In our latest Quarterly Perspectives: Financial Reporting & Beyond webinar, we discussed what we’ve seen in the past quarter, described what we’re seeing here and now, and looked ahead to the future for conversations you should be having. Continue reading for a summary of the webinar, including updates on the economic environment, CECL for nonfinancial institutions, and more. Don’t forget to register for next quarter’s webinar as well!

Looking Back

The Economic Environment

The last three months reflect what we’ve seen the last few years: uncertainty with the economy. We’ve seen some signs of improvement and evidence of the “soft landing” many predicted, such as slow but steady GDP growth, the Fed slowing on interest rate hikes, and there’s continuing low unemployment relative to past periods. However, we’re still seeing challenges ahead. Broadly, with the last debt ceiling crisis cycle, the U.S. lost its AAA credit rating. And as a specific issue, those who may be in the commercial real estate sector will likely see difficulties with lease renewals for urban office and retail spaces.

You may be wondering, “How do these recent events impact us from an accounting perspective?” Goodwill impairment considerations (as well as other asset impairments), going concern evaluation, impacts to cash flow forecasts, and budgeting are areas that you may want to give special attention to in light of recent events. It may be helpful to bring in a third party to provide further insight into your accounting in these different areas.

AICPA “New” Standards

For many nonpublic companies, their auditors will be following new auditing standards related to accounting estimates and using specialists for calendar year 2023 audits. SAS 143 “Auditing Accounting Estimates and Related Disclosures” and SAS 144 “Amendments to AU-C Sections 501, 540, and 620 Related to the Use of Specialists and the Use of Pricing Information Obtained from External Information Sources” may seem relevant only to your auditor at first glance; however, these standards will prompt questions and additional considerations that will require your company to have more robust documentation supporting the accounting estimates included in your financial statements.

Questions may be asked about your process, the data used, methods, and various assumptions made for your accounting estimates and disclosures. If your company deals with complex accounting requirements and employs the use of a specialist, your auditing firm may also seek the assistance of its own specialist to review the work done and assumptions made for determining accounting estimates. Prepare in advance and make sure you keep ample documentation.

NOCLAR

Switching gears to public companies, you may remember our presenters quickly mentioning noncompliance with laws and regulations (NOCLAR) at the end of our Q2 webinar. The PCAOB had released a proposal on the auditor’s consideration of a company’s potential NOCLAR as part of the audit. This is an important proposal brought forward at the beginning of June, with comments due a short two months later, which could greatly impact how an auditor must address NOCLAR. The proposal states that auditors would identify laws and regulations for which noncompliance could have a material effect on the financial statements. Not only identifying those items which have a direct effect but, in a significant change, also items that could indirectly and materially affect the financial statements. In the past, we have seen maybe 50 or fewer comment letters in response to a PCAOB proposal—this proposal received 139, garnering attention from many constituencies due to the potential impacts of the proposed rule.

Here & Now

We’ve had our focus on the current expected credit losses (CECL) model for financial institutions for quite some time—now our focus is going to nonfinancial institutions and what the adoption of ASC Topic 326 and CECL looks like for them.

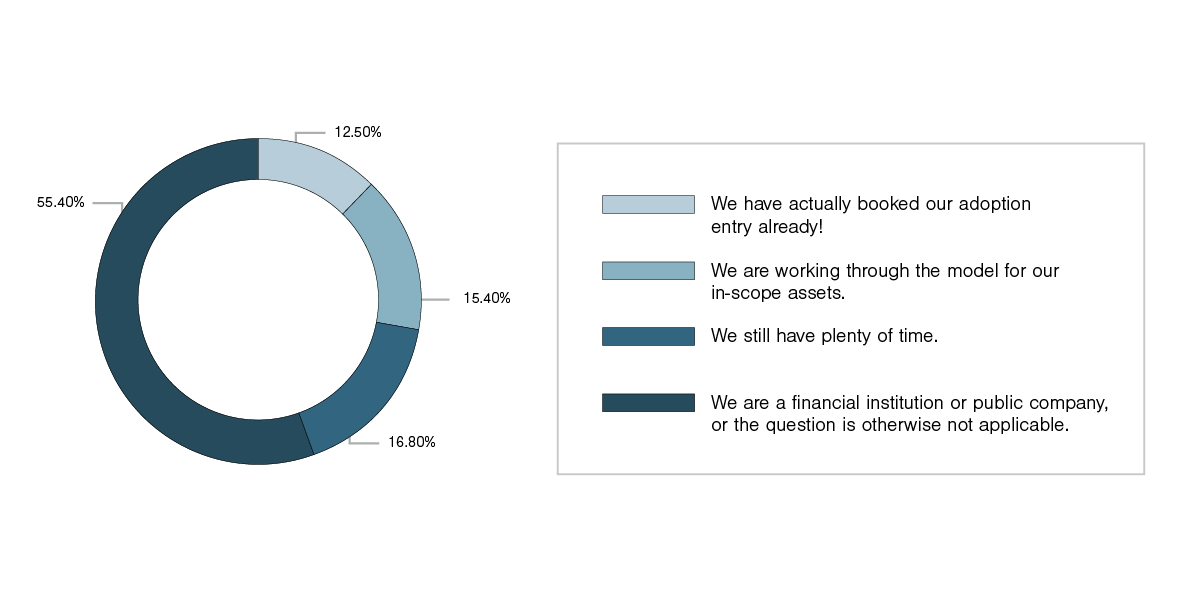

Let’s take a look at our webinar audience’s response to our polling question: For nonpublic commercial companies, where are you on the journey to adopting the CECL model for the allowance on financial assets under ASC 326?

Of those that are nonpublic or nonfinancial institutions, it seems that companies are evenly split between having already adopted, in-process of adopting, and having not yet started their adoption journey.

CECL for Nonfinancial Institutions

For commercial companies, CECL adoption will require a bit more of a scoping exercise. Below, we outline what is in-scope versus out of scope for nonfinancial institutions.

In Scope | Out of Scope |

|---|---|

|

|

Note: This is not an all-inclusive listing; there may be specific items that are in or out of scope for your business, we recommend working with your auditor or specialist for more information.

Once you’ve identified what is in scope, how are you going to apply the CECL model? And will it be as painful of a process as we saw with some financial institutions? For most, probably not. With financial institutions, there was additional complexity, and many institutions had to consider the option of a third-party vendor to help with their model methodology. For companies with less complex assets, it most likely will not require the need of a vendor model. But it will require changes from what was done in the past!

Some general hot topics to think about as you go through scoping and methodology are:

- Variety of acceptable estimation methods

- Expected losses over the contractual life of each asset

- Reasonable and supportable forecast

- Day one impact with entry to opening retained earnings in the period of adoption

- Zero loss expectation

- Increased disclosure requirements

Companies are expected to have robust documentation in response to the requirements of ASC Topic 326 and management’s decisions made during the implementation process. Some resources that provide more authoritative guidance on the subject are example illustrations in ASC 326-20-55-17 and FASB Staff Q&A Topic 326, No. 1.

Accounting Estimates in Financial Statements

We’re certainly seeing documentation as a theme through these trending topics. The AICPA standards introduce a new way of working through the estimate process, both from the development side and the audit side, and it all goes back to thorough, robust documentation that can support why you estimated using certain models and assumptions.

As you go through the process of implementing these standards, consider:

- Identifying all your accounting estimates

- Whether you did or should have used a specialist

- What was your methodology for the development of those estimates?

- What inputs and assumptions are being made to determine the estimate?

Be prepared—your auditor should be asking about the data, methods, and assumptions used by management. Their questions will require more documentation than in the past. Connect with your auditor now and outline how that might look and what they’re expecting.

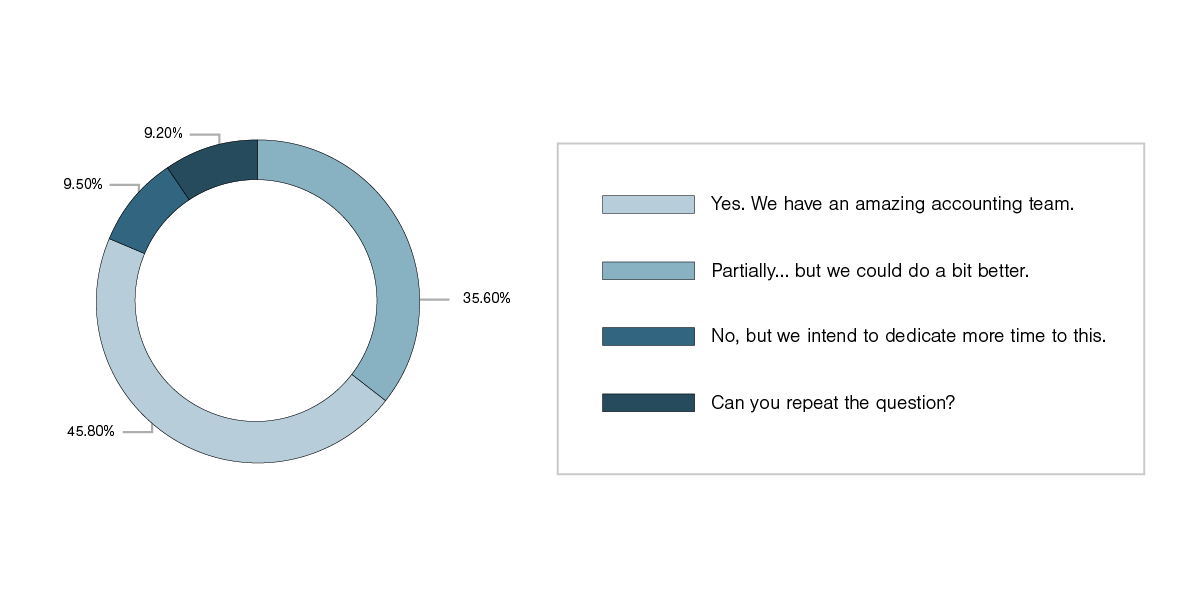

We asked our audience: Does your company periodically reassess all of the accounting estimates in your financial statements?

Make sure that your in-house accounting team is prepared for these standards and the questions that will be coming from your auditor.

New SEC Final Rule: Cybersecurity Risk Management, Strategy, Governance, & Incident Disclosure

Proposed in March 2022 and finalized in July 2023, this rule was driven by the need for improved disclosure around cybersecurity processes and events. While the SEC has expected disclosure in the past, there are now more specific requirements around reporting:

- What you do to monitor cyber risks

- When an event has occurred

New Reg S-K Item 106 requires disclosures regarding:

- Process to assess, identify, and manage material cybersecurity risks

- Management’s role in assessing and managing material cybersecurity risks

- Board’s oversight of cybersecurity risks

These will be required for fiscal years ending on or after December 15, 2023.

For periodic reporting, new Item 1.05 to Form 8-K requires companies to disclose material cybersecurity events and their related impact. This is to be filed within four business days after the determination that an event will have or is reasonably likely to have a material impact and will be required after December 18, 2023 for most SEC filers (and after June 15, 2024 for smaller reporting companies).

Conversations You Should Be Having

Documentation

As we’ve noted on all the items above, robust documentation is key. As new accounting standards are implemented, make sure your team is documenting appropriately. Thorough documentation will assist management in discussions and requests from both auditors and regulators. As your business goes through changes or is contemplating future changes, make sure each stakeholder is considering accounting ramifications. If you think you already document enough…document more!

New FASB Proposed Standard

Topic 718, Scope Application of Profits Interest Awards: Compensation—Stock Compensation, provides helpful examples of what pulls a profit’s interest into the scope of ASC Topic 718. Our team has worked through some of these agreements with clients, and as we look at the various provisions in these agreements, it’s evident that sometimes the agreements are written without thinking of accounting implications. This proposed standard provides some guidance to help you discern whether ASC Topic 718 is applicable. You’ll want to keep an eye on this proposed standard and see where it lands.

Trends in FASB Standards – Disaggregation

With recent FASB standards and proposals, we’re seeing trends with disaggregated information. Key elements within your income statement may need to be broken down and disclosed. Some items embedded in line items on the income statement that need to be broken out include cost of sales and inventory, marketing expense, employer comp depreciation, intangible asset amortization, and more.

Conclusion

We’re keeping an eye on trends for both our public and private companies and will bring you more insights in our next webinar. Make sure to register now for Quarterly Perspectives: Financial Reporting and Beyond / Q4 2023. For more information, please reach out to a professional at FORVIS.