For many clients, the process of selecting a trustee can be a challenging task. Some clients will choose a family member, business partner, or close friend, while others will choose a bank or other corporate fiduciary. Unfortunately, however, clients rarely have a firm understanding of the responsibilities of a trustee prior to deciding who to appoint to that role.

The duties of a trustee are complex and require knowledge of law, accounting, investing, administration, and even counseling. In addition, a trustee is considered to be a fiduciary, which means that they are held to the highest standard of care under the law for all of their actions while serving as trustee. This means that choosing the right person or organization to fulfill this role is particularly important. Below we will examine several of the key duties of a trustee to help with the decision-making process.

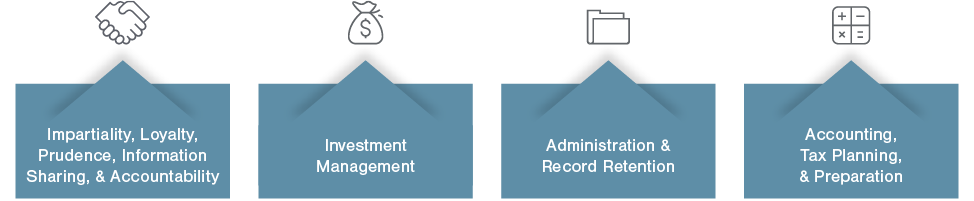

Duties of a Trustee

- Impartiality, Loyalty, Prudence, Information Sharing, & Accountability

- Investment Management

- Administration & Record Retention

- Accounting, Tax Planning, & Preparation

Let’s take an in-depth look at some of the many hats that a trustee wears:

Accounting

Trust accounting and taxation are complicated and follow rules that are different than those for individuals and businesses. In addition, the income and distributions from a trust can impact both the grantor’s income taxes (if the trust qualifies as a grantor trust), and the beneficiary’s income taxes. For example, a trustee is required to differentiate between principal and income of the trust, which requires dual-ledger accounting. To make matters even more complex, these items are either outlined in the document or, if the document does not reference them, they default to state law, which can vary from state to state.

The trustee also needs to understand whether the trust or the grantor is paying the trust taxes. If the trust is paying the taxes, what state(s) does the trust pay in? It is not as simple as declaring the state where the trust became irrevocable is the state where it will pay taxes. Once again, the respective state tax requirements for trusts vary greatly and where a trust is paying (or not paying) taxes can be a weighty decision.

Another important consideration is how beneficiaries may be taxed on trust distribution. Unsurprisingly, the answer is “it depends.” It is imperative that the trustee understand these nuances.

If an individual is selected to serve as trustee, it will be important for them to hire a CPA who is experienced in trust tax reporting to not only prepare the returns but help explain to the beneficiaries how they are taxed.

Investments

The investments held by a trust can often be another area of complication. The first step is for the trustee to determine what assets the trust holds. A trust can typically hold any asset that an individual holds; however, the trustee must review the trust instrument carefully to determine their duties with regard to the assets of the trust. State law will spell out the trustee’s responsibility for managing the investments held in a trust; however, the trust instrument may alter these requirements or waive them altogether. Whatever type of asset the trust holds, the trustee is responsible for the oversight and management of those assets, ensuring they are securely held, properly insured, and held for the benefit of the beneficiaries.

When a trust holds liquid assets, an investment policy statement (sometimes called a mandate) should be prepared that will outline the investment allocation. When developing an investment allocation, it is important to look at the trust assets holistically rather than in isolation. The trustee also will need a solid understanding of the distribution provisions and the taxability of the trust, as well as the needs and goals of the current beneficiaries while keeping in mind the interests of the remainder beneficiary. Depending on the asset mix, the trustee will likely have to hire not only an investment professional, but also may need to engage a property manager, a realtor to sell assets, or an individual to manage trust-owned businesses.

A trustee is held to a higher standard than an individual, which means the trustee is obligated to ensure that the trust fund is being invested appropriately.

Administration

To properly administer a trust, the trustee needs to have custody of the assets. An individual trustee may use multiple advisors to establish different accounts for the trust, whereas a corporate trustee will usually have custody of the assets in-house. There are different types of corporate trustees, and it is important to inquire in advance how they have custody of the assets.

The trustee also is responsible for understanding and analyzing the distribution provisions of the trust and making distributions to the beneficiaries in accordance with those provisions. The trustee is charged with carrying out the intentions of the trust creator, which can be difficult sometimes depending on how the distribution language is written. In addition, in making distribution decisions for current beneficiaries, the trustee also must be cognizant of the interests of remainder beneficiaries and balance the interests of both. When a beneficiary makes a request for a distribution, the trustee may have to request personal and financial information from a beneficiary, which can become awkward for individual trustees, particularly those who may be related to the beneficiary.

A trustee must maintain the books and records of the trust in a format that can be reviewed and communicated to the beneficiaries at any time. In most cases, once a beneficiary reaches 18 years of age the trustee is required to provide a copy of the trust instrument and statements to the beneficiary at least annually. The trustee also must be able to answer questions and discuss items in the trust instrument and the annual statements with beneficiaries. This may be a sensitive subject for the grantor, and it is important that they understand the reporting requirements the trustee will be subject to. If this is not something that you as the grantor are comfortable with, be sure to speak with your attorney to determine if there are different reporting requirements options in other jurisdictions.

Counselor

Establishing a relationship with the beneficiaries of the trust is a key component to the success of a trustee. Part of the role of a trustee is to educate the beneficiaries about the trust; however, it does not end there. Helping the beneficiaries understand the purpose of the trust can encourage them to take an active role in becoming stewards of their family legacy.

A successful trustee should understand the beneficiaries’ current situation and their goals and plans for the future. With that understanding, the trustee can help them navigate when a request to the trust is appropriate, guide them through the process, and, in certain cases, help them to look for outside resources rather than coming to the trust for a distribution.

Some of the challenges beneficiaries report is that they don’t know why the trust was created, they don’t understand the provisions of the trust, or they are intimidated by the trustee, so they are hesitant to develop a relationship. Being a trusted partner and a resource to the beneficiary(ies) is one of the most important yet often overlooked roles of a successful trustee.

A successful trustee must be able to manage the accounting, investing, administration, and counseling responsibilities that come with their role. Prior to selecting a trustee, whether it is an individual or a corporate trustee, a client should meet with them to manage expectations—both the client’s and the potential trustee’s. While this may sound like common sense, it is far from customary practice. Quite often the trustee is not made aware that they are named until the time they are called upon the serve, in which case they may be either unprepared or unwilling to accept the role. To that end, ensure that your trust document contains provisions for trustee resignation, removal, and replacement. This allows for all parties to feel secure in the knowledge that there is a path to resolution if the relationship is not meeting expectations.

If you have any questions or need assistance, please reach out to a professional at FORVIS Private Client™.