The Inflation Reduction Act of 2022 (IRA) provided a variety of opportunities for increased credit amounts for clean energy projects and investments. The Domestic Content Bonus Credit is designed to encourage the use of materials and manufacture of products within the United States. Therefore, Sections 45, 48, 45Y, and 48E include provisions for this bonus credit to promote this domestic activity within the clean energy space.

If the project meets the domestic content requirements, then a bonus of up to 10% or 10 percentage points (depending on the credit) may be available on top of the existing energy credit amount. The U.S. Department of the Treasury (Treasury) and the IRS issued Notice 2023-38 providing guidance on determining eligibility and claim requirements for the domestic content bonus tax credits. Administrative requirements, including certification and record-keeping, also are included in the notice. Further instruction is forthcoming in proposed regulations.

Notable Highlights of Notice 2023-38

Determining Eligibility

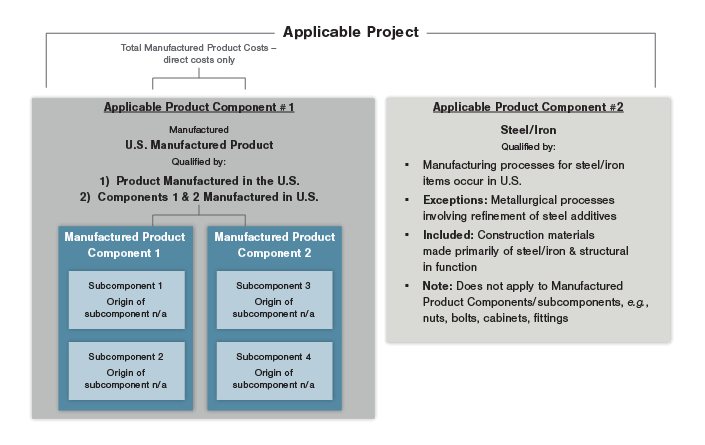

To determine eligibility of the Domestic Content Bonus Credit, applicable projects must apply the Adjusted Percentage Rule. On a high level, a certain percentage of the product must be manufactured domestically. The Adjusted Percentage Rule requires the taxpayer to first calculate the Domestic Cost Percentage (the formula shown in Exhibit 1) and compare it to a defined threshold (the “adjusted percentage”). The Domestic Cost Percentage is calculated by dividing the Domestic Manufactured Products and Components Cost by the Total Manufactured Products Cost calculated for the applicable project. Obtaining the direct material and labor cost information required for this formula from suppliers—both foreign and domestic—may be a challenge in reality. Suppliers will need to disclose their internal details of what their products cost to make, along with the split between their direct and indirect costs. Whether the demand for the Domestic Content Bonus Credit affects the availability of this kind of information is yet to be seen.

If the Domestic Cost Percentage equals or exceeds the “adjusted percentage” that applies to the applicable project, then the applicable project satisfies the Adjusted Percentage Rule (and the Domestic Content Bonus Credit is available to the taxpayer). The adjusted percentage threshold is different depending on the type of product under question. The “adjusted percentage” is 100% for steel and iron and at least 40% for manufactured product for most projects.12

Two-Factor Test for Applicable Components

To determine which of these two percentages apply, applicable components are required to meet a two-factor test: a steel or iron requirement, and a manufactured product requirement.

Steel or Iron Requirement

In general, all structural steel or iron items are required to be produced in the U.S. to meet the steel or iron requirement. More specifically, the Notice states that “all manufacturing processes with respect to any steel or iron items that are Applicable Project Components [must] take place in the United States, except metallurgical processes involving refinement and steel additives.” The requirement includes “construction materials made primarily of steel [or] iron and are structural in function.” The key here is the latter part of that statement—if the steel or iron is not structural in function, then it doesn’t have to be considered for the domestic content requirement. Therefore, the Notice indicates pieces of products like bolts, washers, clamps, adapters, and similar items that are made of steel or iron but are not structural in function are not subject to the requirement. In other words, the steel or iron requirement does not apply to manufactured product components or their subcomponents. This distinction is consistent with the “Buy America” regulations prescribed by 49 CFR §661.5, which the Notice directly includes by reference.

Manufactured Products Requirement

A manufactured product is an item produced as a result of the manufacturing process. Essentially, the component materials are combined in a way that result in a product that has its own new function. Examples would include solar panels, batteries, or equipment, among others. As discussed previously, taxpayers must analyze where the components and subcomponents of these manufactured products are made to determine their domestic cost percentage.

The Notice provides an illustrative example of how this analysis, and application of the Adjusted Percentage Rule, should be applied for manufactured products:

EXAMPLE 1

| Asset | Cost | U.S. or Non-U.S. |

|---|---|---|

| Manufactured Product 1 | $100 (overall, inclusive of 1A and 1B) | U.S. |

| Component 1A | $30 | U.S. |

| Component 1B | $45 | U.S. |

| Manufactured Product 2 | $200 (overall, inclusive of 2A, B, and C) | Non-U.S., due to Component 2C |

| Component 2A | $30 | U.S. |

| Component 2B | $50 | U.S. |

| Component 2C | $100 | Non-U.S. |

In this example, assume that these manufactured products are part of an applicable project component within an applicable project. Assume that all costs are direct costs of the manufacturer of the manufactured products. Essentially, all of these costs are relevant to the calculation of the domestic cost percentage.

To apply the Adjusted Percentage Rule, the following calculations should be completed:

Domestic Manufactured Products and Components Cost = $100 + $30 + $50 = $180

Total Manufactured Products Cost = $100 + $200 = $300

Domestic Cost Percentage = $180 / $300 = 60%

Adjusted Percentage = 40%

The Adjusted Percentage Rule is satisfied as the Domestic Cost Percentage exceeds the adjusted percentage. This applicable project would be eligible for the Domestic Content Bonus Credit, so long as the steel or iron requirement is met as well.

To illustrate further, the below outlines an applicable project that would meet the domestic content requirements:

Safe Harbor

The IRS has provided a safe harbor that classified certain applicable project components as needing to meet either 1) the steel or iron requirement, or 2) the manufactured product requirement. Some of the items listed include utility-scale photovoltaic systems, land-based wind facilities, offshore wind facilities, and battery energy storage technology. A non-exhaustive chart of items in Table 2 of the Notice is available to assist taxpayers with this classification as well. This safe harbor listing may require further clarification, so Treasury is open to hearing additional proposals with respect to the safe harbor list.

Administrative Considerations

Taxpayers also must comply with timely self-certification and record-keeping obligations. To complete the self-certification requirements, a statement must be made for each applicable project. The statement must be signed by a person with legal authority under penalties of perjury3 and must include:

- Whether the project is a qualified facility, energy project, or energy storage technology;

- The specific type/category of the applicable project;

- Geographic coordinates and address of the applicable project;

- Placed in service date;

- Total Domestic Content Bonus Credit amount in the first taxable year in which a Domestic Content Bonus Credit is reported; and

- Any additional information

This certification should be filed with the taxpayer’s annual return for the first taxable year in which the Domestic Content Bonus Credit is reported. A taxpayer must certify that an applicable project meets the domestic content requirement as of the date the applicable project is placed in service. This is the date on which such property is placed in a condition or state of readiness and availability for a specified assigned function, regardless of trade or business or in the production of income. Further guidance surrounding record-keeping is still expected.

Final Thoughts

Despite the published guidance, many questions still remain to be answered. Additional clarification and details regarding the new energy credits are forthcoming. Be sure to follow our weekly From the Hill publication for updates.

To be sure, there are many considerations in play with the Domestic Content Bonus Credit. In fact, even retrofitted projects may qualify as an applicable project. Therefore, reach out to a tax professional at FORVIS, or submit a Contact Us form, to consider whether the Domestic Content Bonus Credit is available for your clean energy investments and projects.

- 1Offshore wind facilities start at 20% and cap at 55% for facilities that begin construction in 2028 or later.

- 2Note that for purposes of the §45Y credit, these adjusted percentages vary based on the year in which construction begins.

- 3“Under penalties of perjury I declare that I have examined the information contained in this Domestic Content Certification Statement and to the best of my knowledge and belief, it is true, correct, and complete.”