Split-dollar life insurance arrangements have existed since the 1940s. Originally, they were designed to have an employer assist an executive in obtaining life insurance coverage by paying all or part of the insurance premium. In more recent years, split-dollar arrangements have been used to informally fund supplemental executive retirement plans and also have been used in the wealth transfer context where the insurance policy is owned by an irrevocable life insurance trust (ILIT).

This article will provide a very high-level explanation of some potential uses of a split-dollar life insurance arrangement in regard to supplemental retirement plans or wealth transfers. These are complicated planning techniques, and each arrangement will have its own positives and negatives, so it’s important to discuss all options with your professional tax advisor.

Business Planning With Split Dollar

Unlike true deferred compensation, split-dollar plans operate at the employer’s discretion and are typically not subject to Internal Revenue Code Section 409A. In the examples below, the business and the key employee enter into a split-dollar agreement with a cash value life insurance policy being purchased on the life of the key employee.

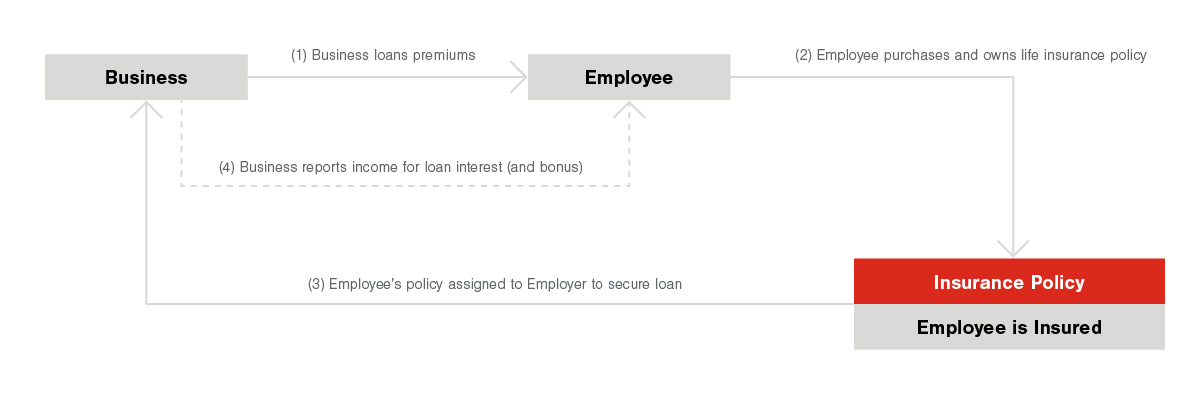

Loan Regime Split Dollar

- The employee purchases the policy and then collaterally assigns the value to the business.

- The business pays all policy premiums, which are treated as an interest-bearing loan to the employee. The business reports income to the employee for the interest on the loan. Interest is typically bonused to the employee by the business.

- When the employee retires, or the assignment is released, the employee only recognizes the cost basis of the policy (total premiums paid) as income, not the full value of the policy.

- If the employee dies prior to retirement, the employer receives a portion of the death benefit equal to total premiums paid, and the employee’s beneficiaries receive the remainder tax-free death benefit.

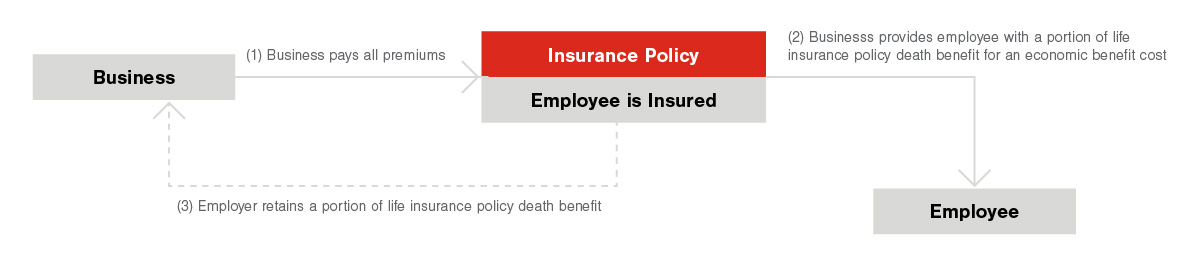

Endorsement (Economic Benefit) Split Dollar

The business purchases and owns a life insurance policy on the employee.

The business pays the full policy premium, and the employee reimburses the annual economic benefit cost to the business. Economic benefit is calculated using an IRS table or alternative term life insurance rates.

If the employee dies prior to retirement, the employer receives a portion of the death benefit equal to total premiums paid and the employee’s beneficiaries receive the remainder tax-free death benefit (same as loan regime).

When the employee retires, the policy may be maintained by the business or transferred to the employee through a compensation bonus for the full market value (cash value) of the policy.

If supplemental income is not needed by the employee, the policy can be kept in force and transferred or gifted to an ILIT for legacy or estate tax purposes, regardless of which regime is used.

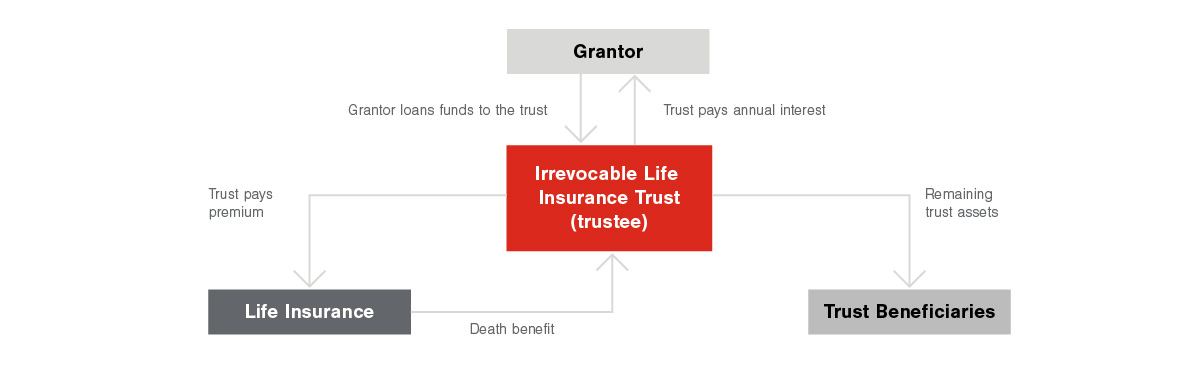

Private Premium Financing (Not to Be Confused With Premium Finance)

Up until recently, historically low interest rates have offered high-net-worth individuals and families an opportunity to tap into the estate planning benefits of life insurance using a private premium financing (PPF) strategy. In a typical PPF situation, the trust grantor loans funds to an irrevocable grantor trust (IGT) to pay life insurance premiums. The IGT pays the premiums—while also making annual principal and interest payments to the grantor. When the insured dies, the death benefit is used to pay off the loan. This strategy is often used when an individual or family has maximized their annual and lifetime gifting exemptions with other strategies.

There are several ways to fund the IGT:

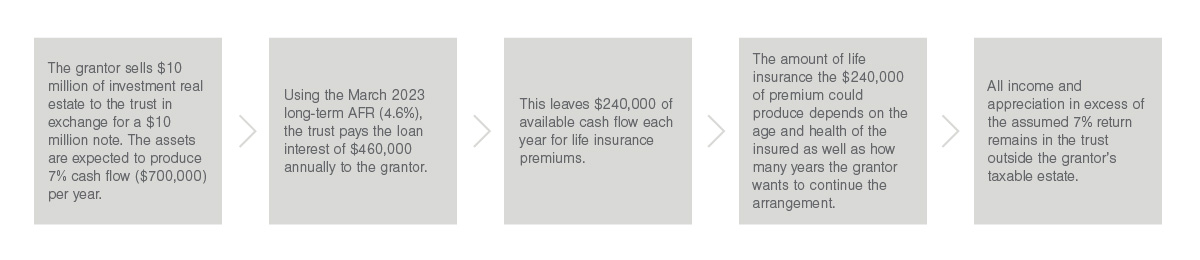

1. Using Proceeds From a One-Time Lump Sum Sale of Assets

In this scenario, the grantor of an IGT sells an asset(s) to the trust for a promissory note. This strategy is most effective by using investment assets producing significant annual cash flows to help achieve your ideal outcome. A one-time, lump-sum sale enables you to “lock in” interest rates for any time up to the grantor’s life expectancy, which, up until recently, had been particularly attractive with near-record low interest rates. With an IGT, no gain is recognized on the sale of the assets to the trust. In addition, all interest on the note received is free from income taxes. The grantor will continue to pay the tax on income generated by the assets.

Here is an example:

2. Paying Annual Premium Payments

Those looking to maintain current asset levels may prefer to loan needed premiums to the IGT each year with, or without, capitalized loan interest. In this arrangement, the loan would be repaid from the policy’s death benefit. Paying an annual premium allows you to maintain current cash flow and investment assets. For younger individuals and families, using a cash accumulation life insurance policy may make it possible to repay the loan from policy values after 15 to 20 years. It should be noted that as the loan balance increases, it may result in less and less of the policy death benefit remaining in the irrevocable trust.

3. Economic Benefit With Lump Sum Sale of Assets

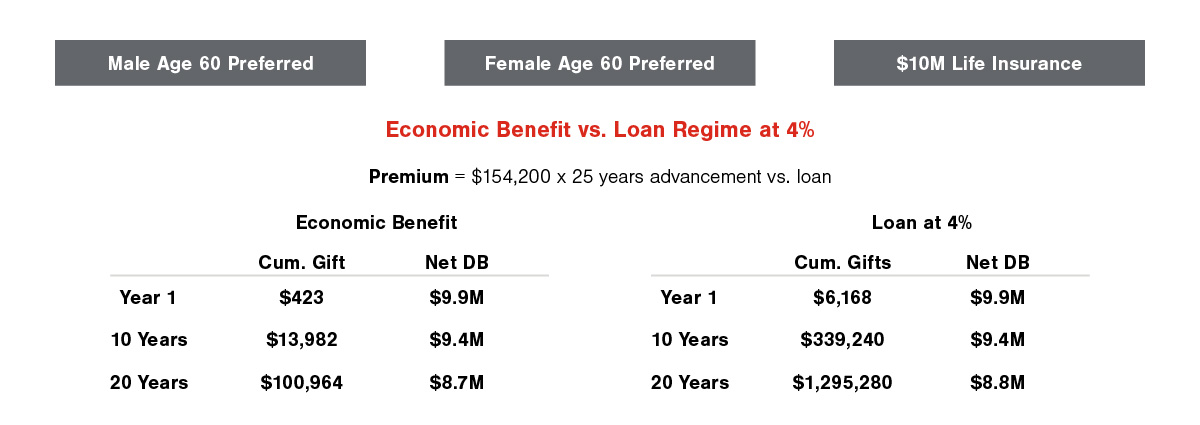

Prior to the rapid increase in interest rates, private financing was generally done as a lump sum loan locking in the applicable federal rate (AFR). Since lump sum financing may not be palatable, a better option for single or survivorship life insurance is to execute a collaterally assigned (economic benefit) split-dollar arrangement using economic benefit gift measurements. This allows the grantor to pay a lower amount and have a very small gift exposure. Once interest rates decline, the plan can be switched to a loan regime and a lump sum can be loaned with a locked-in rate. The table below shows the short-term comparison of cumulative gifts for economic benefit and loan regime at 4%.

- The above example illustrates a scenario where a survivorship life insurance policy is purchased, insuring the life of a husband and wife, both age 60, and both receiving a preferred rating from the insurance carrier. The scenario also assumes that the annual premium for this policy is $154,200. Several factors can affect the cost of insurance such as age, health, size of the policy, etc. You should discuss your particular situation with your professional advisors.

- The cumulative gift ($423 in year 1) in the above example for economic benefit is calculated using an IRS table or alternative term life insurance rates multiplied by the premium amount of $154,200. The loan regime cumulative gift ($6,168) is calculated using a loan interest rate of 4% multiplied by the premium amount.

Exit Strategy

The IRS table or alternative term life insurance rates used with economic benefits are very cost-effective but will increase substantially when a client reaches their 80s. Also, the interest that can accrue over a long period of time with loan regime can reduce the net benefit of life insurance. For these and other reasons, clients should remember that split-dollar life insurance planning is a temporary premium payment technique, and quite often some sort of exit strategy is needed to wrap up the plan. This may include the use of gifts, grantor retained annuity trusts, or sales to defective trusts, depending on your circumstances. You should consult with your professional tax advisor if you are considering a split-dollar arrangement.

If you have questions or need assistance, please reach out to a professional at FORVIS or use the Contact Us form below.