On July 27, 2023, the Federal Reserve Board, the Office of the Comptroller of the Currency, and the Federal Deposit Insurance Corporation (“Agencies”) jointly released a proposal for the implementation of the Basel III Endgame—the final round of Basel III capital framework reforms. The complete package of proposed reforms would apply to banks with $100 billion or more in total assets (“large banks”). Additionally, a portion of the reforms related to market risk would also apply to non-large banks with significant trading activities.1

According to the Agencies, the objective of the proposal is to improve the strength and resiliency of the U.S. banking system by introducing modifications to increase the transparency and consistency of the regulatory capital framework to better capture underlying risks. The Agencies plan to accomplish these goals by:

- Eliminating from the capital regulations the ability to use internal model-based approaches for the calculation of capital requirements for credit risk and operational risk.

- Introducing the “Expanded Risk-Based Approach,” a new set of standardized requirements that would apply to large banks for the calculation of credit risk, operational risk, CVA risk, and market risk.

- Requiring large banks to reflect unrealized gains and losses on available-for-sale securities in regulatory capital.

- Applying the supplemental leverage ratio and the countercyclical buffer, if activated, to large banks.

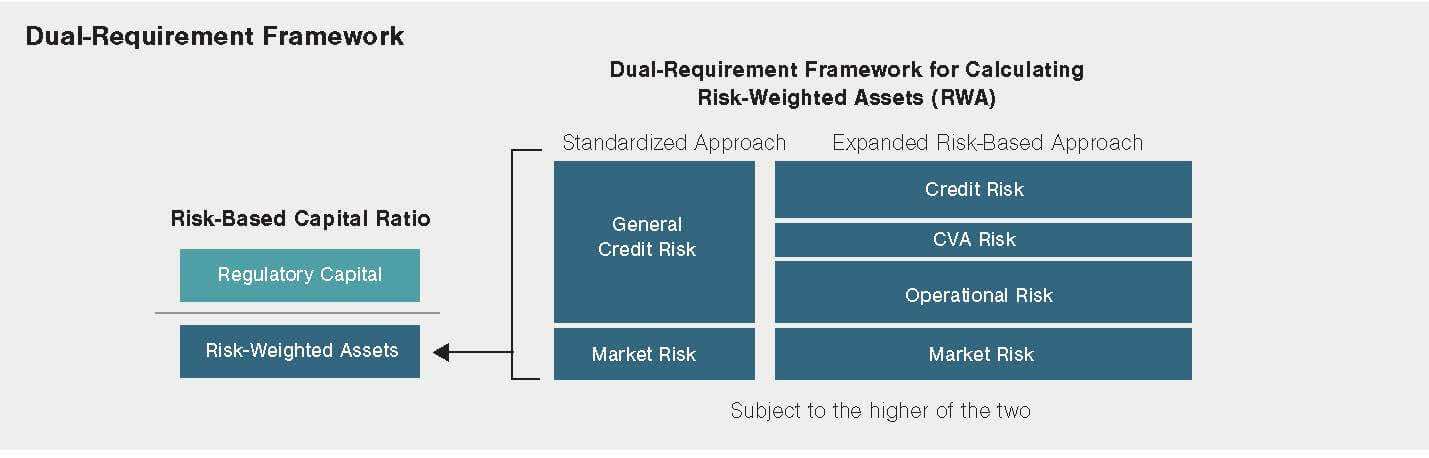

- Requiring large banks to apply a “dual-requirement framework” where banks will calculate their risk-weighted asset amounts under the current standardized approach and the expanded risk-based approach and use the higher of the two risk-weighted asset amounts to meet their minimum capital requirements.

What Does This Mean for Organizations?

The Basel III regulatory capital rules will apply to all banks with $100 billion or more in total assets. As a result, Category III and IV banks will now be subject to the extensive Basel III capital requirements similar to Category I and II banks, thereby significantly altering the existing tailoring framework. However, only Category I banks (GSIBs) will be subject to the GSIB surcharge and the enhanced supplementary leverage ratio requirements.

Key Elements of the Proposal

- Credit Risk: The new Expanded Risk-Based Approach would increase granularity, robustness, transparency, and comparability of the credit risk capital framework.

- Operational Risk: A new standardized approach for measuring operational risk would be introduced that measures operational risk based on a variety of factors, including business volume, fee income, and historical losses.

- Market Risk: The current market risk framework would be replaced with a new standardized methodology for calculating risk-weighted assets for market risk and a new models-based approach. The new models-based approach would require a more rigorous model approval process, which includes supervisory trading desk-level approval for the use of models. The new models-based approach would require the use of expected shortfall-based measurements to better account for tail risk and better reflect the risks associated with less liquid trading positions.

- Financial Derivative Risk (i.e., Credit Value Adjustment): The current model-based approaches for measuring capital requirements for CVA risk for OTC derivative contracts would be replaced with a standardized approach, and a less burdensome option intended for less complex banking organizations.

| Credit Risk | Operational Risk | Market Risk | Financial Derivative Risk (i.e., CVA Risk) |

|---|---|---|---|

|

|

|

|

Impact to Category III and IV Organizations

The Basel III Endgame proposal would require Category III and IV institutions to meet certain standards that are currently only applicable to Category I and II institutions, thus aligning definitions across categories:

- Category IV organizations would be subject to the supplementary leverage ratio and countercyclical capital buffer, representing a departure from the current capital rules that exclude such institutions from these requirements.

- It recognizes most elements of AOCI (accumulated other comprehensive income) in regulatory capital, most notably unrealized gains and losses, on available-for-sale (AFS) securities.

- The proposed changes would also impact the criteria for minority-interest inclusion in capital and apply more stringent requirements around capital deductions, i.e., investments in the capital of unconsolidated financial institutions, mortgage servicing assets, and certain deferred tax assets.

- It would apply the Total Loss Absorbing Capacity (TLAC) holdings deductions treatments.

Impact to the Industry

- In aggregate, across organizations subject to category I–IV, it is estimated that the binding common equity tier 1 capital including minimum capital buffers will increase by 16%.

- Across depository institutions, subject to category I–IV, it is estimated that the binding common equity tier 1 capital will increase by an estimated 9%.

- It has been noted in the FDIC board meeting that the shortfall in capital is estimated to be equal to an amount less than one year’s worth of average earnings within the past seven years for large holding companies.

- In addition to the regulatory capital impact, banks will be required to significantly modify their existing IT systems, regulatory compliance framework, and regulatory reporting systems to accommodate the new requirements.

Key Items to Consider

Capital Buffers

In the current capital rule, the capital ratio is the sum of the minimum requirements and buffer requirements. The buffer requirements are determined by the sum of the banking organization’s stress capital buffer requirement, applicable countercyclical capital buffer requirement, and applicable GSIB surcharge.

Unlike the above, the new rules will introduce a “single capital conservation buffer requirement” which incorporates all the previous buffers of the banking organization’s risk-based capital ratios, regardless of whether the ratios result from different types of approaches.

Stress Capital Buffers (SCB)

The SCB calculation will be revised for large banking organizations such that the “stress test losses” and “dividend add-on components” will be calculated using the binding CET 1 capital ratio regardless of whether the binding ratio results from the expanded risk-based approach or the standardized approach. In general, banking organizations subject to Category I, II, and III standards would be required to project risk-based capital ratios in their company-run stress tests and capital plans based on the approach that resulted in the binding ratio as of December 31 of a given year. For banking organizations subject to the Category IV standards, the risk-based capital ratio would be projected under baseline conditions in their capital plans and FR Y–14A submissions using the approach that results in the binding ratio as of the start of the projection horizon.

NPR Changes to the Additional Rules

- Modification of RWA to calculate TLAC requirements, long-term debt requirements, and short-term wholesale funding score (incl. GSIB surcharge method 2 score).

- Revision of single-counterparty credit limit calculation by removing the option of using banking organization’s internal models to calculate derivatives exposure amounts and requiring the use of standardized approach instead.

- Removal of the exemption of calculating RWA under subpart E of the capital rule currently available to U.S. intermediate holding companies of foreign banking organizations under Board’s enhanced prudential standards.

The Federal Reserve Board will also issue a notice of proposed rulemaking which revises the GSIB surcharge calculation applicable to GSIBs and systemic risk report applicable to large banking organizations.

Timing

The proposed changes would be phased in over a three-year transition period that would start on July 1, 2025. Thus, the regulations would not be fully effective until the second half of 2028. Given the complexity of the rule, the notice of proposed rulemaking will have a 120-day public comment period.

What organizations need to do:

- Become familiar with the proposed regulations and how they will apply to your operations.

- Perform an impact assessment to understand the effects that the proposed regulations would have on your regulatory capital requirements as well as the costs associated with compliance.

If you have questions or need assistance, please reach out to a professional at FORVIS or submit the Contact Us form below.

- 1For banking organizations with less than $100 billion of total assets, the revised market risk will apply if the organizations have $5 billion or more in trading assets plus trading liabilities OR trading assets plus trading liabilities equal to or more than 10% of total assets.