On September 15, 2023, the IRS released its proposed changes to certain sections of federal Form 6765, Credit for Increasing Research Activities (R&D tax credit or research credit). While the IRS has not issued any further information about the proposed changes since the September release, its website does mention it is considering making the new Form 6765 effective in tax year 2024. This article seeks to provide an overview of Form 6765, outline the proposed changes, share the implications of those proposed changes for taxpayers, and pose questions based on the IRS changes that could provide significant challenges to taxpayers wanting to claim an R&D credit in tax years 2024 and beyond.

Overview of Current Form 6765

Form 6765 is currently a two-page form that includes four sections. Taxpayers have the choice of completing either Section A or Section B to compute their R&D tax credit. The Section A computation follows the regular research credit (RRC) methodology, while Section B follows the Alternative Simplified Credit (ASC) methodology. The final line of both Section A and B gives taxpayers the opportunity to elect a reduced credit under Internal Revenue Code (IRC) Section 280C.

Section C of Form 6765 is used to determine the taxpayer’s current year R&D tax credit, while Section D is included for qualified small businesses that elect the payroll tax credit.

Form 6765 currently requires almost exclusively quantitative information to be reported by taxpayers; however, recent court cases have highlighted the IRS’ increased demand for taxpayers to adequately support the R&D credits claimed through detailed project accounting records and contemporaneous documentation (see Little Sandy Coal v. Commissioner). The proposed changes, if made effective, would formalize the heightened support requirements sought by IRS examiners for all taxpayers who seek to claim an R&D credit.

Proposed Changes

The IRS proposed three major changes to Form 6765:

- The addition of qualitative questions to the top of the form

- The addition of Section E

- The addition of Section F

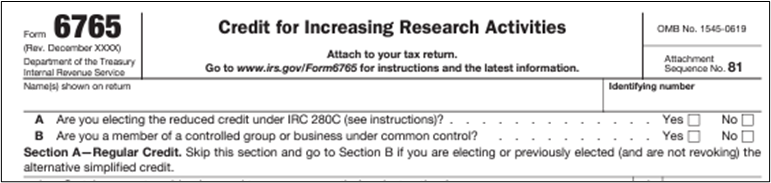

Addition of Questions

The first proposed change now lists two questions prior to Section A about the reduced credit and controlled groups or businesses under common control. The first question, Item A, gives taxpayers the option to elect the reduced credit under IRC Section 280C. The second question, Item B, asks if the taxpayer is a member of a controlled group or businesses under common control.

- Form 6765

- (Rev. December XXXX)

- Department of the Treasury

- Internal Revenue Service

- Credit for increasing Research Activities

- Attach to your tax return.

- Go to www.irs.gov/Form6765 for instructions and the latest information.

- OMB No. 1545-0619

- Attachment Sequence No. 81

- Name(s) shown on return

- Identifying number

- A: Are you electing the reduced credit under IRC 280C (see instructions)? ... Yes or No

- B: Are you a member of a controlled group or business under common control? ... Yes or No

- Section A - Regular Credit. Skip this section and go to Section B if you are electing or previously elected (and are not revoking) the alternative simplified credit.

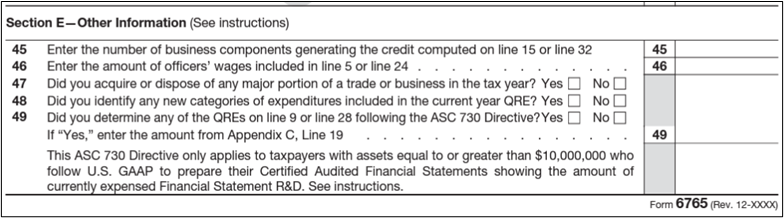

Section E – Other Information

The addition of Section E consists of five new questions of “Other Information” for all taxpayers to complete. The five questions include:

- 45. The number of business components generating the R&D credit

- Internal Revenue Code Section 41(d)(2)(B) defines a business component as “any product, process, computer software, technique, formula, or invention which is to be held for sale, lease, or license, or used by the taxpayer in a trade or business of the taxpayer.”

- 46. The amount of officers’ wages that are included in the taxpayer’s reported wage QREs

- 47. A yes/no question asking if any major acquisitions or dispositions occurred in the tax year

- 48. A yes/no question asking if new categories of expenditures were included in current year QREs

- 49. A yes/no question asking if any of the taxpayer’s current year QREs followed the ASC 730 Directive

- Section E - Other Information (See instructions)

- 45. Enter the number of business components generating the credit computed on line 15 or line 32

- 46. Enter the amount of officers' wages included in line 5 or line 24

- 47. Did you acquire or dispose of any major portion of a trade or business in the tax year? Yes or no.

- 48. Did you identify any new categories of expenditures included in the current year QRE? Yes or no.

- 49. Did you determine any of the QREs on line 9 or line 28 following the ASC 730 Directive? Yes or no.

- If "Yes," enter the amount from Appendix C, Line 19.

- This ASC 730 Directive only applies to taxpayers with assets equal to or greater than $10,000,000 who follow U.S. GAAP to prepare their Certified Audited Financial Statements showing the amount of currently expensed Financial Statement R&D. See instructions.

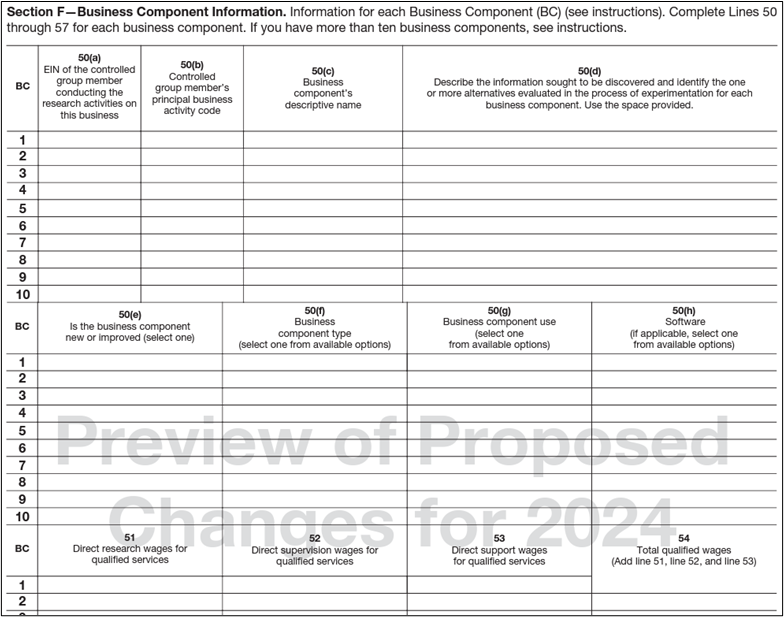

Section F – Business Component Information

The proposed addition of Section F, titled “Business Component Information,” is by far the most robust of the three proposed changes. The proposal from the IRS would request extensive information for each controlled group member’s business components which are associated with the R&D tax credit computation. This includes, but is not limited to:

- 50(a) & 50(b). The controlled group member’s EIN and principal business activity code

- 50(c). The business component’s descriptive name

- 50(d). A description of the information sought to be discovered and the alternatives evaluated in the process of experimentation (using the space provided)

- 50(e). Whether the business component was new or improved

- 50(f). The business component type, e.g., a product, process, computer software, technique, formula, or invention

- 50(g). Whether the business component is intended to be used for sale, lease, license, or used in the taxpayer’s trade or business

- 50(h). If the business component is software, and which type of software using the IRS’ available options (ten options are provided in the proposed guidance)

- 51. The wage QREs allocated to the business component related to direct research for qualified services

- 52. The wage QREs allocated to the business component related to direct supervision for qualified services

- 53. The wage QREs allocated to the business component related to direct support for qualified services

- 54. The total wage QREs allocated to the business component

- Section F - Business Component Information. Information for each Business Component (BC) (see instructions). Complete Lines 50 through 57 for each business component. If you have more than ten business components, see instructions.

- 50(a)

- EIN of the controlled group member conducting the research activities on this business

- 50(b)

- Controlled group member's principal business activity code

- 50(c)

- Business component's descriptive name

- 50(d)

- Describe the information sought to be discovered and identify the one or more alternatives evaluated in the process of experimentation for each business component. Use the space provided.

- 50(e)

- Is the business component new or improved (select one)

- 50(f)

- Business component type (select one from available options)

- 50(g)

- Business component use (select one from available options)

- 50(h)

- Software (if appliable, select one from available options)

- 51

- Direct research wages for qualified services

- 52

- Direct supervision wages for qualified services

- 53

- Direct support wages for qualified services

- 54

- Total qualified wages (Add line 51, line 52, and line 53)

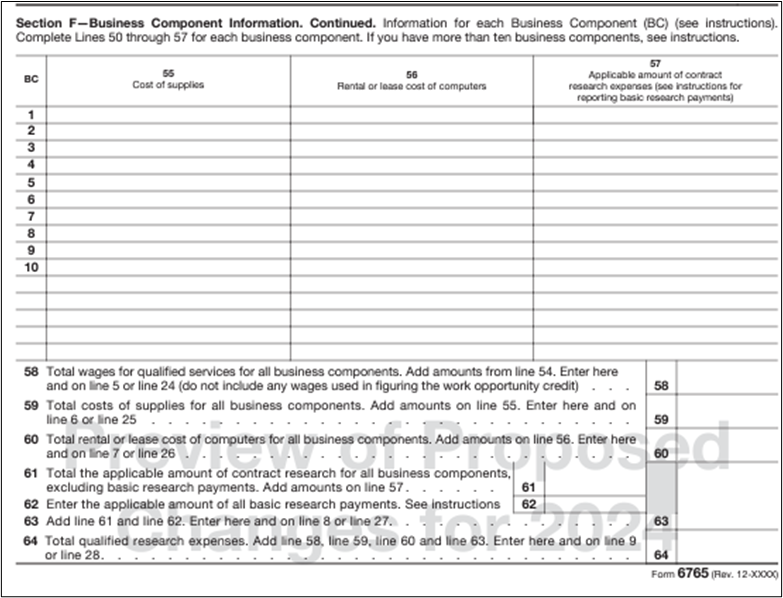

- 55. The total supply QREs allocated to the business component

- 56. The total rental or lease cost of computers QREs allocated to the business component

- 57. The total contract research QREs allocated to the business component

- 58. The total wage QREs allocated to all business components

- 59. The total supply QREs allocated to all business components

- 60. The total rental or lease cost of computer QREs allocated to all business components

- 61. The total contract research QREs allocated to all business components

- 62. The amount of all basic research payments, if applicable

- 64. The total QREs allocated to all business components, which is required to be reported in Section A or B as the taxpayer’s total current year QREs in the R&D credit calculation

- Section F - Business Component Information. Continued. Information for each Business Component (BC) (see instructions). Complete Lines 50 through 57 for each business component. If you have more than ten business components, see instructions.

- 55

- Cost of supplies

- 56

- Rental or lease cost of computers

- 57

- Applicable amount of contract research expenses (see instructions for reporting basic research payments)

- 58

- Total wages for qualified services for all business components. Add amounts from line 54. Enter here and on line 5 or line 24 (do not include any wages used in figuring the work opportunity credit)

- 59

- Total costs of supplies for all business components. Add amounts on line 55. Enter here and on line 6 or line 25.

- 60

- Total rental or lease cost of computers for all business components. Add amounts on line 56. Enter here and on line 7 or line 26.

- 61

- Total the applicable amount of contract research for all business components, excluding basic research payments. Add amounts on line 57.

- 62

- Enter the applicable amount of all basic research payments. See instructions.

- 63

- Add line 61 and line 62. Enter here and on line 8 or line 27.

- 64

- Total qualified research expenses. Add line 58, line 59, line 60 and line 63. Enter here and on line 9 or line 28.

Implications & Observations

While plenty of uncertainty clouds the additions of Sections E and F (such as what happens if taxpayers elect not to provide the information requested in Section F), these concerns related to both sections should be noted by taxpayers who plan to claim R&D credits in future years.

Section E – Other Information

- With the addition of officers’ wage QREs to this section, taxpayers should be prepared to provide contemporaneous documentation to support the qualified activity of highly compensated employees (Scott Moore, et al. v. Commissioner1; Suder v. Commissioner2).

- Taxpayers will need to ensure their base period QREs are properly calculated, especially in situations where acquisitions or dispositions have occurred in the tax year or when previously unclaimed sources of QREs are identified in the current tax year. Taxpayers who check "Yes" to either of these two boxes in Section E can expect heightened base period scrutiny from the IRS in the event of an examination.

Section F – Business Component Information

- The most significant takeaway from the proposed IRS changes is the importance of taxpayers adopting business component accounting to accurately report business component QREs and associated information on Form 6765. Potential challenges include identifying all relevant business components within a given tax year, tracking wages, supplies, computer rental, and contract research costs to those business components in a manner the IRS deems sufficient, and the significant time and effort required from subject matter experts to provide the requested information for each business component.

- Timing is also an important consideration; in the past, taxpayers have been able to gather supporting contemporaneous documentation as they were available simply as a precaution against a potential IRS exam in future years. However, the proposed changes greatly increase the urgency for taxpayers to gather contemporaneous documentation; a detailed level of support will be required to identify and describe each business component on Form 6765 before filing deadlines. Taxpayers should evaluate their current process for maintaining and gathering supporting documentation and look for ways to make this information more readily available in future years.

Potential Taxpayer Questions

The proposed IRS changes to federal Form 6765 generate additional questions.

Section E

- In Section E, line 48, how does the IRS define a “new category of expenditures”?

- For example, would this only apply if a taxpayer who did not claim any supply QREs in its base years identified a brand-new source of supply QREs in the current year?

- What if the taxpayer claimed supply QREs in its base years but identified a new source of data (such as scrap expenses) that existed in prior years, though they were not claimed as supply QREs until the current year?

- What if a taxpayer who utilizes time tracking details to quantify wage QREs identifies a new group of employees outside of the time tracking system who performed qualified activity, and thus quantifies their current year wage QREs through a time?

- What if a taxpayer has an employee who was around in the base period years but whose qualified wages are being claimed for the first time in the current tax year, all while in the same job function as other employees?

Section F

- What is the IRS’ expectation for the scale of business components reported on Form 6765? Could a taxpayer report a product line or product category as a single business component? Or would that taxpayer be required to report each new or improved product as a business component? Requiring each product to be reported as an individual business component could discourage taxpayers from claiming an R&D credit due to the time and effort required to gather the required information to report on Form 6765.

- What level of detail is required in explaining the information sought to be discovered and alternatives evaluated (line 50(d))? We can look to question 20 in the IRS’ FAQs for Research Credit Claims on Amended Returns as a starting point for the desired level of detail, but more clarification is needed from the IRS.

- What happens if a taxpayer does not complete Section F? Would the R&D tax credit claim be disallowed?

- How do the proposed changes impact taxpayers who use the LB&I ASC 730 Directive? Would these taxpayers still be required to report each of their business components in Section F?

- How should taxpayers who utilize a statistical sample report their business components? Statistical sampling has been relied upon in situations where taxpayers have more business components than can be feasibly reported or documented, sometimes in excess of one thousand business components per year. Would these taxpayers be required to provide the requested information in Section F for all of its business components, or just those that were selected in the statistical sample? If only those in the statistical sample are required to be reported, then how should the taxpayer complete lines 58 through 64? For instance, would it be permissible if the wage QREs reported on line 54 do not tie to the taxpayer’s total wage QREs shown on line 58?

While the proposed IRS changes to Federal Form 6765 are clouded with uncertainty, taxpayers should anticipate reporting requirements for research credits to grow soon. Taxpayers who wish to continue claiming research credits in future years should strongly consider adopting business component accounting, maintaining diligent records of business component development, and keeping contemporaneous documentation readily available to meet IRS expectations for claims.

If you have any questions or need assistance, please reach out to a professional at FORVIS.