In our “Quarterly Perspectives: Financial Reporting & Beyond / Q2 2023” webinar, we share observations on what has happened over the last few months, what companies are currently focusing on, and what will require attention in the future. In our Quarterly Perspective webinars, we refer to these as “looking back,” “here and now, and “conversations you should be having.” Learn key takeaways from the Q2 2023 webinar with the following recap.

Looking Back – The Labor Market, Bank Failures, & Clawback Rules

The Labor Market

Over the second quarter of this year, we continued to hear through news articles and anecdotally the challenges confronting public and private companies and accounting firms due to the tight labor market. It is no secret that everyone is looking for good accountants to keep on staff. Some public companies have even cited resource constraints as contributing to a reported material weakness.

Fallout From Bank Failures

Another area that was top of mind was the potential fallout from recent bank failures. Some may have expected an increase in impairment charges from this; however, while there were certainly impairment conversations, we did not see an uptick in actual impairment charges take place. The economy—and the bank sector—have been fairly resilient, despite the fact that stock prices and book values have fluctuated.

SEC Approves Clawback Rules

Another notable item we witnessed over the second quarter was the SEC’s approval of the NYSE & NASDAQ proposed executive compensation clawback rules, with a compliance deadline of December 1, 2023. With the June approval, there is now a specified timeline for compliance by companies. The rules will be effective on October 2, 2023. While some companies may have made initial efforts to craft policies based on the proposed rules, all companies now know they must have their policies in place by December 2, 2023 (60 days after the exchanges’ rules go into effect).

Here & Now – The Employee Retention Credit (ERC), FASB’s Private Company Council (PCC), & Business Combinations

The ERC

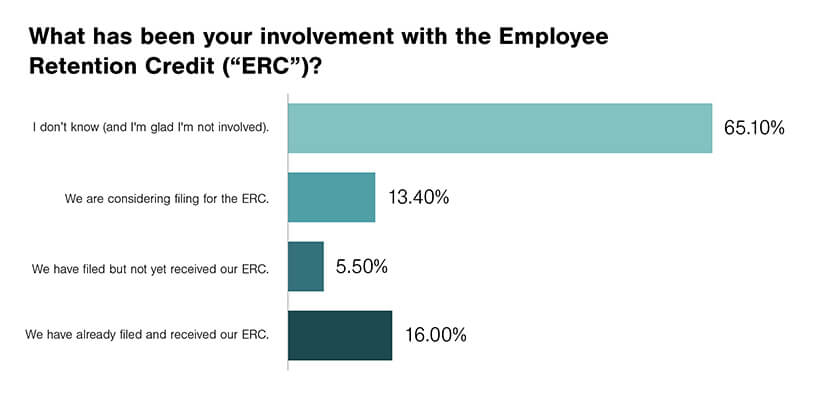

If you have not heard about the ERC from your advisor, you have likely heard about it from radio ads, emails, or even text messages to your personal phone! Our polling question during the webinar asked participants about their experience with the ERC, with most having no involvement to date:

If you do not know about the ERC or are still considering filing for it, you may be asking if it is too late to do so. The answer is no. The statute of limitations for the ERC runs through April 18, 2024 for 2020 ERCs and through April 5, 2025 for 2021 ERCs, allowing individuals to file claims still for the 2020 and 2021 tax years.

However, there is no limit on the IRS for the statute of limitations to assess taxpayers for false or fraudulent claims. This is something to be aware of as the IRS has listed the ERC on its dirty dozen list, as “aggressive promoters” are “making offers too good to be true.” If you have not filed an ERC and are thinking of doing so, be diligent in compiling your claim. The IRS is looking for very detailed and specific information—narratives alone are not sufficient, although they are helpful. You will need to point specifically to gross receipts and domestic government orders, including the time period covered by the government order and how it affected your business. You also will want to show the IRS that the government order had a more than nominal effect on your business.

If you have already filed for the ERC and now have questions regarding whether you have sufficient information to support the claim, start conversations with the original vendor or specialist you used and review the documentation. Make sure you have appropriately quantified documentation to back up your claim in addition to any narratives as to qualification for the ERC. Still have concerns? Our professionals can help you through IRS examination reports and IRS audits, even when we are not the original vendor you used. Visit our Assurance page to get connected to our team.

(Note that subsequent to the webinar, the IRS announced a moratorium on processing new claims for the ERC given concerns over potential scams targeted at small business owners. See our September 18, 2023 alert “The Employee Retention Credit – The IRS Is Getting Serious” for more on these recent developments.)

The PCC

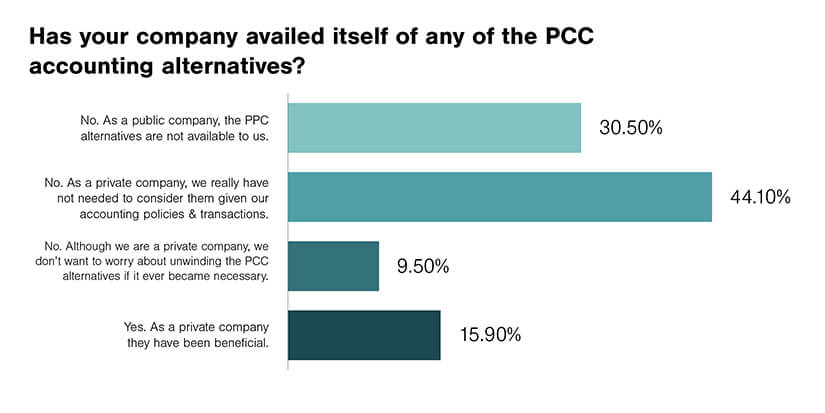

We put a spotlight on the PCC this quarter and learned more about the PCC’s key role in FASB’s standard-setting process. Our webinar polling results show a range of awareness and implementation of PCC accounting alternatives:

The PCC focuses its time on three objectives: private company accounting alternatives, advisory, and outreach. Upon creation of the PCC, private company accounting alternatives became a focus area, as many private companies were struggling with more complex elements of U.S. GAAP. Much of the PCC’s time is spent advising FASB as it works through accounting standards and helps ensure private company needs are taken into consideration. For example, a current project for the PCC is accounting for profits interests, resulting in FASB issuing an exposure draft for an Accounting Standards Update (ASU). The PCC also is working with FASB in advising it on private company needs on current FASB projects, such as income tax disclosures, crypto assets, and accounting for software costs.

Business Combinations

For those who are working through mergers and acquisitions, you realize the complexity in the accounting for business combinations. Therefore, having the right resources, including valuation specialists, is important to help ensure the accounting is accurate and complete. It is important to be fully engaged when working with valuation specialists. However, even when you use a specialist for these transactions, the company is ultimately responsible for (and needs to understand) the results and the accounting. For instance, you will want to understand the data and the underlying assumptions your specialist used. The details matter in business combinations, and the fine print in agreements can often lead to different accounting outcomes.

A best practice is to get your accounting professionals and specialists involved early to avoid surprises at the end when both time is scarce and deadlines are looming.

Conversations You Should Be Having – Uncertainty, CECL, & Non-Compliance With Laws & Regulations (NOCLAR)

Global & National Uncertainty

We continue to be in a period of both global and national uncertainty. Such uncertainty can give rise to an economic environment that may trigger concerns about potential impairments. While we may not have seen a significant number of impairments this past quarter following the uncertainty resulting from a few well-publicized bank failures, no one knows what the future will bring. In these periods of uncertainty, certain sectors in the market will likely be affected more than others. Impairment rules in accounting are numerous and will differ depending on the asset. Companies should continue to focus on the issues relevant to their operations and market valuations.

CECL

CECL has greatly impacted the financial services sector, which has generally adopted the standard at this point (ASU 2016-13, as amended) along with many public companies. The standard is required to be adopted by any remaining entities, including private entities, for this year-end and will have varying degrees of impact. There is an opportunity for private entities to learn from the public company experience to facilitate a smooth adoption this year. Be prepared for this final wave of adoption. See our CECL services to learn more.

NOCLAR

The PCAOB issued a proposed rule addressing how auditors of public companies should consider NOCLAR. Auditors currently have responsibilities in this area; however, if adopted, this standard will vastly expand those responsibilities.

Given the nature of the proposal, the closest example we have to a new standard of this magnitude is from 20 years ago, when auditors began auditing the internal control over financial reporting as part of integrated audits. What has been proposed with NOCLAR may be parallel in terms of rigor.

While the proposal does not directly address the company, as usual, when there are new audit requirements, it means your auditor will likely expect or need specific actions and items from you. This is important for public companies to consider as they follow this consequential PCAOB proposal.

(Note that at the time of the webinar, the Center for Audit Quality (CAQ) had created an informational webpage targeted to audit committees, and we recommended that public companies also review the website. Subsequent to the webcast, FORVIS commented on the PCAOB’s proposal, in part highlighting the effects on midmarket and smaller public companies.)

Conclusion

The only constant we are seeing—and will continue to see—is change. We will continue to bring you updates about what we are seeing, what is happening here and now, and what conversations you should be having as you look to the future.

Register now for the next webinar in the series, “Quarterly Perspectives: Financial Reporting & Beyond / Q3 2023.”

If you have questions or need assistance, please reach out to a professional at FORVIS or submit the Contact Us form below.