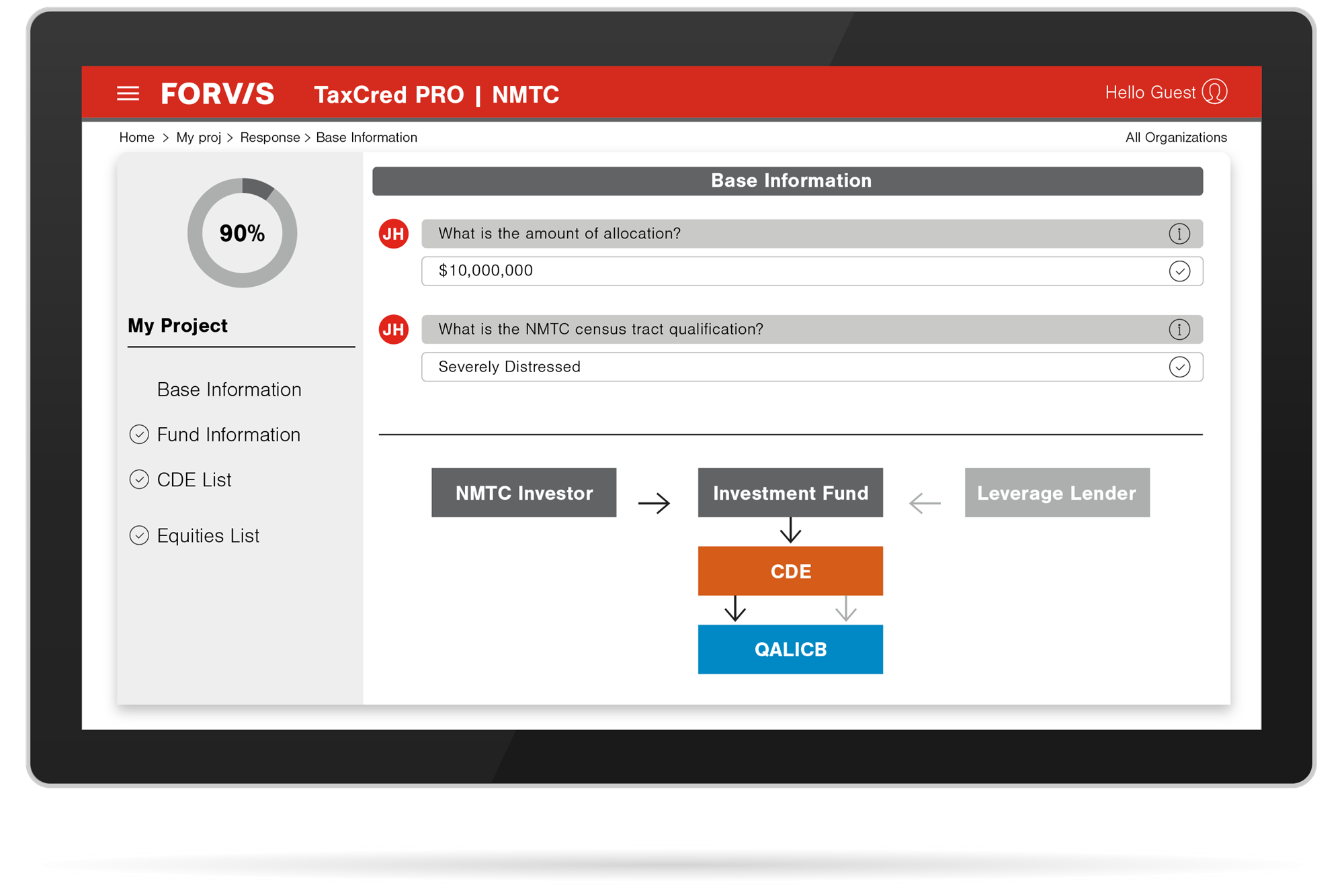

What is the NMTC Program?

The Federal NMTC Program is a financing tool for qualified projects and a tax incentive for investors. The NMTC Program, financed by the Community Development Financial Institutions (CDFI) fund, attracts private capital into low-income communities by permitting individual and corporate investors to receive a tax credit against their federal income tax in exchange for making equity investments in specialized financial intermediaries called Community Development Entities (CDE).

The credit totals 39% of the original investment amount and is claimed over a period of seven years. Low-income communities often experience a lack of investment, as evidenced by vacant commercial properties, outdated manufacturing facilities, and inadequate access to education and healthcare services. The NMTC Program aims to break this cycle of disinvestment by attracting the private investment necessary to reinvigorate struggling local economies.