Bank mergers and acquisitions (M&A) were hard hit last year, with only 168 announced whole bank and thrift transactions in 2022. Excluding the pandemic low of only 112 transactions in 2020, banking M&A fell to its lowest level since 2011 when only 145 transactions were recorded. The unexpected liquidity crisis in early 2023 that included the collapse of Silicon Valley Bank, Signature Bank, and First Republic Bank sent shockwaves through the banking industry and further cooled the already tepid bank M&A market. Transaction activity through May 2023 has slowed significantly, putting deal activity for the year on pace for even fewer deals than in 2022.

Battling persistently high levels of inflation, the Federal Reserve (Fed) continued to tighten monetary policy in 2022, enacting seven interest rate increases totaling 425 basis points. The Fed continued to try to cool the economy in 2023, but at a slower pace as the banking industry faced a liquidity crisis and worries about an economic downturn continued to build, enacting three additional interest rate increases of only 25 basis points each, before announcing a much-anticipated pause in June after some moderation in inflation data.

Based on the latest data available as of this writing, The Conference Board’s Leading Economic Index® declined for a 14th consecutive month in May. This continued decline has led The Conference Board to forecast a mild recession toward the end of 2023 or the beginning of 2024. The worsening economic outlook, and slight moderation in inflation pressures, makes it likely that the Fed will hold off on additional interest rate hikes for some time after its decision to pause rate increases at the June meeting. However, with inflation still running ahead of the Fed’s 2% target, it’s possible that the Fed could re-evaluate as additional economic data becomes available throughout the year.

Stock prices for banks continue to face downward pressure in 2023. The Dow Jones U.S. Banks Index (DJUSBK) is down 22.72% at $390.05 for the 12-month period ended May 31, 2023, while the KBW NASDAQ Bank Index (BKX) is down 33.59% at $81.23 in the same period.

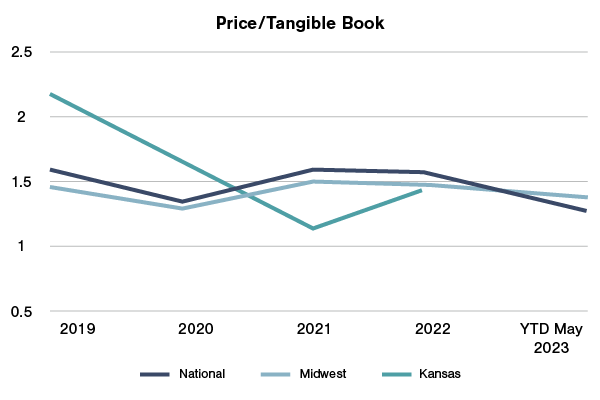

Pricing for whole bank and thrift transactions in 2022 was nearly flat compared to 2021, with an average price to tangible book value (P/TBV) of 155% in 2022, compared to 157% in 2021. Pricing in 2022 also was reasonably in line with the pricing seen pre-pandemic of 158% P/TBV in 2019.

Year-to-date through May 2023 has seen a total of 34 announced transactions nationwide, which is significantly lower than the 67 transactions announced through May 2022. Based on transactions with pricing data available, P/TBV has averaged 128% through May 2023.

From a regional perspective, Midwest transactions totaled 71 in 2022 compared to 84 in 2021, with an average P/TBV of 150% compared to 147% in 2021. Year-to-date through May 2023 has seen a total of 21 announced transactions in the Midwest, which is behind the 31 transactions announced through May 2022. Based on transactions with pricing data available, P/TBV has averaged 137% through May 2023 for these Midwest transactions.

In Kansas, there were five transactions in 2022 compared to seven transactions in 2021.

There were two transactions with disclosed pricing data in Kansas in 2022, which were Spring Harvest Corporation’s acquisition of My Anns Corporation, the parent company of Piqua State Bank, at 134% P/TBV and Landmark Bancorp Inc.’s acquisition of Freedom Bancshares, Inc. at 152% P/TBV. There was only one transaction with disclosed pricing data in the state in 2021, which was Equity Bancshares, Inc.’s acquisition of American State Bancshares, Inc. in May 2021 at 113% P/TBV.

In Kansas, four transactions have been announced year-to-date May 2023, which is ahead of the two announced transactions through May 2022. Based on transactions with pricing data available, P/TBV averaged 143% in Kansas in 2022. There have been no transactions with pricing data announced year to date through May 2023.

Source: S&P Global Market Intelligence

With the continued increase in interest rates from the Fed, many banks with available-for-sale securities have seen sharp increases in unrealized losses in their investment portfolio. The negative impact of the decline in accumulated other comprehensive income on total equity capital continues to present significant challenges in transactions. We have seen this successfully navigated in transactions in the current environment, but the increase in unrealized losses has been a significant deal impediment overall.

Given ongoing economic uncertainty, stock valuations, and the liquidity crisis that is still fresh on bankers’ minds, it appears likely that 2023 transaction volume will come in below 2022 transaction volume. Those banks that continue to be interested in growth through M&A will likely see opportunities, but they will need to ensure sufficient capital to pursue those opportunities; sharpen their operational, diligence, and integration focus; and prepare for an extended period of uncertainty in the industry where their approach may feel contrarian.

If you have any questions or need assistance, please reach out to a professional at FORVIS or use the Contact Us form below.