Stocks rallied in the second quarter on better-than-expected trends in inflation and economic growth. Interest rates rose during the period, causing bonds to post slightly negative returns. The end of the Federal Reserve’s rate hike cycle is near, reducing a significant market headwind.

Is the U.S. Economy Headed Toward Recession?

The U.S. economy continues to defy predictions that a recession is imminent. First-quarter real GDP growth was revised upward to 2% from the initial 1.1% estimate. The unemployment rate for June was 3.6%, hovering just above its 50-year low. The ISM service sector index showed expansion for the fifth consecutive month in May. Consumer spending remains strong despite higher interest rates. Rising stock prices have contributed to a “wealth effect,” increasing consumers’ confidence to spend.

The U.S. economy is expected to continue the recent trend in the near term. Forecasts for second-quarter GDP growth are in the range of 1% to 2%. While the consensus view is shifting toward a “soft-landing” scenario, the resiliency of the economy could be tested in the latter part of the year. The cumulative effect of past Fed rate hikes won’t fully be realized until late 2023 or early 2024. Additional Fed tightening could aggravate the situation. Fortunately, the strength of consumer and corporate balance sheets and strong employment conditions should limit the extent of any downturn.

Why Have Stocks Performed So Well This Year?

Despite ongoing Fed rate hikes, the failure of three large regional banks, and the government debt ceiling drama, stocks surged higher through June. U.S. stocks gained nearly 17% in the first half of the year, while international stocks rose almost 12%. The year-to-date gains have lifted the market to the highest level since April 2022, recouping about two-thirds of last year’s losses.

Strong market returns have been prompted by several factors, including these:

- Stronger-than-expected economic growth

- Anticipation of the end of Fed Reserve rate hikes

- Less-than-expected decline in first-quarter corporate profits

- Relief that banking industry issues appear to be isolated

- Excitement over the potential benefits of artificial intelligence (AI)

| Market Scoreboard | 2Q 2023 | 2023 YTD |

|---|---|---|

| S&P 500 (Large U.S. stocks) | 8.74% | 16.89% |

| MSCI EAFE (Developed international stocks) | 2.95% | 11.67% |

| Bloomberg Aggregate Bond (U.S. taxable bonds) | (0.84%) | 2.09% |

| Bloomberg Municipal Bond (U.S. tax-free bonds) | (0.10%) | 2.67% |

| Wilshire Liquid Alternative (Alternative investments) | 1.38% | 2.68% |

Source: Morningstar Inc, Tamarac Advisor View as of June 30, 2023.

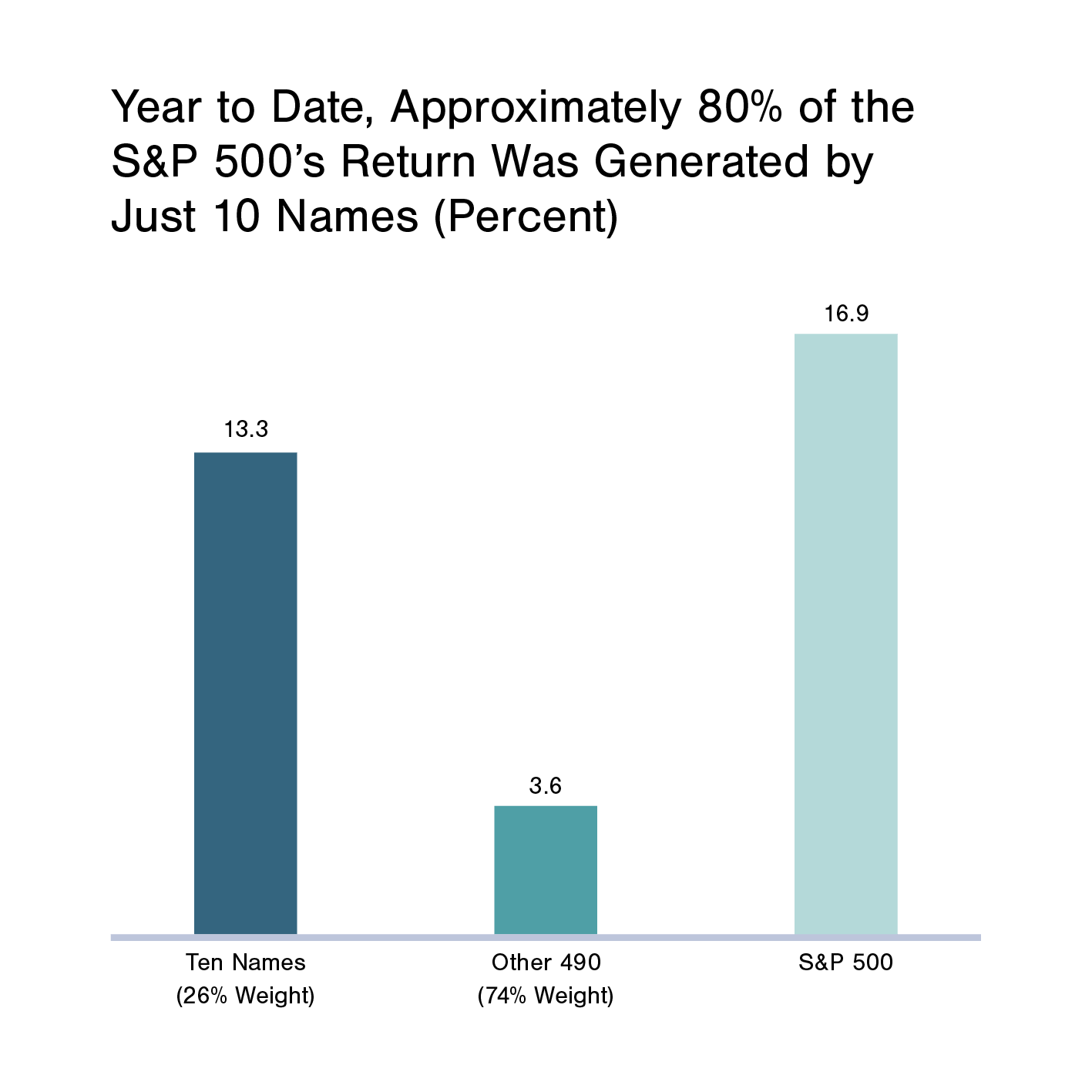

Market returns have been very “top-heavy” this year. Ten mega-cap stocks focused in the technology sector account for nearly 80% of the S&P 500’s year-to-date gain, while the other 490 stocks are barely positive.1 These 10 companies represent more than 25% of total U.S. stock market capitalization and have driven a 23% performance advantage of growth over value stocks this year.

Bond values declined this quarter as interest rates rose in response to higher Fed funds rate expectations. But with starting yields near 10-year highs, the impact of the rise in rates was muted, allowing both taxable and tax-free bonds to maintain positive returns for the year.

What Is the Latest Outlook for Fed Policy?

Another quarter brought yet another shift in the direction of Fed policy. After the banking crisis erupted in March, the Fed turned cautious on the outlook for rates. The published forecast at that time removed any future rate hikes. Leading up to its June meeting, the Fed signaled that rates would hold steady. As a result, most market participants assumed that meant the current tightening cycle was over.

While the Fed did forgo a rate increase in June, the market was surprised by an updated forecast that implied two additional 0.25% hikes by the end of 2023. The post-meeting press conference, subsequent meeting minutes, and recent speeches by Fed Chair Jerome Powell indicate that the Fed still believes rates need to move higher to bring inflation under control. This caused bond yields to rise from the lows of early April. U.S. Treasury yields climbed 0.51% on 10-year maturities and 1.12% on two-year maturities. However, investors doubt the Fed’s forecast, with futures markets pricing in only one increase of 0.25% in July, with rate cuts beginning in early 2024. In our view, inflation trends will continue to play the dominant role in determining the actual path of interest rates the remainder of this year and next.

Given the Rapid Decline in Inflation, Why Is the Fed Still Concerned?

The rate of inflation dropped significantly over the past year. In June 2022, the Consumer Price Index (CPI) hit a high of 9.1% before falling to 6.5% by year-end. The most recent CPI reading for June 2023 was just 3%. Some forecasters believe inflation could fall to the 2% range by year-end. Given this, why is the Fed still so concerned about inflation?

The reason is that the Fed considers a different inflation measure in setting policy. This is due to the volatility of food and energy prices. Oil offers a good example of this—over the past three years, oil prices have gone from near zero during the COVID crisis to more than $100 per barrel after Russia’s invasion of Ukraine, and most recently dipped back below $70. Attempting to set policy using a measure that can change so dramatically is difficult and could result in poor decision making.

Because of this, the Fed prefers to use the “core” rate of inflation, which strips out food and energy prices to better gauge underlying trends. This “core” rate of inflation is much less volatile. Unfortunately, it also has been slower to decline over the past year. After reaching a high of 6.6% last October, core CPI has only fallen to 4.8% as of June. Most forecasts show this core rate reaching about 4% by the end of the year, well above the Fed’s target rate of 2%. This explains why the Fed continues to be concerned about inflation. Until core inflation rates show a significant decline, the Fed is likely to remain biased toward higher rates.

Market & Economic Outlook

There have been several positive developments in the market environment as we enter the second half of the year. Inflationary pressures are easing. The end of Federal Reserve rate hikes is close. The economy has proven to be more resilient than expected, increasing the odds of a “soft landing.” And expectations for 2024 corporate earnings growth are strong.

These and other factors have led to a more optimistic tone in recent weeks. Asset values are up and employment conditions are strong, fueling a surge in travel and vacation activities. Strong wage growth combined with declining inflation has increased purchasing power. Consumers have remained engaged and confident despite rising borrowing costs.

The markets reflect this optimism, with both U.S. and foreign stocks posting double-digit gains in the first half of the year. The rise in stock prices, combined with a slight decrease in earnings, has driven the market’s P/E multiple above 19 times 2023 expected earnings. Much like year-to-date market returns, this increase in valuation has been led by expanding P/E multiples for several of the largest technology stocks.

In our view, for stock markets to build on these gains in the second half of the year, two things need to occur. First, the rise in prices needs to broaden beyond the small handful of stocks that drove the majority of first-half gains. Broad-based market rallies tend to be more sustainable than narrow advances. Second, corporate profits need to show a trend of improvement toward lofty 2024 expectations. While current market valuation is not extreme assuming interest rates have peaked, the next move higher is more likely to be powered by earnings growth than additional P/E multiple expansion.

From a risk management standpoint, bonds are poised to stabilize balanced portfolios if market volatility increases. With yields across most segments of the bond market near 10-year highs, the portfolio return contribution also should be much greater going forward.

The Long View

One of the key investment principles of FORVIS Private Client™ is that “smart global diversification reduces risk and improves return potential.” Whether across asset classes or within, diversification helps smooth out returns over the long run. But there are times when returns become concentrated in a small part of the market. These periods may cause investors to question the wisdom of diversification. Year-to-date, a few large-cap technology stocks have delivered abnormally high returns, accounting for most of the S&P 500’s gain. After trailing the market significantly in 2022, these “Big Tech” companies have once again caught investors’ attention.

The excitement over AI further boosted the share prices of these companies. Claims about how AI will change the world have investors contemplating the potential for massive profits. Why remain diversified and not go “all in” on Big Tech? The reasons are many and touch on other foundational investment philosophies, namely the importance of avoiding emotional decision making and market timing. Rewards ultimately accrue to disciplined, long-term investors. Technology is changing the world, but the important question is how will these investments affect your portfolio based on today’s circumstances? Investors who bet big on dot-com stocks in the late 1990s learned the hard way that societal-changing technologies sometimes take a very long time to boost corporate earnings.

The magnitude of positive change that AI will offer remains to be seen, and as with any emerging technology will progress in fits and starts. While it may be tempting to chase the potential for outsized gains in big tech, going “all in” over the fear of missing out is a classic investment mistake.

Source: Alliance Bernstein and Bloomberg, Inc., as of June 30, 2023.

Taking a longer-term, diversified approach is a prudent strategy for preserving and compounding wealth. Doing so also helps avoid many pitfalls that compromise the achievement of financial goals.

Thank you for the confidence you have placed in the FORVIS Private Client team!

- 1Bloomberg, Inc.