On September 19, 2023, GASB authorized the release of an exposure draft, Disclosure and Classification of Certain Capital Assets, that would require capital assets held for sale, intangible assets, lease assets, and subscription assets to be broken out separately in note disclosure.

Comments are requested by January 5, 2024.

Background

Existing accounting guidance does not define the term nonfinancial assets. It is most commonly used to describe capital assets, which is defined in Statement 34 as being “used in operations.” The issuance of Statement 87, Leases; Statement 94, Public-Private and Public-Public Partnerships and Availability Payment Arrangements; and Statement 96, Subscription-Based Information Technology Arrangements, expanded the nonfinancial assets universe to also include right-to-use intangible assets. GASB research indicated that financial statement users would evaluate information about intangible capital assets differently than information about tangible capital assets. Tangible capital assets have different life expectancies, conditions, and service capacities from intangible capital assets. GASB concluded that intangible capital assets should continue to be classified as capital assets but disclosed separately by major class because of the variety and type of intangible assets.

Proposed Presentation

For the capital assets notes disclosure required by Statement 34, the following items should be broken out separately:

- Capital assets held for sale, by major class of assets

- Lease assets reported (Statement 87) by major class of underlying assets

- Subscription assets (Statement 96)

- Intangible assets other than lease and subscription assets

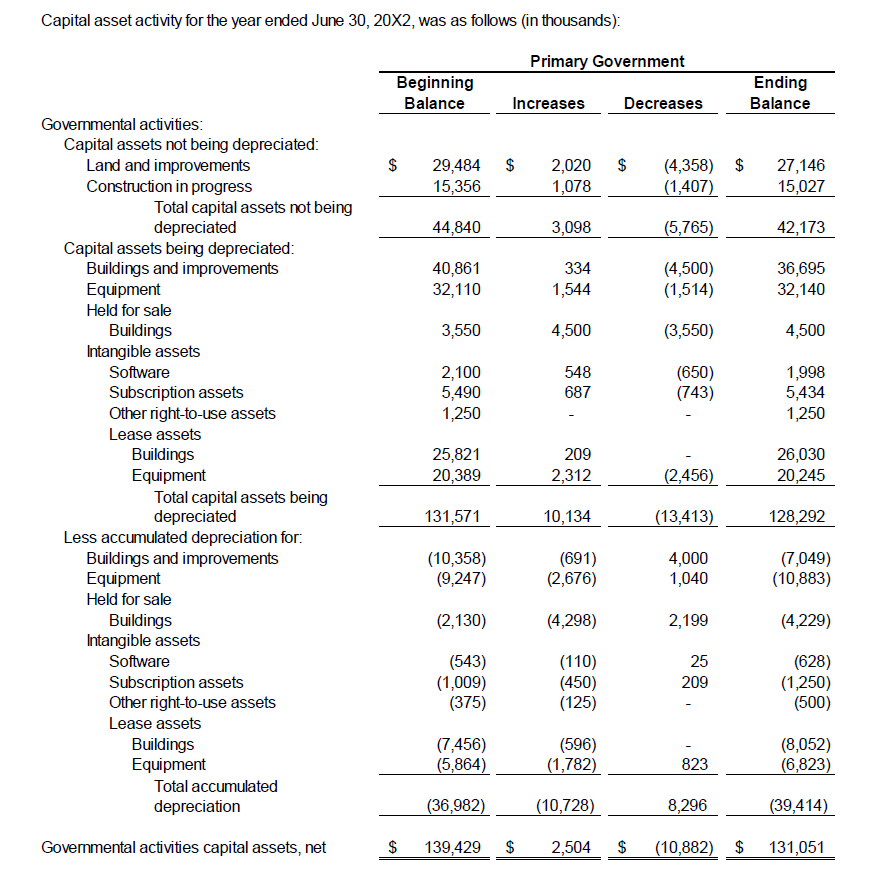

Intangible assets that represent the right to use intangible underlying assets are not required to be disclosed separately but should not be reported with owned intangible assets. The proposal includes the following example:

Source: GASB

There are no proposed changes to current recognition or measurement requirements.

Capital Asset Held for Sale

A capital asset should be classified as held for sale if:

- The government has decided to sell the asset

- It is probable that the sale will occur within one year of the financial statement date

The exposure draft includes—but is not limited to—the following factors to be considered when evaluating whether it is probable that the sale will occur:

- The asset is available for immediate sale in its present condition

- An active program to locate a buyer has been initiated, incorporating the idea of an asset being put out for bid

- Market conditions for the type of asset

- Regulatory approvals needed to sell the asset

This classification should be evaluated each reporting period.

Transition & Effective Date

If ratified, the changes would be effective for fiscal years beginning after June 15, 2025 and amendments would be applied retroactively to all periods presented in the basic financial statement. If restatement is not practicable, the reason for not applying changes retrospectively should be disclosed. Early adoption is encouraged.

Conclusion

Our public sector accounting, audit, and consulting experience and resources can help you stay compliant, stretch your dollar, and plan for the future. For more information, please reach out to a professional at FORVIS.