On December 1, 2023, the SEC announced that it postponed the effective date of its Share Repurchase Disclosures rule. The rule is stayed pending further SEC action. Almost as soon as the final rule was issued in May 2023, the U.S. Chamber of Commerce brought a legal challenge on the basis that the SEC failed to adequately substantiate the rule’s benefits and costs in violation of the Administrative Procedure Act (APA). In October 2023, the U.S. Court of Appeals for the Fifth Circuit required the SEC to provide additional materials by November 30, 2023. Rather than vacating the rule, the court gave the SEC until November 30, 2023 to correct this defect. The SEC decided to indefinitely postpone the effective date, which is allowed under the APA. FORVIS will continue to follow developments.

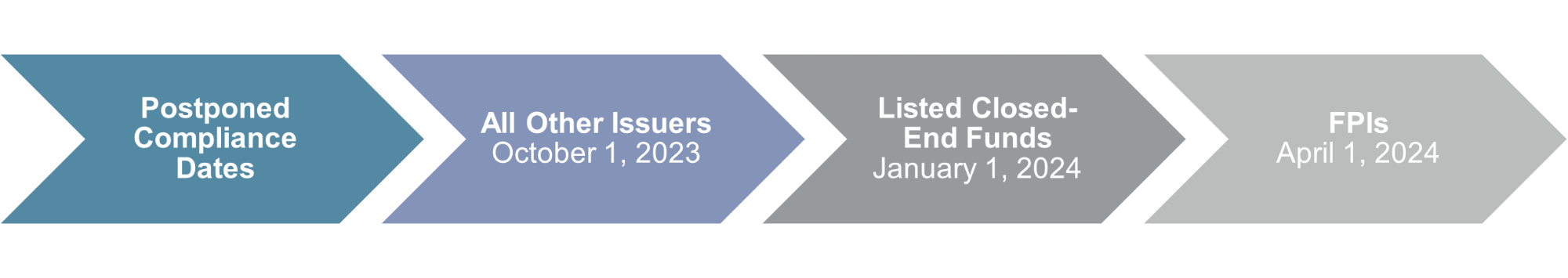

Had the SEC not stayed the effective date, reporting would have been required beginning with the first Form 10-Q or 10-K covering the first full fiscal quarter, i.e., for the 10-K, the fourth quarter that began on or after October 1, 2023.

For details on the rule, see “New SEC Share Repurchase Rules for Issuers & Closed-End Funds.”

If you have any questions or need assistance, please reach out to a professional at FORVIS.