Your college or university leadership has confidence in the future, but change has been difficult, and those difficulties are starting to show (at least to insiders).

The external view of your institution is not always synchronized with the internal view. The last couple of years (2021 and 2022), many universities benefited from multiple private and public gifts and grants to help them get over the pandemic hurdle. Three rounds of federal grants, forgiven Paycheck Protection Program loans, and Employee Retention Credits have been the primary federal funding vehicles. FORVIS also recognized that many colleges and universities continued to pursue major capital, endowment, or comprehensive giving campaigns. These windfalls helped paint a positive financial picture for many colleges that, in their absence, would have appeared to struggle—some significantly so.

FORVIS’ survey that supported our 2023 annual outlook noted the success of schools launching major fundraising campaigns. Out of the 117 campaigns reported from 2016 to 2022, 73 were completed. Of the completed campaigns, nearly 40% of them met or exceeded goals during very difficult times.

Will the level of federal and private contribution continue? The only additional federal assistance on the horizon appears to be the continued discussion of large increases in Pell and clearing certain student loan debt. Both of those items face many hurdles before providing positive impact on higher education budgets.

On private giving, it’s hard to tell. We seem to be in an environment where large investment gains cannot be counted on as a source of motivation for stock gifts. On the other hand, we are still amid a generational wealth transfer and one-time monetizing of business owner assets.

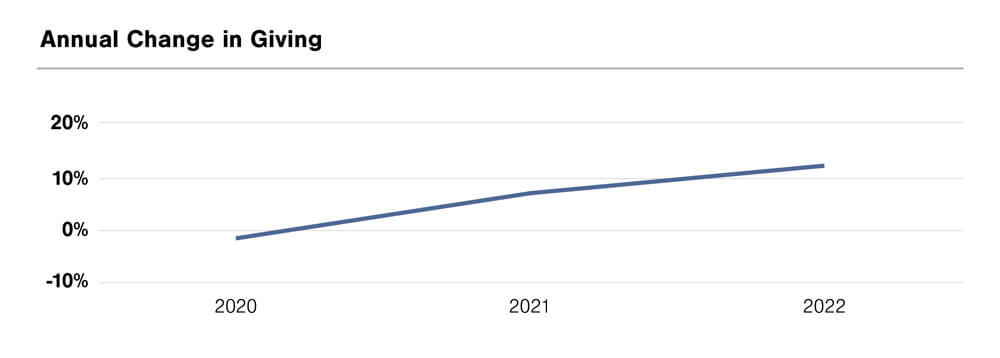

Outsized increases of funding experienced over the last couple of years appear to be a window of opportunity that may close with a jittery economy and volatile investment markets. Despite that logic, there are recent reports of increases in higher education fundraising over the last couple of years.

Exhibit 1

Source: Inside Higher Ed1

Private colleges that rely more on their own ability to generate revenues net of costs to provide educational products and services take the fate of their economic health into their own hands. Heavy reliance on external sources (like investment return and contributions) for the gaps in funding today seems to have some risk attached. Public universities that rely more on those external sources and state and local tax aid are equally at risk.

Focusing on the internal generation of funds from an institution’s core business is inherently less risky than depending on external sources of revenue if the focus is fine-tuned, up to date, and synchronized with the current market for education. Why? Because this revenue and expense stream is controllable by institutional leaders. Taking steps to focus on the academic program markets for starting, stopping, and growing academic programs is an important move toward ongoing financial resilience. Those schools that fail to stay in step with the market could experience pressure on enrollment and margins.

What do those outside the higher education industry think of the risks inherent in today’s environment? Rating agencies have turned mostly negative. Fitch notes struggles with inflation, labor cost pressure, and mixed enrollment trends.2 Moody’s notes the mismatch between revenue and rising costs. It did concede, however, on relatively stable balance sheets and state coffers that were full at the time it published its 2023 Ratings Outlook.3

Fortunately, external auditors (so far) have not viewed the financial health of their higher education clients in a manner that gives them substantial doubt about the organization’s ability to continue in operation. Eighty-four percent of schools reported not having interactions about the school’s ability to continue as a going concern.

Reality lies somewhere between the interpretation of rating agencies’ negative outlook and auditors’ views that do not question the ability to continue.

The next article in our Outlook in Focus series will review general information about how schools are dealing with that reality and the adjustments they are making. If you have any questions or need assistance, please reach out to a professional at FORVIS or submit the Contact Us form below.