the meantime, here are some things to consider:

- Timeliness: Almost all the initiatives in the SOP are contingent on the success of one or several other initiatives. According to the SOP, the Service “may need to adjust timelines and/or the breadth and depth of delivery for specific transformational initiatives—most notably in the areas of taxpayer service and technology.” Of particular concern is that areas that may likely prove to be most labor and time intensive also are ones that are least generously funded. For example, according to the SOP, funding for taxpayer service improvements when combined receive considerably less funding than enforcement.

This disbalance may prove problematic because the reform components are interdependent, and the success of the overall project is dependent on each of the identified components being fully operational. - Digital IRS: For tax year 2022, approximately 213.4 million returns and other tax forms were filed electronically. Of individual tax returns, 93.8% were filed electronically, according to the 2022 IRS Data Book. Visitation to IRS.gov has increased significantly, and taxpayers appreciate the availability of self-assistance options online. Digitization, however, may not have appeal to everyone. For example, in a May 1, 2023 letter to the IRS, a bipartisan group of lawmakers urged the IRS to fully consider the dangers posed by technology and artificial intelligence (AI).

Given recent AI advancements, the Service continues to prepare for and warn against incredibly sophisticated scam attempts specifically designed to trick vulnerable taxpayers. Small businesses, senior citizens, and the technologically illiterate are all especially at risk. Arguably, the antiquity of the Service has for years served as their defense against online scam attempts. For example, the IRS regularly emphasizes that taxpayers should be aware of scammers using email and text messages, since the IRS initiates most contacts with taxpayers through regular mail and never by email, text, or social media regarding a bill or tax refund. So, if the IRS is moving toward a more modernized, digital agency, what risks do taxpayers face in terms of privacy and data security? That’s an important consideration that will determine just how much of its objectives the IRS can accomplish in the SOP.

Final Thoughts

The SOP has tremendous potential to revolutionize the way the Service and taxpayers interact. Yet there are still many details to clarify, and there have already been significant changes made to the plan since it was released in April. For example, in May 2023, Congress passed the Fiscal Responsibility Act of 2023, which rescinds $1.4 billion of the $80 billion in additional funding received by the IRS under the IRA. Another $20 billion of that IRS funding will later be redirected over two years to other nondefense spending.

The Service has yet to determine which areas within the SOP will be reduced, but in remarks during a meeting of the Treasury Advisory Committee on Racial Equity, Treasury Secretary Janet Yellen provided assurances that “the IRS has the resources it needs in the near term – to modernize customer service and improve enforcement among high earners and large corporations that are not paying the taxes they owe,” even in light of the budget changes under the Fiscal Responsibility Act of 2023.

FORVIS will continue to monitor the spending plan as more details emerge. If you have any questions or need assistance, please reach out to a professional at FORVIS or submit the Contact Us form below.

- 1Assumes entity and individual taxpayers, i.e., amounts are based on the number of returns and other forms filed by C corporations, S corps, partnerships, individuals, and estates and trusts in fiscal year 2022 (Table 3 in 2022 IRS Data Book). These amounts do not account for changes made to IRS IRA funding under the Fiscal Responsibility Act of 2023.