Just about every major accounting software system has, at least, a year-end process whereby you close the books. This process may do different tasks, depending upon the software being used. However, in all cases, it’s important to perform this process. This article will highlight reasons why you should perform the process of closing sooner rather than later.

The Benefits of Closing the Books

One benefit to closing the books is being able to produce reports that require beginning balances for accuracy. For example, the Balance Sheet and Cash Flow Statement reports need beginning balances. Other reports you generate also may need beginning balances for the current year. Some systems will calculate the beginning balances for you.

Another benefit to closing is locking down the periods to prevent users from updating them. There’s nothing like publishing financial reports only to have the numbers change because of an errant entry. Restricting users from causing this type of issue can help prevent it.

For instance, in Microsoft Dynamics GP, there’s a Routine (as it’s named) called Year-End Close. This process does the following steps:

- Marks the year as Historical.

- Creates beginning balances for Balance Sheet accounts.

- Updates Retained Earnings with the previous year’s balance plus the net of Profit and Loss activity.

These steps are important for producing Balance Sheet and Cash Flow reports in the new year.

Here are a couple of other accounting software system processes:

Microsoft Dynamics 365 Business Central

- Select Close Year from the Accounting Periods window.

- Use the Close Income Statement action.

- Post the year-end closing entry.

Microsoft Dynamics 365 Finance

- Set your closing options in the General Ledger Parameters page under Fiscal Year Close.

- Create year-end close templates.

- Run year-end close.

Many organizations resist closing the books until the audit adjustments are done. However, in the three systems above, you don’t need to hold off the closing process to make audit adjustments.

The above systems enable you to reopen the year, post entries into the closed year (with permissions), or both. Some systems, like Sage Intacct, enable you to post Adjusting Entries into the closed year (Book, in its terminology).

To learn the closing process details for the Microsoft systems mentioned, please review Microsoft’s documentation. There also are multiple videos on YouTube in support of these products. In fact, several can be found on our Business Technology YouTube playlist.

Impact on Other Systems

Some organizations use external reporting solutions like Solver and Microsoft Power BI to create financial reports. These tools need data or calculations to determine beginning balances.

For these examples, let’s use the data in this spreadsheet for a given account number.

| Trx Date | Trx Amount | Account |

|---|---|---|

| 1/1/2023 | 500 | 1100 |

| 2/1/2023 | 1000 | 1100 |

| 3/1/2023 | 200 | 1100 |

| 4/1/2023 | 400 | 1100 |

| 5/1/2023 | 600 | 1100 |

| 6/1/2023 | -500 | 1100 |

| 7/1/2023 | 200 | 1100 |

| 8/1/2023 | 250 | 1100 |

| 9/1/2023 | 300 | 1100 |

| 10/1/2023 | -200 | 1100 |

| 11/1/2023 | 500 | 1100 |

| 12/1/2023 | 600 | 1100 |

| 1/1/2024 | -1000 | 1100 |

| 2/1/2023 | 200 | 1100 |

One option is to accumulate the activity from the beginning of time. In Power BI, you would create a measure to do this. This calculation would sum the values up to the last date of the prior year.

Beginning Balance =

VAR MaxDate = DATEADD(ENDOFYEAR('Date'[Date],"12/31"),-1,YEAR)

VAR Result = CALCULATE(SUM([Trx Amount]),'Date'[Date] <= MaxDate, ALL('Date'))

RETURN

Result

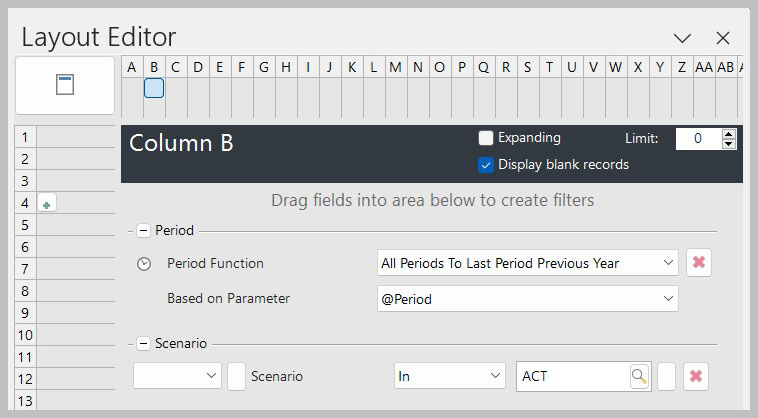

In Solver, you could use a period function or an expression. Here is the period function usage:

In this example, Solver is adding the activity (ACT) for all periods up to and including the last period of the prior year.

As time goes by, the amount of data the report processes will increase and the time to calculate the results will increase. Consider the number of accounts, dimensions, and periods your system has. If you’re building reports using transaction details, the amount of processing time will increase greatly.

Additional Options

Your accounting system may create beginning balances per year. However, if the year wasn’t closed, the new year won’t have a beginning balance to use. To save computing time, having a beginning balance is useful because it reduces the amount of data to summarize in either system.

Here’s an updated spreadsheet showing the beginning balance for 2023.

| Trx Date | Trx Amount | Account | Scenario |

|---|---|---|---|

1/1/2023 | 2000 | 1100 | Beg Bal |

1/1/2023 | 500 | 1100 | Activity |

2/1/2023 | 1000 | 1100 | Activity |

3/1/2023 | 200 | 1100 | Activity |

4/1/2023 | 400 | 1100 | Activity |

5/1/2023 | 600 | 1100 | Activity |

6/1/2023 | -500 | 1100 | Activity |

7/1/2023 | 200 | 1100 | Activity |

8/1/2023 | 250 | 1100 | Activity |

9/1/2023 | 300 | 1100 | Activity |

10/1/2023 | -200 | 1100 | Activity |

11/1/2023 | 500 | 1100 | Activity |

12/1/2023 | 600 | 1100 | Activity |

1/1/2024 | -1000 | 1100 | Activity |

2/1/2024 | 200 | 1100 | Activity |

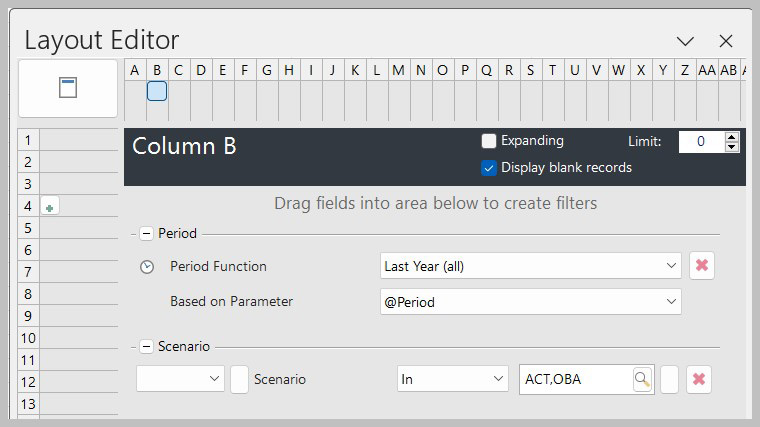

In Solver, you can use the Last Year (all) period function to include last year’s beginning balance (OBA) plus the activity (ACT).

In Power BI, if your data includes beginning balances for each year, then you can calculate the sum of all data for the prior year.

Beginning Balance 2 =

CALCULATE(

SUM(Sheet1[Trx Amount]),

DATESYTD(DATEADD('Date'[Date],-1,YEAR),"12/31"))

In these examples, by having a beginning balance, the system only needs to process 12 months of data, shortening the processing time and increasing the time to get results.

Summary

In most accounting software systems, you may be able to open a closed year to post adjusting entries into it. Alternatively, you may be able to post entries into a closed year but need to perform closing functions again. For reporting, the benefit of closing the year means less data will be processed by the report. More importantly, the results are available more quickly. Remember, timely book closure can help your financial statements reflect reality, and it’s a smart move for any organization.

If you’d like to dive into more best practices and options for closing the books in accounting software, please reach out. The Insights & Automation team at FORVIS has certified experience with Solver and Microsoft business applications. In addition, FORVIS holds technology provider partnerships with Microsoft, NetSuite, Sage, Salesforce, and Solver.